GBPJPY Is Showing A Incomplete Bearish Sequence

Image Source: Unsplash

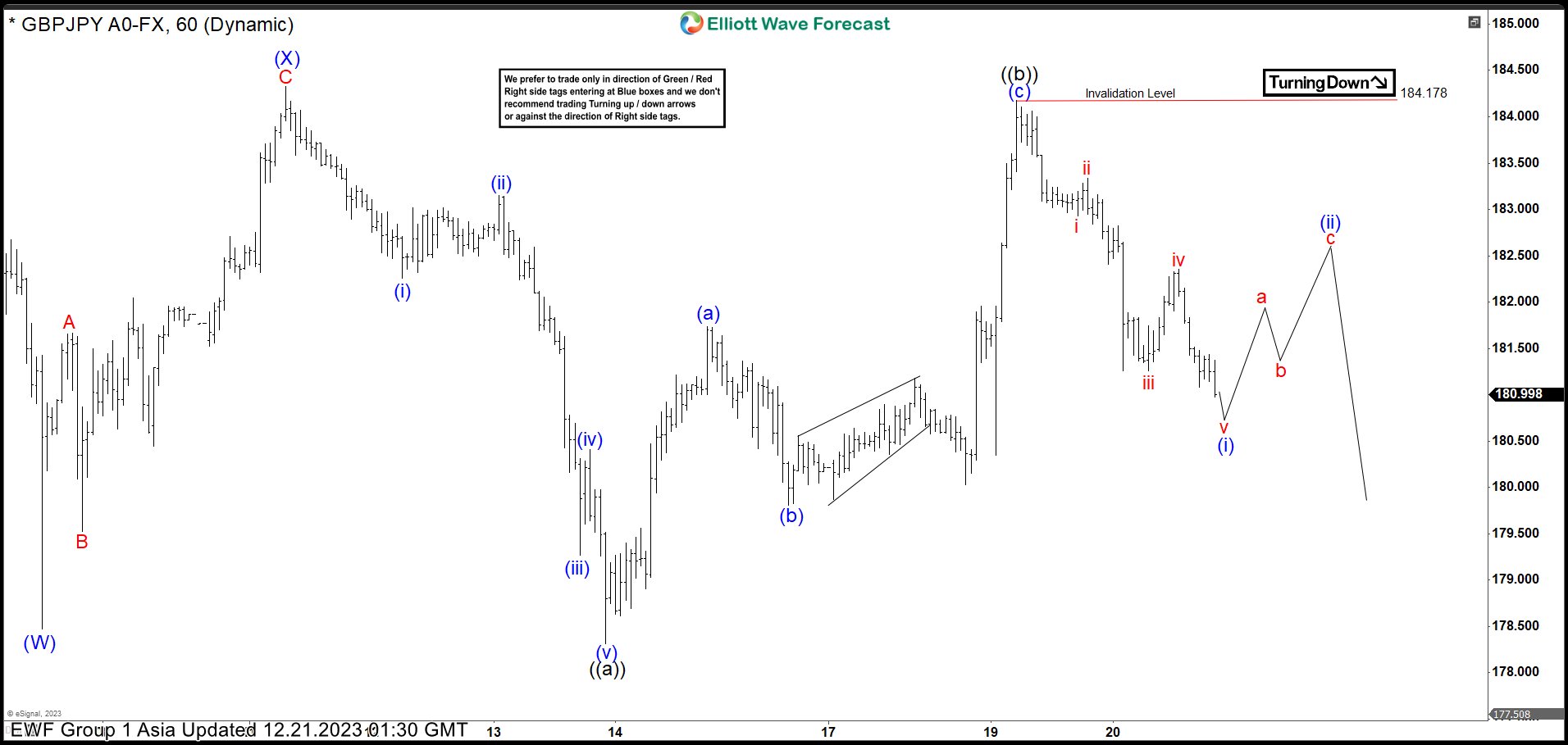

Short Term Elliott Wave View in GBPJPY shows that it has ended wave ((3)) at 188.66. Pullback in wave ((4)) is currently in progress as a double three Elliott Wave structure. Down from wave ((3)), wave A ended at 185.06 and wave B ended at 186.18. Wave C lower made a strong drop ended at 178.47 which completed wave (W). The yen pair then corrected in wave (X) as a zigzag structure. Up from wave (W), wave A ended at 182.04 and wave B ended at 180.45. Wave C higher ended at 184.32 which completed wave (X).

The GPBJPY then turned lower in wave (Y). Down from wave (X), wave ((a)) ended at 178.32 breaking the low of wave (W) opening the idea of a incomplete bearish sequence. Wave ((b)) pullback was very high retesting wave (X) ended at 184.17. The yen pair is now trading lower in wave ((c)) of W. Down from wave ((b)), wave (i) is expected to end soon, then it should pullback in wave ((ii)), followed by further downside in wave (iii) of ((c)). Then, as far as pivot at 184.18 high remains intact, the GBPJPY has scope to see further downside in a larger double three in wave (Y).

GBPJPY 60 Minutes Elliott Wave Chart

GBPJPY Elliott Wave Video

Video Length: 00:03:45

More By This Author:

Ethereum Should Find Buyers In 3, 7, Or 11 SwingApple Keeping The Momentum & Reacting Higher From Blue Box Area

American Express Is Heading To A Potential Selling Area

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more