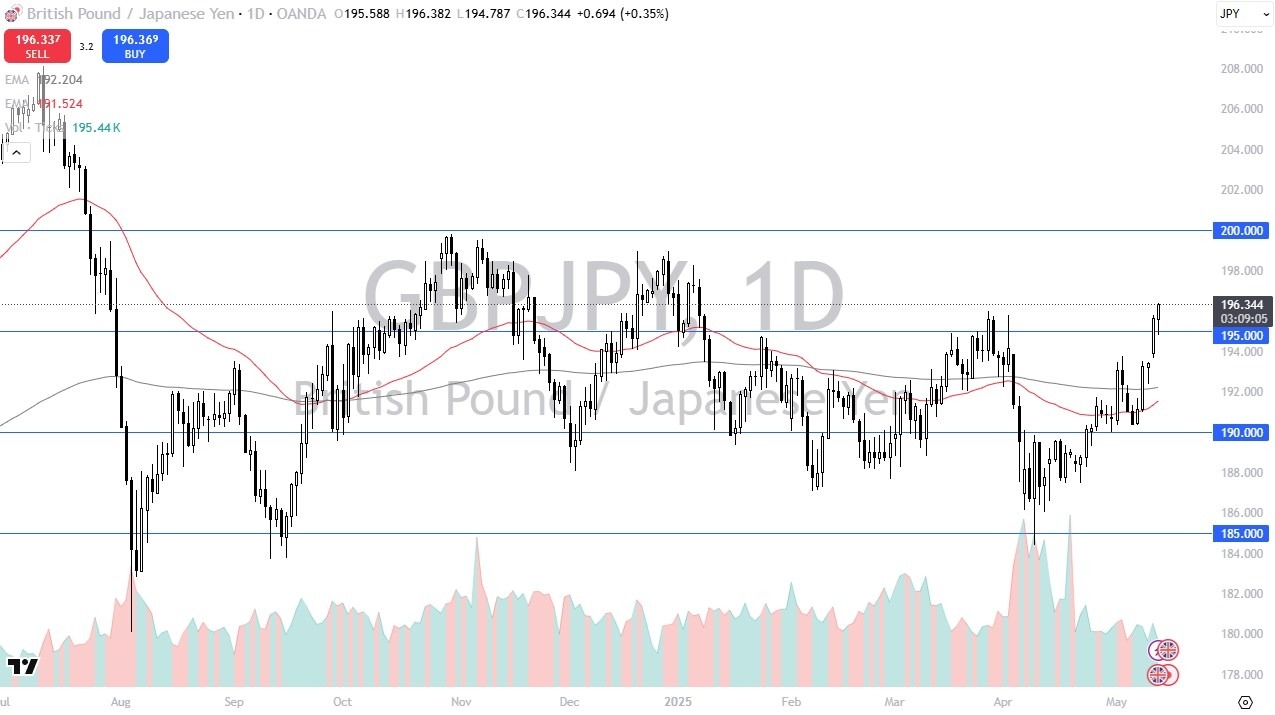

GBP/JPY Forecast: Rebounds From ¥195

- The British pound initially pulled back a bit against the Japanese yen, but it has found support at the 195 yen level.

- This is an area that is a large round psychologically significant figure and an area that I think you probably would expect to see a little bit of noise regardless.

- The shape of the candle is rather impressive, and it does suggest that we have further upward pressure.

At the end of the session, we are closing, at least it looks like we will, at the very top of the range of the day. At this point, I suspect that if we continue to see more risk on behavior, the market will likely try to get to the 198 yen level, possibly even the 200 yen level. Short-term pullbacks, I think at this juncture continue to offer value. And you should keep in the back of your mind that commercial traders are net short of the Japanese yen in the futures market, which gives us an idea as to how the big money might be targeting this market.

Swap Matters Over the Long Term

But also, it's worth noting that this is a market that pays you at the end of every day to hold on to it. So, there is a reason to pay close attention to that. The 200 yen level is probably a major ceiling, and I don't necessarily think we break through that easily, but this is a chart that looks like it wants to try to go back there and test that area. Underneath, we have significant support near the 193.50 yen level, and then again at the 200 day EMA, which is close to the 192 yen level. Ultimately, I am bullish, and I do think that short-term pullbacks offer short-term buying opportunities.

More By This Author:

EUR/USD Forecast: Falls After Trade Deal TalksBTC/USD Forecast: Overextension Is An Issue

Pairs In Focus - Gold, GBP/USD, USD/CAD, EUR/USD, Dax, Nasdaq 100, Bitcoin, USD/JPY

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more