Forex Friday: USD/JPY, USD/CNH, USD/CHF And EUR/JPY

Image Source: Unsplash

In this week’s edition, we discuss a couple of dollar pairs, EUR/JPY, and look forward to the key events coming up in the week ahead.

Welcome to another edition of Forex Friday, a weekly report in which we discuss selected currency themes mainly from a macro viewpoint, but we also throw in a pinch of technical analysis here and there.

In this week’s edition, we discuss a couple of dollar pairs, EUR/JPY, and look forward to the key events coming up in the week ahead.

- What’s moving and driving the markets?

- USD/JPY hits fresh 2023 high

- USD/CHF could be set for breakout next

- USD/CNH breaks 200-day average

- EUR/JPY could be heading to 145+

What’s moving?

As we head towards the week’s finale, the US dollar continues to show strength, and risk assets continue to struggle for direction. Thursday saw the major US indices bounce back sharply off their lows to close in the black, but futures have since turned lower along with European indices. Overnight saw Chinese markets drop. Gold and silver’s struggles continue amid a recent rise in bond yields and strength for the dollar. At the time of writing, stock indices were testing session lows ahead of the publication of US data. China A50 (-1.4%) was leading the declines, followed by Germany 40 (-0.9%) and US Tech 100 (-0.7%). The USD/JPY recovered fully from the overnight drop to rise near 135.50, while gold and silver headed to fresh weekly lows.

What’s driving the markets?

There are a couple of reasons why the dollar is showing strength and risk assets weakness. First and foremost, it has been the mostly stronger-than-expected US data and hawkish Fed commentary that has been boosting the dollar and providing headwind for gold, cryptos, and equity indices. Rising borrowing costs are benefiting no one, certainly not governments or individuals struggling with the cost-of-living crisis. We also have some geopolitical risks in the background, with China reportedly increasing its support for Russia, as we enter the first anniversary of Moscow’s invasion of Ukraine.

Although US GDP was revised unexpectedly lower on Thursday to 2.7% from 2.9% in the initial estimate, this was offset by GDP price index, which was revised up to 3.9% from 3.5%, meaning more inflation. GDP is backward-looking data anyway, which is why the market has not attached too much importance to it. More to the point, the jobs market remains hot, and we saw more evidence of that with unemployment claims falling to 192k, well below expectations. The data came following the hawkish-leaning FOMC minutes released on Wednesday. Despite Fed Chair Jerome Powell declaring that the 'disinflation process has started', the minutes revealed that further rate increases were needed and there were no hints of a pause. So, the market is expecting at least two more 25bp hikes from the Fed over the March and May meetings and possibly another one in the June meeting. While the door also remains open for a 50 bp move in the future if the economy continues to grow rapidly, I agree with the market view that the next rate rise will be 25 basis points.

Looking ahead, the immediate focus will be on the US Core PCE price index coming up later. This is the Fed’s favorite inflation measure and so should move the markets if we see a figure that shows deviation from market expectations of a 0.4% m/m reading. The data is due at 13:30. We also have personal income and spending at the same time. Later in the afternoon, we will have new home sales and revised UoM figures.

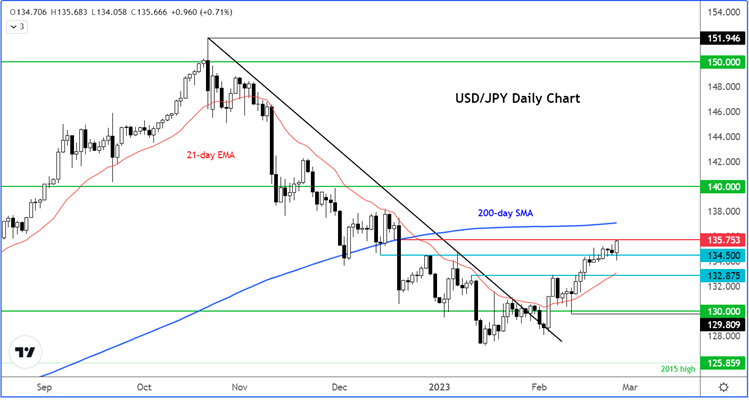

USD/JPY hits fresh 2023 high

The dollar has risen across the board, and you will see the same picture looking at any major pairs. The USD/JPY is catching everyone’s attention today because it has hit a new high for the year after initially falling during the volatile Asian trading session. However, after the initial move, the yen has fallen back after the incoming Bank of Japan Governor Kazuo Ueda said it was appropriate to keep an ultra-loose monetary policy. With rates break above 134.50 and holding above this level, the path of least resistance is clearly to the upside and will remain that way unless rates fall back below this level.

(Click on image to enlarge)

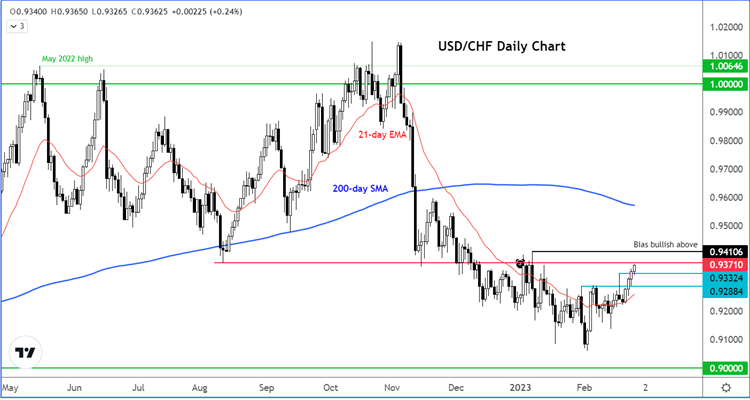

USD/CHF could be set for a breakout next

The USD/CHF was testing an important resistance area around 0.9325 to 0.9370ish, at the time of writing. Previously this area was resistant. We have already seen a price break above the short-term bear trend and the 21—day exponential moving average. What the bulls will want to see next is a clean move above the aforementioned resistance area to completely turn the tide. Specifically, a move north of 0.9410 could trigger a short-squeeze rally toward the 200-day average at 0.9575.

Meanwhile, the bears will now want to see clear evidence of price topping out, before potentially stepping in on the short side. A move below this week’s low at 0.9220 could be the trigger they are looking for.

(Click on image to enlarge)

USD/CNH breaks 200-day average

As we warned on Thursday, the USD/CHN has now broken cleanly above its 200-day average around 6.90ish, and in doing so it has also taken out resistance at 6.9300. Correspondingly, the China A50 index has fallen sharply overnight. Most of the positivity about China re-opening has already been priced in. So, this does not come as surprise to us that we are seeing renewed pressure on the yuan, especially given the fact the PBOC is continuing to provide monetary support to the economy and remains in the dovish camp among the major central banks.

EUR/JPY could be heading to 145+

The yen has also fallen against other currencies after Kazuo Ueda said it was appropriate to keep an ultra-loose monetary policy. The EUR/JPY has bounced off the 21-day exponential average and was looking to create a hammer candle above 143.00 on the daily chart. If so, this would keep the bullish trend intact, with the bulls likely to then target 145+ in the days ahead.

Looking ahead to next week

There’s plenty of macro data to look forward to in the week ahead. Among them, these are the most important ones:

- ISM Manufacturing PMI (Wednesday, March 1)

Stronger US data has raised hawkish Fed bets, but manufacturing activity has remained weak, with the PMI consistently remaining below 50.0. So far, it has been the services sector where most of the growth has come from. But will we finally see evidence that the manufacturing sector is also beginning to recover?

- Eurozone CPI (Thursday, March 2)

Inflation figures remain the most important data for the markets as investors continually try to front-run the major central banks. We have heard lots of hawkish comments from several ECB officials, mirroring the Fed in recent weeks. If inflation turns out to be hotter than expected, this should cement expectations of another 50-basis point rate hike in March and boost the prospects of additional tightening further.

- ISM Services PMI (Friday, March 3)

This week saw the S&P Global’s services PMI come in much hotter than expected, albeit at 50.5 the sector barely grew. Nonetheless, it was about 3 points above expectations as the sector returned to growth for the first time since June. The ISM version of the PMI, which last month blew past expectations at 55.2, has historically been more impactful on the markets. If it shows a similar strong reading, then this will further fuel hawkish Fed bets.

More By This Author:

Gold Finds Relief But Risks Tilted To Downside

Technical Tuesday: Nasdaq, Yields, WTI and GBP/JPY

Markets Mixed As Investors Eye Bigger Events

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more