Focus Returns To The Fed's Terminal Rate

MARKETS

Stocks took off on Friday as Jerome Powell officially let the cat out of the bag and said the Fed was ready to cut interest rates. Citing a cooling labour market and inflation finally zeroing in on that elusive 2% target, Powell gave investors precisely what they were hoping for. Currently, Wall Street is living the dream—getting its cake and eating it too. The best-case scenario? A wave of rate cuts that steer clear of a recession. But here's the kicker: the market’s next big move depends on whether recent US macro data signals merely a slowdown or the first tremors of a recession. The stakes couldn’t be higher—will we glide to a soft landing or brace for a rough descent?

Leading up to Powell’s speech, virtually everyone on “The Street” was betting he’d play it safe against the market's aggressive expectations for 100bps cuts by year-end. But Powell threw a curveball, going full dove mode and catching everyone off guard. Sure, he didn’t rubber-stamp the 100bps of cuts priced in for 2024, but his tone? Pure accommodative bliss.

As the Fed shifts gears, presumably moving toward a neutral Fed policy while government fiscal expansion keeps the engines running, we’re staring at weaker dollar and gold prices that are ready to skyrocket. The conversation might buzz around whether the cuts will be 25 or 50 bps in September, but the actual game is figuring out where Fed funds will land next year.

Powell might’ve hinted at a 3% neutral rate, but let’s not kid ourselves—when he says “doing everything we can” to protect the labour market, that trap door could get blown wide open. If the slow creep in unemployment, which Powell slyly let slip, turns into a full-on job loss frenzy, the Fed might not just cut rates by 200 bps—they could be slashing 250 or even 300bps by next year.

So, let’s not get lost in the weeds of short-term moves. This is about positioning yourself for the long haul because the Fed’s final destination could change the game entirely. Buckle up—the narrative’s about to shift, and the next big trade could be just around the corner.

FOREX STRATEGY

We've been riding the reversion waves for the past two weeks, selling the US dollar into any sign of strength. But as experience often teaches—especially with consecutive lower highs—I knew that strategy’s well was drying up. Still, I fell for the market gossip heading into Jackson Hole, expecting Powell to push back on the 100 bp cuts chatter instead of sticking to my analysis that the Fed needs to ease. It’s a perfect example of how quickly strategies can flip and why you must always stay sharp.

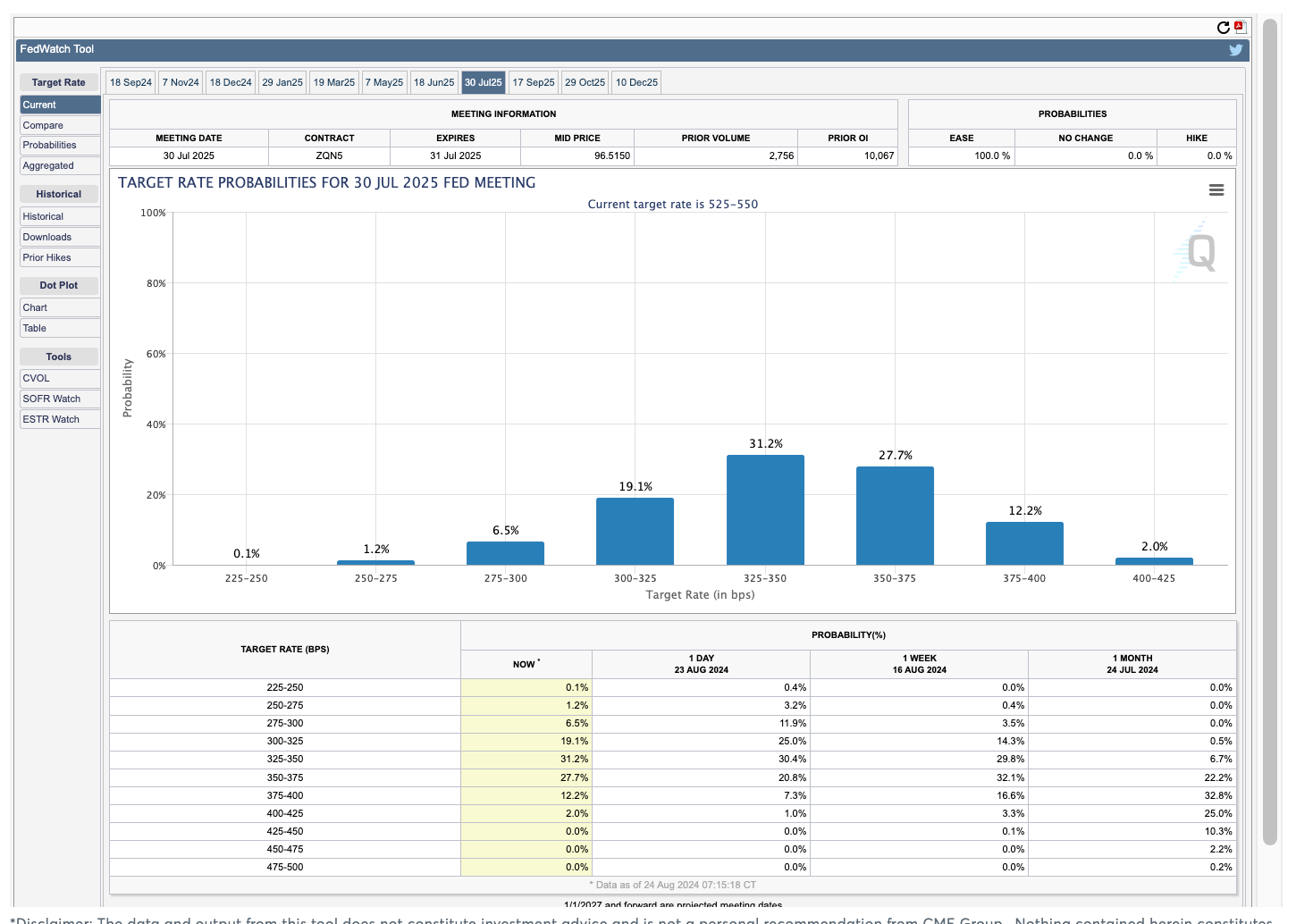

Most of my calls are rooted in where I think the Eurodollar futures on the IMM (the very futures that Fed Watch is calculated on) should be trading, not where they are trading—don’t confuse this with EUR/USD futures. Having spent three years trading at the Chicago IMM during my tenure at the Bank, I can tell you this is where most market moves are born. If you believe the IMM is underpricing a 50 bp cut in September at 34.5%, you will buy the contract, effectively lending money at that rate, and you should be willing to sell some dollars. As the probability of a deeper rate cuts increases along the curve, the dollar should weaken, giving you a solid foundation for a long-term US dollar selling strategy. Of course, the opposite can happen, but the Fed has pivoted to going low.

Over the short term, benchmark the September IMM contract. If Fed Watch ticks up and the odds of a 50 bp cut increase, you could sell a weighted dollar amount daily this week ( wink wink). But be cautious—it's not all about September; the cumulative cuts between now and December matter, too. So, while dollar strength might be worth selling, I’d advise keeping plenty of powder dry until after the NFP, which will tip the scales to 75 bp or 100 bp for 2024 and likely affect the curve out to July 2025. But then you need to kick the can to the March 2024 IMM contract.

This weekend, you’ll hear the usual chatter about selling dollars and buying gold. Still, the key is to have your quantified and qualified US dollar selling strategy in place, at least until mid-October when election risks could start heating up.

Despite what the mainstream media polls say, the market's still betting on Trump. And don’t underestimate how much RFK Jr. could sway the swing states. It’s fascinating—three former Democrats (Trump, RFK Jr., and Musk) seem to be on a mission, and that’s something worth keeping an eye on.

More By This Author:

Chair Powell Affirms: 'The Direction Of Travel Is Clear' Rate Cuts Are On The Way

Does The Fed Have The Backbone To Go Big ?

NFP Revisions Serve As Another Wake-Up Call For The Fed