Fed To Hike 25bp Should Conditions Allow

While the most prudent course of action may be to pause and digest the fallout from regional banking woes, the Federal Reserve is focused on inflation and will look to hike 25bp if conditions allow. With both higher borrowing costs and reduced access to credit set to weigh on growth and inflation, we continue to expect rate cuts in the second half of this year.

Banking stresses are a de facto tightening

It has been a remarkable few days in financial markets. As recently as 7 March, Fed Chair Jerome Powell opened the door to a 50bp rate hike, citing concerns that “unacceptably high” inflation could last for longer given the tightness of the jobs market. Just two days later and troubles at Silicon Valley Bank prompted fears of contagion and turmoil, leading to a collapse in rate hike expectations for both the 22 March FOMC meeting and the future path of interest rates. In fact, from pricing 100bp of cumulative hikes, we were looking at a potential 75bp of cuts by the end of the summer at one point.

For a long time, we have been on the more dovish end of expectations for interest rate moves in 2023. The concern was that this has been the most aggressive monetary policy tightening cycle for 40 years and by going harder and faster into restrictive territory you naturally have less control over the outcome. In such an environment we need to be alive to the risk of economic and/or financial stress and Silicon Valley Bank is a clear example of this. SVB and the failure of Signature Bank could be viewed as special cases but Credit Suisse’s woes are intensifying the nervousness that is rippling through the industry.

Disrupted credit flow will hit growth and depress inflation

Furthermore, it wasn’t just the rapid increase in borrowing costs that we felt was an issue for the economy. There has also been a rapid tightening in lending conditions too, which we felt would increasingly weigh on credit flow to the detriment of the economy.

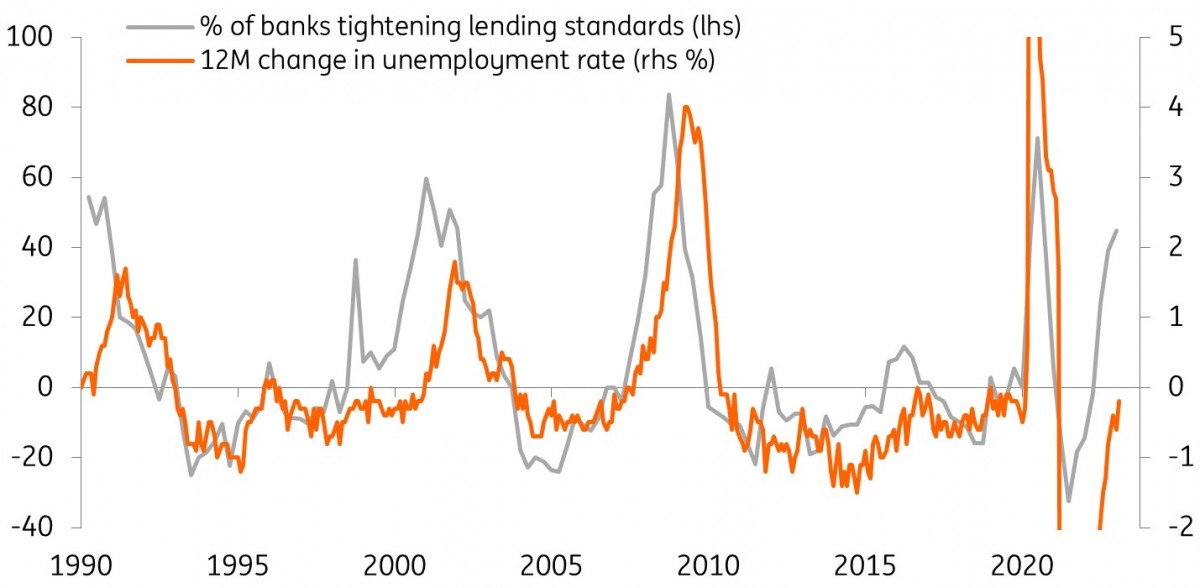

We imagine that the stresses created by the SVB fallout will only make banks more nervous about who they lend to, how much they lend, and at what interest rate. With regulators also likely sensing a need to be more proactive, this could lead to a snowball effect of risk aversion and tightening of lending standards that hampers credit flows, weighs on the economy, and allows inflation pressures to ease more quickly. The chart below shows that when banks pull back on credit (tightening of lending standards), unemployment soon starts climbing. That can quickly stamp out any residual inflation threat.

Tighter lending conditions result in rising unemployment

Image Source: Macrobond, ING

2% inflation isn’t the Fed’s only job

We then need to look at the purpose of the Federal Reserve – “To promote the health of the economy and the stability of the US financial system”

They do this via five functions:

1. Conducting monetary policy to keep inflation at 2% and maximize employment

2. Supervising & regulating financial institutions and their activities

3. Promoting consumer protection & community development

4. Promoting financial system stability

5. Fostering payment & settlement system safety and efficiency

Now at least three of those functions are scrambling to deal with SVB and potential issues in other regional banks and that, in the near term, should trump inflation. Then again, just as the European Central Bank did, the Federal Reserve can argue that it has different tools for different problems and the lending backstops and liquidity measures introduced can mitigate some of the current pain.

Fed would prefer to hike rates with 25bp as the most likely outcome

Moreover, there are clearly major hawks on the Fed, hence Chair Powell opening the door to 50bp last Tuesday so we can’t dismiss the possibility of a rate hike. The fact that the ECB was able to raise policy rates by 50bp with limited market reaction also suggests a hike is doable. A 50bp Fed rate hike would though, in the market’s mind, unnecessarily heighten the recession risk in an environment of tightening credit conditions. A surprise rate cut, as predicted by one bank, would signal major concern at the Federal Reserve, which could in turn mean financial market worries turn into a panic that exacerbates recession risks.

It is therefore between a 25bp move and no change on 22 March. The most prudent course of action, in our view, would be to pause to assess the damage, but leave the door open to a potential restart if the fallout is limited and inflation concerns persist. However, it is those inflation concerns that mean the Fed retains a desire to get the policy rate higher, should conditions allow. We also suspect the Fed will want to express confidence in the financial system and one way to do this would be to hike 25bp and signal in their forecasts that they think the Fed funds rate will end the year higher than it currently is.

ING expectations for the Federal Reserve's new forecasts

Image Source: Macrobond, ING

Ten days ago the expectation was that the Fed could be looking to get the Fed funds rate up to 5.5-5.75%, with some commentators talking about 6%. We doubt this will happen for the reasons already outlined. Instead, we think the Fed will likely raise their end-2023 central tendency projection to 5.4% from 5.1%. To indicate rate cuts in their forecasts for this year would give the green light to Treasury yields plunging and the dollar selling off, which the Fed would likely contend risks keeping inflation higher for longer.

Rate cuts to be the key theme for 2H 2023

Our own view is that if they do hike 25bp on 22 March, we could get one final 25bp hike before the summer leaving the Fed funds to range at 5-5.25%. This is not a conviction call given the likely damage to credit flow on top of the “long and varied lags” from monetary policy changes on the economy, in what has been the most aggressive tightening cycle for 40 years. Higher borrowing costs and reduced access to credit mean a higher chance of a hard landing for the economy. Rate cuts, which we have long predicted, are likely to be the key theme for the second half of 2023.

Fed’s new Term Funding Program will add liquidity, the reverse of what quantitative tightening achieves

There will be a keen ear to any commentary from Chair Powell on the new Term Funding Program. The terms of this facility are so good that a significant take-up is quite probable. Initially, there may be a reluctance to take advantage, so as to avoid raising red flags on individual names. But names will not be published, and once volumes build, more and more (mostly smaller) banks will likely use the facility. Note that this will re-build bonds on the Fed’s balance sheet. Not quite quantitative easing, but going in the opposite direction to the quantitative tightening process that’s ongoing (through allowing redeeming bonds to roll off the front end at a pace of US$95bn per month). Meanwhile, there is still some US$2tn of liquidity going back to the Fed through the reverse repo facility, the counter of which shows up in lower excess reserves than there would otherwise be. In fact, falling deposits in the banking system are generally reflected here too, with many such deposits showing up in money market funds, and from there into the Fed reverse repo facility.

Directionally, we doubt there is huge room to the downside for market rates, especially given the virtual collapse seen in the past week or so. That said, further falls in the near term are entirely possible should the banking story deteriorate further. But so far the banking issues are more idiosyncratic than systemic, and a system breakdown has become far less likely in the wake of the extraordinary deposit support announced by the Fed in the wake of the SVB collapse. Plus, delivery of a 25bp hike still means the Fed is tightening, and it is likely at least another hike to come. In the background, we envisage a medium-term Fed funds rate equilibrium at 3%, so long rates should not really be shooting below this, barring exceptional circumstances. There is, in fact, a probable scenario where longer-dated rates are under rising pressure, even as the front end ultimately sees pressure for lower rates later in 2023. The inflation issue remains a significant one, and any let-off through interest rate cuts, or even the discount thereof, would leave longer rates less protected from residual medium-term inflation risks.

FX: Financial stability concerns will still play a role

Policy intervention by authorities in both the US and Switzerland has seen stress levels start to improve in FX markets over recent days. Traded FX volatility levels are softening and some of the risk reversal skews to protect against a stronger dollar have started to narrow. Notably, however, investors still resolutely want to own downside protection in USD/JPY – a key financial crisis hedge.

Heading into the 22 March FOMC meeting, the FX options market is pricing a relatively subdued 0.7% range for EUR/USD. The thinking here is that the Fed, like the ECB, manages to get away with probably a 25bp hike without heaping more pressure on markets.

But events in banking markets over the last week suggest investors will not be quick to return to the kind of macro drivers prevalent in FX markets over the last two years. We had been waiting for the turn in the Fed cycle on the back of disinflation/activity to break the huge inversion of the US yield curve and weaken the dollar. That yield curve inversion has broken – but it has been a financial crisis and not the macro proving the catalyst.

Ultimately, we think events over the past week make it more likely that the dollar does indeed weaken later this year and we retain end-year EUR/USD and USD/JPY targets at 1.15 and 120. But in the interim, we need banking markets to settle. For reference, it took a couple of months from the start of Covid (February 2020) for conditions to settle and for the weaker dollar trend to win through. This is consistent with our call now for dollar weakness to be a cleaner story in the third quarter after continued volatility in the second.

For Wednesday’s meeting itself, we do not expect too much volatility if conditions allow the Fed to hike 25bp and the dot plots do not surprise too much. An unlikely 50bp hike would be very bullish for the dollar – and EUR/USD could well trade under big support at 1.05 on the news. A pause could see the dollar weaken a little – but it would be understandable after recent bank failures. Our overall preference is to remain defensive this month and maintain overweight positions in the Japanese yen.

More By This Author:

FX Daily: Data Dependent Or Financial Stability Dependent?

Australia: Employment Surges

FX Daily: Confidence Crisis Sparks Wrong Kind Of Dollar Rally

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more