EUR/USD Weekly Forecast: Easing US Jobs Market Boosts Euro

- US Unemployment claims rose to a bigger-than-expected 231,000 in the previous week.

- Markets predict two Fed cuts in 2024, with the first probably in September.

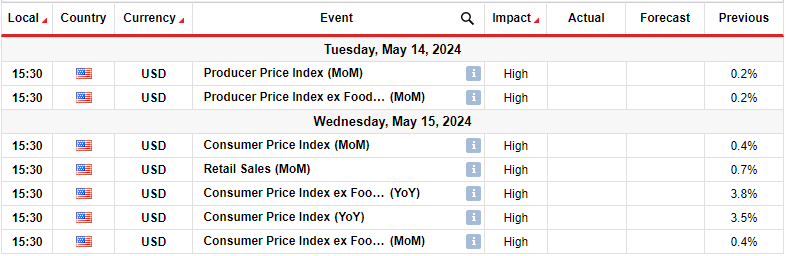

- Next week, the US will release its wholesale and consumer inflation reports.

The EUR/USD weekly forecast points to more bullish momentum as the easing US labor market supports Fed rate cut expectations.

Ups and downs of EUR/USD

The EUR/USD pair had a slightly bullish week characterized by dollar weakness. Investors were still digesting the poor nonfarm payrolls report when the US released more downbeat employment data.

Unemployment claims rose to a bigger-than-expected 231,000 in the previous week, indicating more cracks in the resilient labor market. As a result, there was an increase in Fed rate cut expectations. Markets now predict two cuts in 2024, with the first probably in September.

Next week’s key events for EUR/USD

Next week, the US will release its wholesale and consumer inflation reports. At the same time, investors will pay attention to the retail sales report. Inflation data will significantly impact the market as it will give insight into the outlook for Fed rate cuts. There is a lot of anticipation for this particular report because recent data from the country has shown a slowdown in the economy. Therefore, market participants are waiting to see if this will translate to lower inflation.

At the same time, retail sales data will show the state of demand and consumer spending. A decline in sales would indicate further economic deterioration, which would allow the Fed to start cutting rates in September. However, if any of these reports come in higher than expected, investors will push back the timing for Fed rate cuts.

EUR/USD weekly technical forecast: Bulls challenge solid resistance trendline

EUR/USD daily chart

On the technical side, the EUR/USD price trades above the 22-SMA. At the same time, the RSI supports bullish momentum as it trades above 50. However, although the sentiment is bullish, the larger trend remains down because the price is still making lower highs and lows.

Moreover, although the price has made deep pullbacks, it has respected its bearish trendline. At the moment, bulls are retesting the resistance trendline. If the resistance holds firm as before, the price will fall below the 22-SMA to retest the 1.0601 support level. On the other hand, the bullish bias will strengthen if the price breaches the trendline and the 1.0850 resistance level.

More By This Author:

GBP/SUD Outlook: Pound Rallies On The Heels Of Strong GDP DataAUD/USD Weekly Forecast: Greenback Weak, Focus On US CPI

GBP/USD Forecast: BoE to Implement Two Rate Cuts in 2024

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more