EUR/USD Struggles To Maintain Balance Amidst Mixed Market Signals

Photo by Ibrahim Boran on Unsplash

The EUR/USD pair is trading close to the 1.0900 level on the first Tuesday of April. The market is taking into consideration the latest data on the Core PCE index, which grew by only 0.3% m/m in February, lower than the expected figures. The year-to-year data also dropped by 5.0%, which could be a reason for the Federal Reserve System to pause its monetary policy tightening.

Although no meetings of the Fed management are scheduled for April, investors will keep a close eye on important statistics from the US this week. This includes the PMI in services and products, the factory orders report, and the employment market statistics for last month.

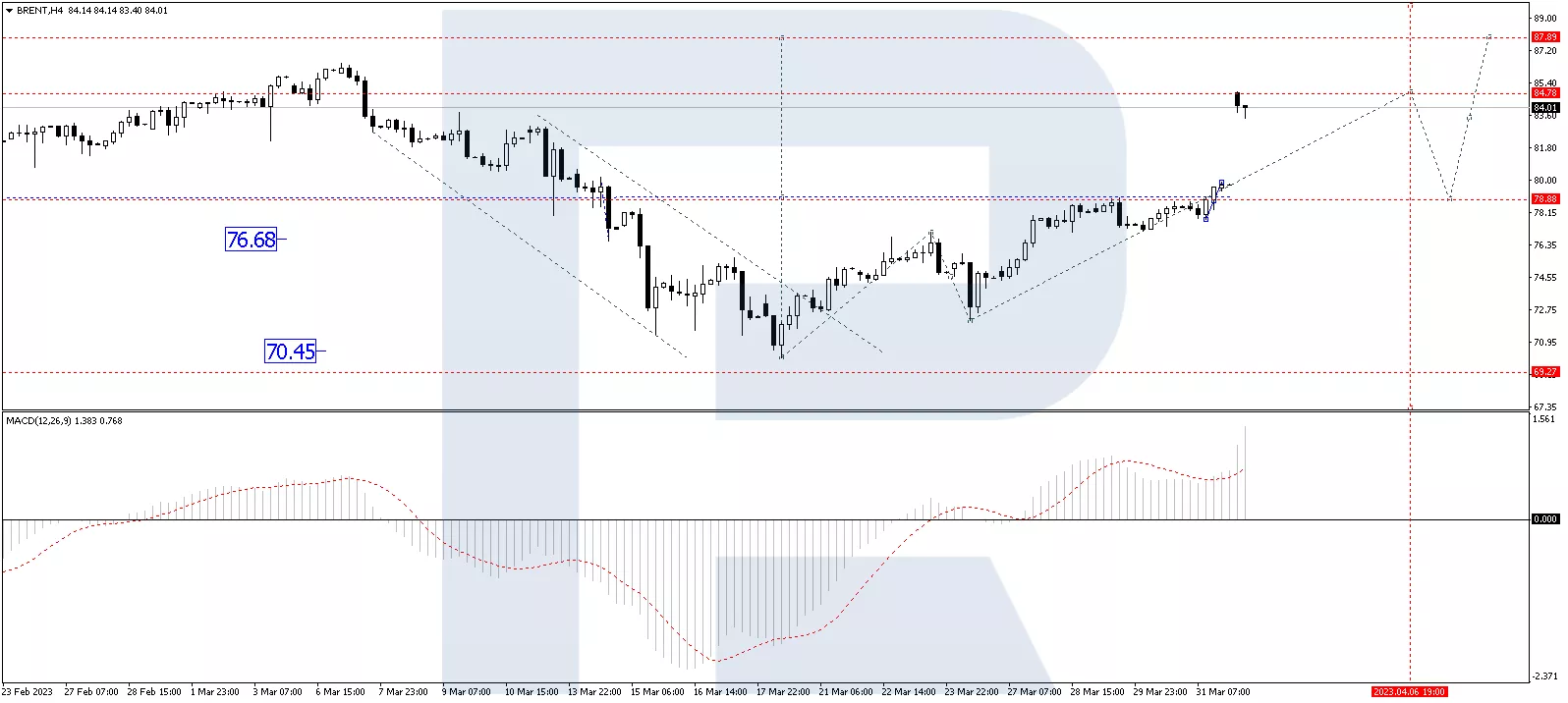

Looking at the technical analysis, the EUR/USD pair has formed a structure of a declining impulse to 1.0788 on H4, and the market is currently consolidating above this level. There is a possibility of a link of growth to 1.0850, followed by a decline to 1.0707, from where the wave could extend to 1.0595. The MACD confirms this scenario, with its signal line above zero and aiming downwards to renew the lows.

(Click on image to enlarge)

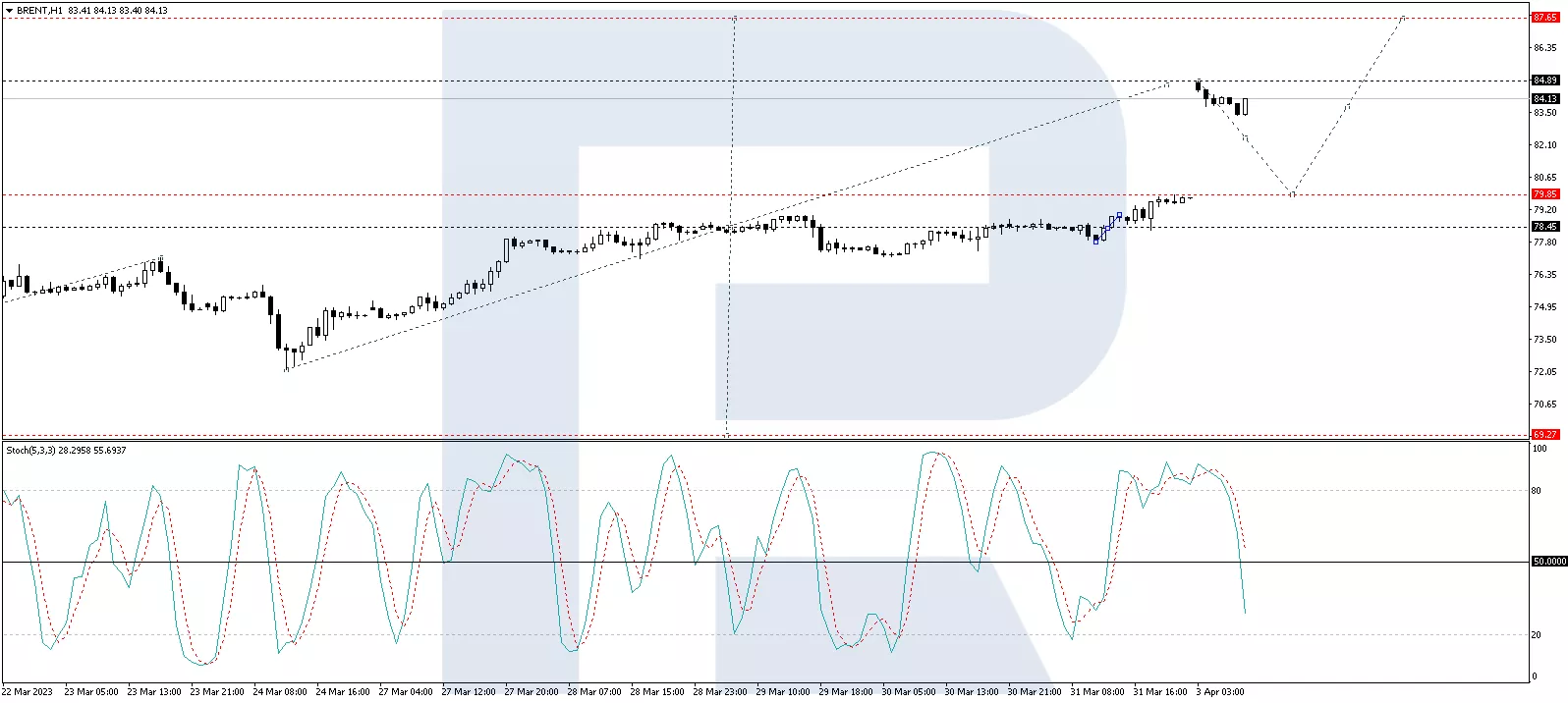

On H1, the EUR/USD pair has completed the structure of a declining wave to 1.0788, and a consolidation range is forming above this level. The price is expected to break the range upwards, reaching 1.0850, and then decline to 1.0697. The target is local, and this is only half of the declining wave. The Stochastic oscillator confirms this scenario, with its signal line near 50, expected to grow to 80 and then fall to 20.

(Click on image to enlarge)

Overall, the market is closely monitoring the data releases from the US this week and waiting for further signals from the Federal Reserve System to make a weighted decision on its monetary policy.

More By This Author:

Gold Shines Brighter Even In Difficult Times: What Is The Reason For The Price Increase

The Fed Will Set The Mood For EURUSD

The US Dollar Got The Needle

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for ...

more