EUR/USD Poised To Renew Two-Month Highs As Buying Momentum Builds

Image Source: Pixabay

Key drivers behind EUR/USD’s rise

A decline in US Treasury bond yields has weighed on the US dollar, following a series of weaker-than-expected US economic reports and dovish remarks from Federal Reserve officials.

Austan Goolsbee, President of the Federal Reserve Bank of Chicago, stated that he does not expect the Core Personal Consumption Expenditures (PCE) index to be as concerning as the recent Consumer Price Index (CPI) data. As a key inflation measure for the Federal Reserve, the Core PCE significantly influences monetary policy expectations.

Meanwhile, St. Louis Fed President Alberto Musalem warned of stagflation risks and the potential challenges in setting future policy.

The latest US jobless claims data further raised concerns, showing an increase to 219,000 from the previous 213,000, exceeding the forecast of 214,000.

In the eurozone, the euro could see further upside if the German election outcome triggers additional short-covering in EUR/USD.

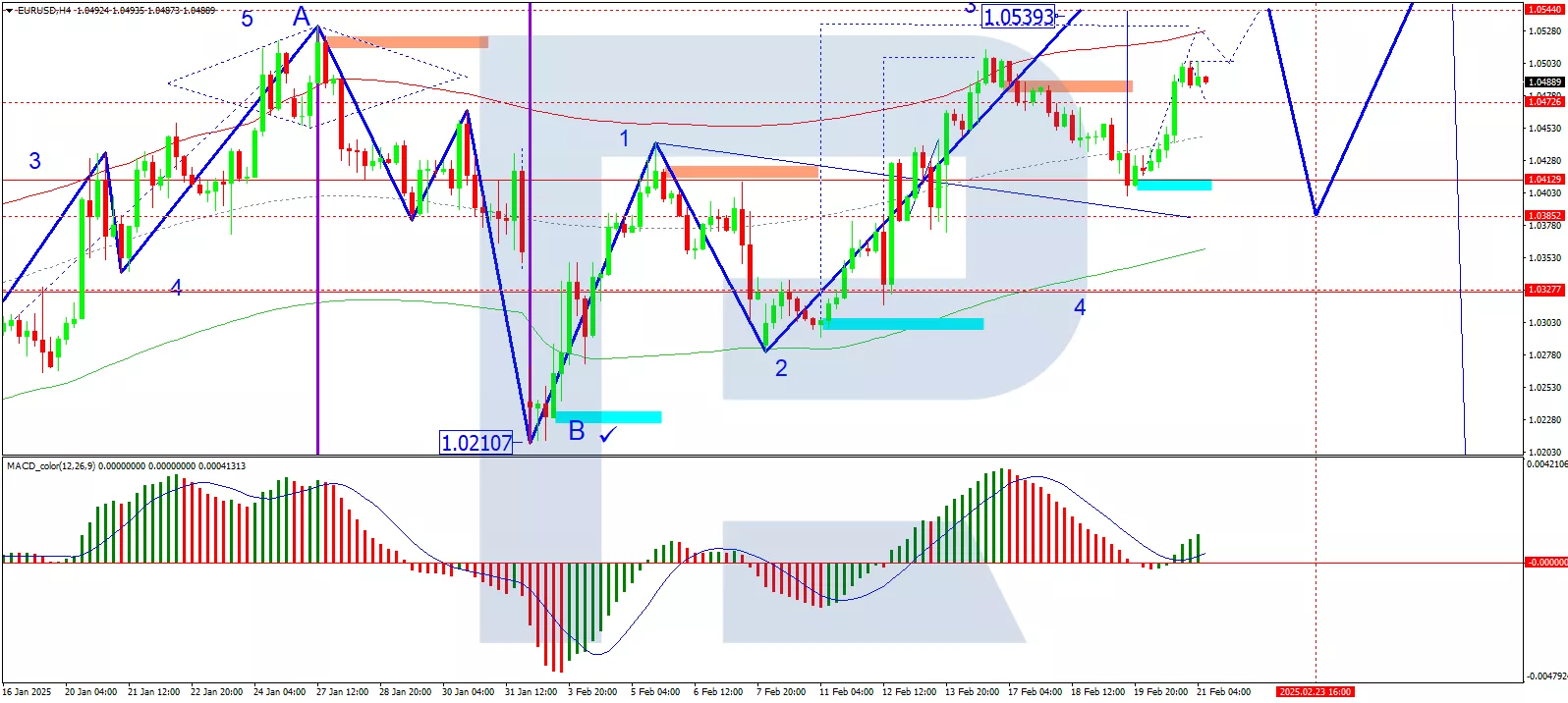

Technical analysis of EUR/USD

(Click on image to enlarge)

On the H4 chart, EUR/USD has completed a growth wave to 1.0470, forming a consolidation range around this level. The market has since broken higher, paving the way for further gains towards 1.0544. A correction towards 1.0385 may follow after reaching this level. The MACD indicator supports this scenario, with its signal line above zero and pointing upwards, indicating continued bullish momentum.

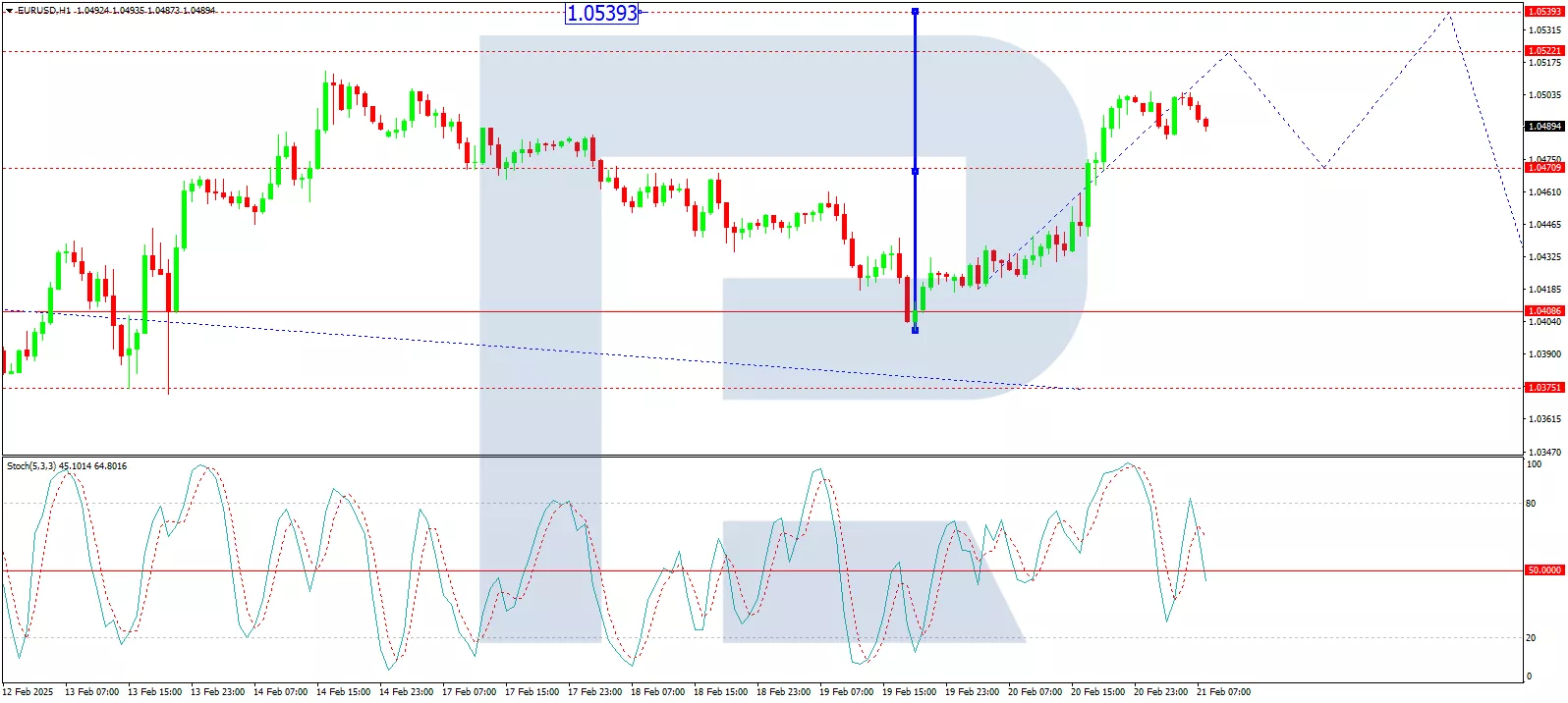

(Click on image to enlarge)

On the H1 chart, the pair executed a growth wave to 1.0470, followed by a narrow consolidation range around this level. The likelihood of an upward breakout towards 1.0520 remains high. After reaching this level, a correction to 1.0470 could occur before the growth wave resumes towards 1.0544. The Stochastic oscillator confirms this outlook, with its signal line above 80 and trending towards 20, suggesting a possible pullback before further gains.

Conclusion

EUR/USD remains in an uptrend, supported by weakening US Treasury yields and a cautious Fed outlook. If bullish momentum continues, the pair may extend gains towards 1.0544. However, a corrective move could follow before further upside. The outcome of the German election could also influence short-term price action, potentially driving additional volatility.

More By This Author:

USD/JPY Hits Two-Month Low As Demand For Safe-Haven Yen Surges

Gold To Extend Its Rally As Market Conditions Remain Favorable

EUR/USD Significantly Rises As Risks Diminish

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for ...

more