EUR/USD Outlook: 0.9850 Support Holds Firm As Markets Await Clarity

EUR/USD Fundamental Backdrop

EUR/USD staged a decent 40 pip rally at the European open and has largely held onto these gains as the session wore on. As anticipation of the FOMC meeting continues to build markets are experiencing some dollar weakness ahead of the event, as investors seek clarity on Fed policy moving forward.

Euro bulls' attempt to push higher toward parity was cut short yesterday as US job opening numbers surprised to the upside, beating estimates of 10 million with a print of 10.7 million. US ISM Manufacturing PMI provided a further boost to the greenback by remaining in expansion territory. As a result, the greenback held firm as EUR/USD erased its daily gains for a fourth consecutive bearish close.

The European Central Bank (ECB) meeting last week was a turning point for the pair. Following a significant rally back above parity we saw subtle hints from ECB President Lagarde during her speech which markets interpreted as dovish and sent the pair down some 200-odd pips. President Lagarde did however stress that monetary policy decisions will remain “data dependent”. Given the inflation numbers out of the zone and Lagarde’s comments the ECB may have no choice but to keep up the pace of rate hikes as inflation remains stubborn.

For all market-moving economic releases and events, see the DailyFX Calendar

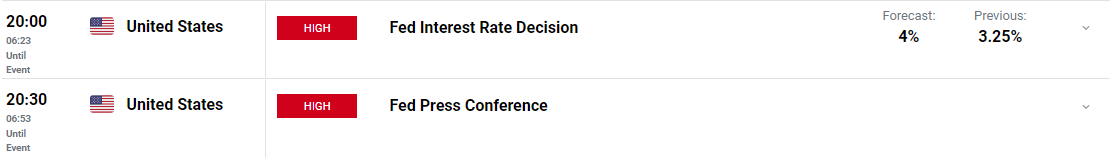

Markets are now firmly fixed on the FOMC meeting later today with a 75bp hike largely priced in. Investors will focus on comments from Fed chair Powell as they look ahead to December and whether we could see a smaller hike of 50bp. We have seen the probability of a 50bp hike for December increase by about 20% over the last week as Fed policymakers’ comments before the blackout period seemed to hold a dovish tone. A similar sort of message from Fed chair Powell could see EUR/USD surge back above parity while hawkish comments could push the pair lower and threaten the YTD lows.

EURUSD Daily Chart – November 2, 2022

(Click on image to enlarge)

Source: TradingView

From a technical perspective, the monthly candle closed as a bullish inside bar which hints at upside ahead. The weekly also had a bullish candle close yet displayed signs of USD buyers returning.

The upside rally last week found resistance at the 100-SMA as the pair is currently testing the 20 and 50-SMA respectively. On the daily timeframe price action remains bullish as we have printed higher highs and higher lows since the YTD low. This coupled with the triangle breakout support a move higher for the pair with the FOMC meeting likely to help or hinder such a move.

The bullish daily structure will remain intact if no daily candle closes below the 0.9700 area. A candle close below here would definitely open up the possibility of lower prices and perhaps a new YTD low.

Key intraday levels that are worth watching:

Support Areas

- 0.9850

- 0.9775

- 0.9700

Resistance Areas

- 1.0000

- 1.0100

More By This Author:

Crude Oil Forecast: Brent Bid On Possible Reduction In China’s COVID Policies, API & FOMCUSD/JPY Slips Back As Market Looks To Fed Chair Powell

British Pound News: GBP Dictated By USD Ahead Of FOMC