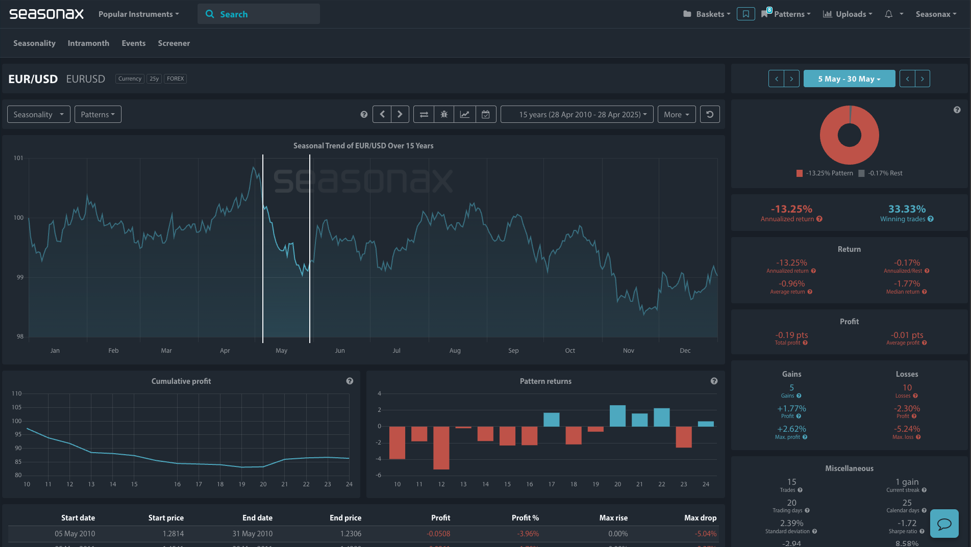

EUR/USD: May Weakness Ahead – Key Technical Test At 1.12000

- Instrument: EUR/USD

- Average Pattern Move: -0.96%

- Timeframe: 5 May – 30 May

- Winning Percentage: 33.33%

- Seasonality Source: Seasonax

You may not realize it, but the month of May often brings headwinds for the euro. Understanding both the historical seasonality and the key technical levels in play right now is critical for navigating this environment. We want to analyze the data in more detail.

Seasonality Overview:

The chart shows you the typical development of the EUR/USD between May 5 and May 30 over the past 15 years. During this period, EUR/USD has historically fallen with an average decline of -0.96% and only a 33.33% win rate for bullish moves, indicating May tends to be a bearish month for the euro.

(Click on image to enlarge)

Macro Drivers to Watch:

- ECB-Fed Policy Divergence: With the European Central Bank (ECB) likely to move ahead of the Fed in cutting rates, relative rate differentials could weigh on the euro.

- Weaker European Growth: The IMF has downgraded growth projections for advanced economies, including the eurozone, adding further macro drag to the currency.

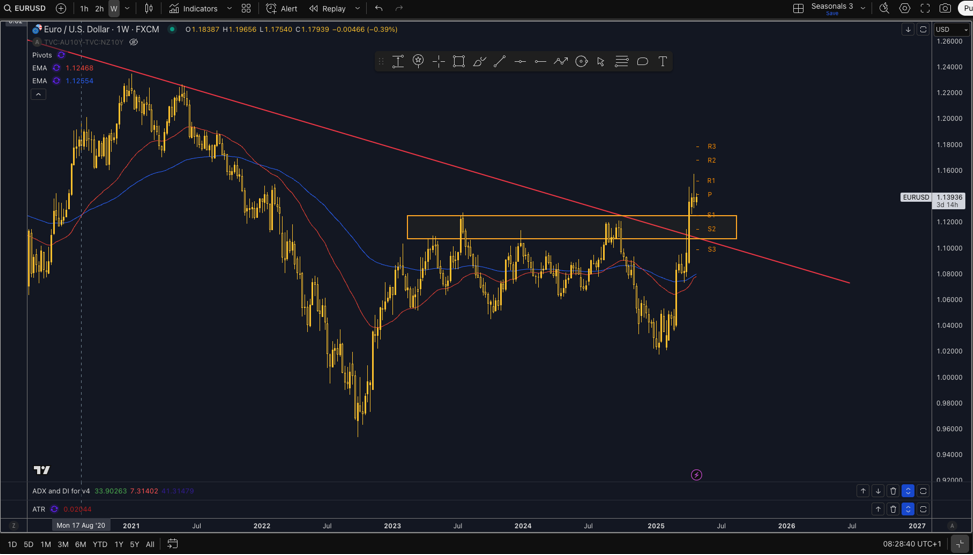

Technical Analysis – 1.1200 Is Pivotal:

The technical picture also highlights a major inflection point. As the chart shows, EUR/USD recently broke out above a long-term downtrend line that stretches back to 2008. This trend line intersects with a significant horizontal resistance zone around 1.1200, a level where price action has repeatedly stalled in the past.

Holding above 1.1200 would validate the breakout and could see bulls targeting the 1.1400-1.1500 area. However, failure to maintain strength above this zone — particularly given the weak seasonal tendencies in May — could trigger a sharp pullback, possibly retesting the breakout zone from below and a move back to 1.0800.

(Click on image to enlarge)

Trade Risks: The moves in EUR/USD will depend heavily on upcoming US inflation prints, ECB commentary, and broader risk sentiment. Should US data disappoint or the Fed turn more dovish, USD weakness could offset some of the usual seasonal downside pressure.

Video Length: 00:02:25

More By This Author:

Nomura’s U.S. Ambitions Face A Historically Harsh SummerS&P 500: Can It Still Rally Out Of The US GDP Print Despite The IMF Downgrade?

DXY: Seasonal Strength At Risk Amid Confidence Crisis

Disclosure: High Risk Investment Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading ...

more