EUR/USD Holds Steady As US Government Shutdown Ends

Image Source: Pixabay

The EUR/USD pair is trading flat on Thursday, hovering around 1.1587, following the House of Representatives' approval of a short-term budget bill that ends the longest US government shutdown in history.

The bill now awaits President Donald Trump's signature – a formality that will allow shuttered government agencies to resume operations within days.

While the resolution clears the way for the publication of a backlog of delayed macroeconomic data, the White House has cautioned that key October reports on employment and inflation may still be withheld from the public.

Market expectations for a December interest rate cut by the Federal Reserve have moderated but persist. The probability of a 25-basis-point cut has eased to 60%, down from 67% the day before.

This cautious sentiment was fuelled earlier in the week by ADP data, which showed that the US private sector shed an average of 11,250 jobs per week throughout October, amplifying concerns over a cooling labor market.

Technical Analysis: EUR/USD

H4 Chart:

(Click on image to enlarge)

On the H4 chart, EUR/USD has completed a corrective wave to 1.1605 and has formed a tight consolidation range below this resistance level. We anticipate a downward breakout from this range, triggering a decline towards an initial target of 1.1505. A breach of this level would open the path for a further extension of the downtrend to 1.1405. This bearish outlook is technically supported by the MACD indicator. Its signal line is above zero but has diverged from its histogram and is pointing decisively downward, suggesting the recent upward correction has run its course and bearish momentum is reasserting itself.

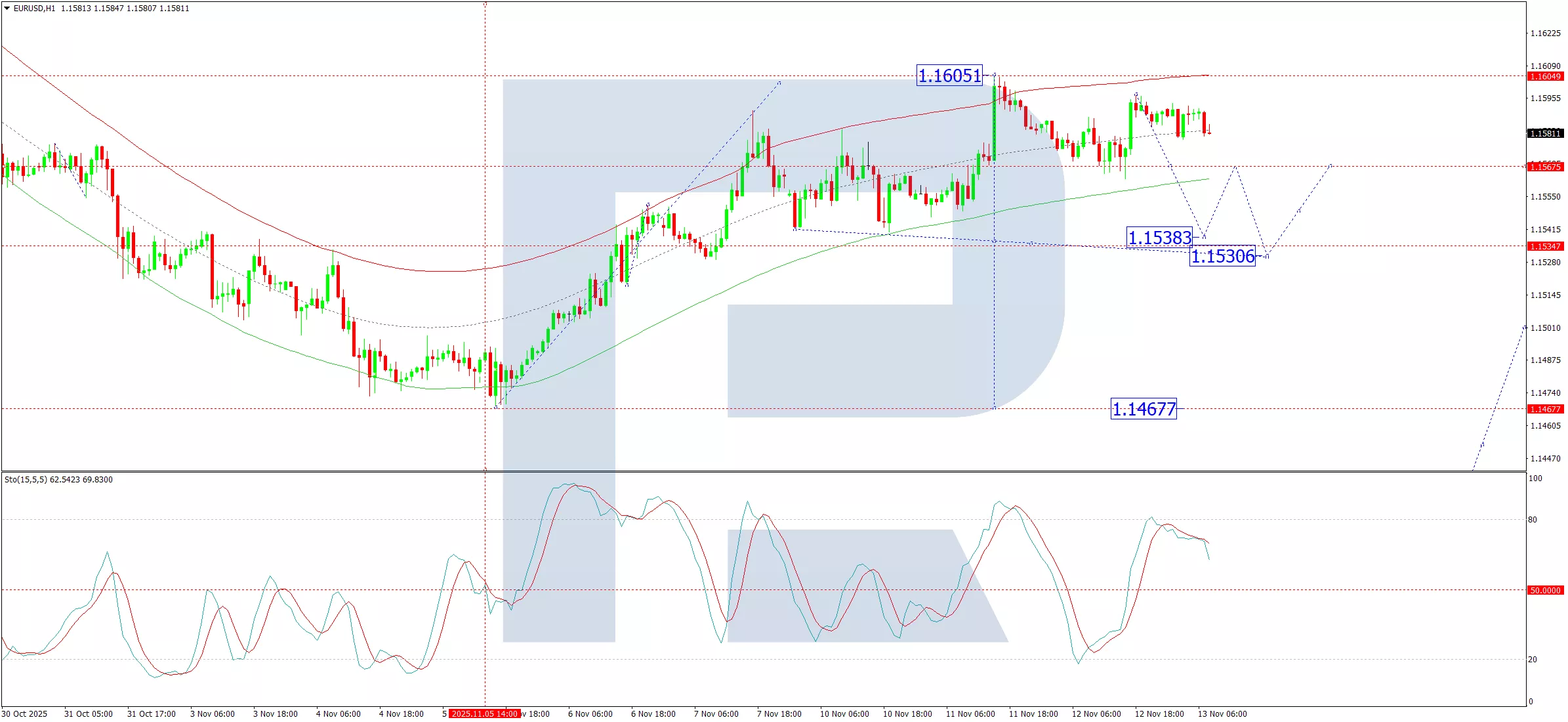

H1 Chart:

(Click on image to enlarge)

On the H1 chart, the pair completed a downward impulse to 1.1563, followed by a corrective bounce to 1.1597. These two levels define the upper and lower boundaries of a new consolidation range. A downward breakout is expected, leading to a resumption of the sell-off towards initial targets at 1.1538 and 1.1530. The Stochastic oscillator corroborates this view. Its signal line has turned down from below the 80 level and is falling steadily towards 20, indicating that short-term downward momentum is building.

Conclusion

While the end of the US government shutdown removes a key market overhang, the EUR/USD pair remains capped by underlying concerns about the US economy and a still-dovish Fed outlook. Technically, the structure points to a bearish resolution. The completion of the correction near 1.1605 suggests the pair is poised for a fresh leg lower, with key downside targets at 1.1505 and 1.1405.

More By This Author:

Pound Succumbs To Pressure From Weak Labor Data

USD/JPY Climbs To Fresh Nine-Month High

Gold Climbs To Two-Week High

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for ...

more