EUR/USD Holds Losses Amid Strong US Data, Easing Geopolitical Tensions

- EUR/USD picks up from 1.1775 but is failing to find acceptance above 1.1820.

- News of a trade deal with India and upcoming talks with Iran are supporting the US Dollar.

- A partial US government shutdown will delay key US labour data scheduled for this week.

The Euro (EUR) posts marginal gains against the US Dollar (USD) on Tuesday, trading right above 1.1800 at the time of writing, but so far unable to find acceptance above 1.1820. Strong manufacturing data in the US and news of a trade deal between the US and India provided additional support to the US Dollar on Monday and eased concerns about a partial US government shutdown.

US President Donald Trump announced a deal with India that will reduce tariffs on Indian products to 18% from the current 50%. Beyond that, Iran's president, Masoud Pezeshkian, said on Tuesday that Tehran will start nuclear negotiations with the US, which has contributed to easing tensions in the region, and provided additional support to the Greenback.

Macroeconomic data was also US Dollar supportive on Monday. The US ISM Manufacturing Purchasing Managers' Index (PMI) improved beyond expectations, offsetting concerns about a partial government shutdown that will delay Friday's Nonfarm Payrolls (NFP) report.

In the economic calendar on Tuesday, the main focus will be on the Federal Reserve (Fed) Governor Michelle Bowman's speech, ahead of Wednesday's US ADP Employment report, which will be observed with particular interest, and Thursday's European Central Bank (ECB) monetary policy decision.

Euro Price Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.07% | -0.09% | 0.11% | 0.07% | -0.82% | -0.55% | -0.17% | |

| EUR | 0.07% | -0.01% | 0.17% | 0.14% | -0.75% | -0.48% | -0.09% | |

| GBP | 0.09% | 0.01% | 0.19% | 0.15% | -0.74% | -0.46% | -0.07% | |

| JPY | -0.11% | -0.17% | -0.19% | -0.03% | -0.92% | -0.66% | -0.26% | |

| CAD | -0.07% | -0.14% | -0.15% | 0.03% | -0.88% | -0.62% | -0.22% | |

| AUD | 0.82% | 0.75% | 0.74% | 0.92% | 0.88% | 0.28% | 0.67% | |

| NZD | 0.55% | 0.48% | 0.46% | 0.66% | 0.62% | -0.28% | 0.39% | |

| CHF | 0.17% | 0.09% | 0.07% | 0.26% | 0.22% | -0.67% | -0.39% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily Digest market Movers: The Dollar strengthens further on upbeat US data

- A firmer US Dollar drew additional support from factory data released on Monday. The US ISM Manufacturing PMI rose to 52.6 in January, its best reading in more than three years, from 47.9 in December and beating expectations of a 48.5 reading.

- Likewise, the US S&P Global Manufacturing PMI was revised up to 52.4 in January from the 51.9 reading released by preliminary estimations.

- Also on Monday, Trump announced a trade deal with China, by which the Asian country commits to buy US Oil, defence goods, and aircraft, and partially open its agriculture sector to US products in exchange for reduced trade tariffs.

- Investors have shrugged off a partial government shutdown after Congress failed to approve funding for some of the federal agencies. The Senate has approved the bill to reopen these agencies, which now heads to the House of Representatives, which is expected to vote on Tuesday. Labour data for this week, including JOTLS Job Openings and the Nonfarm Payrolls reports, will be delayed.

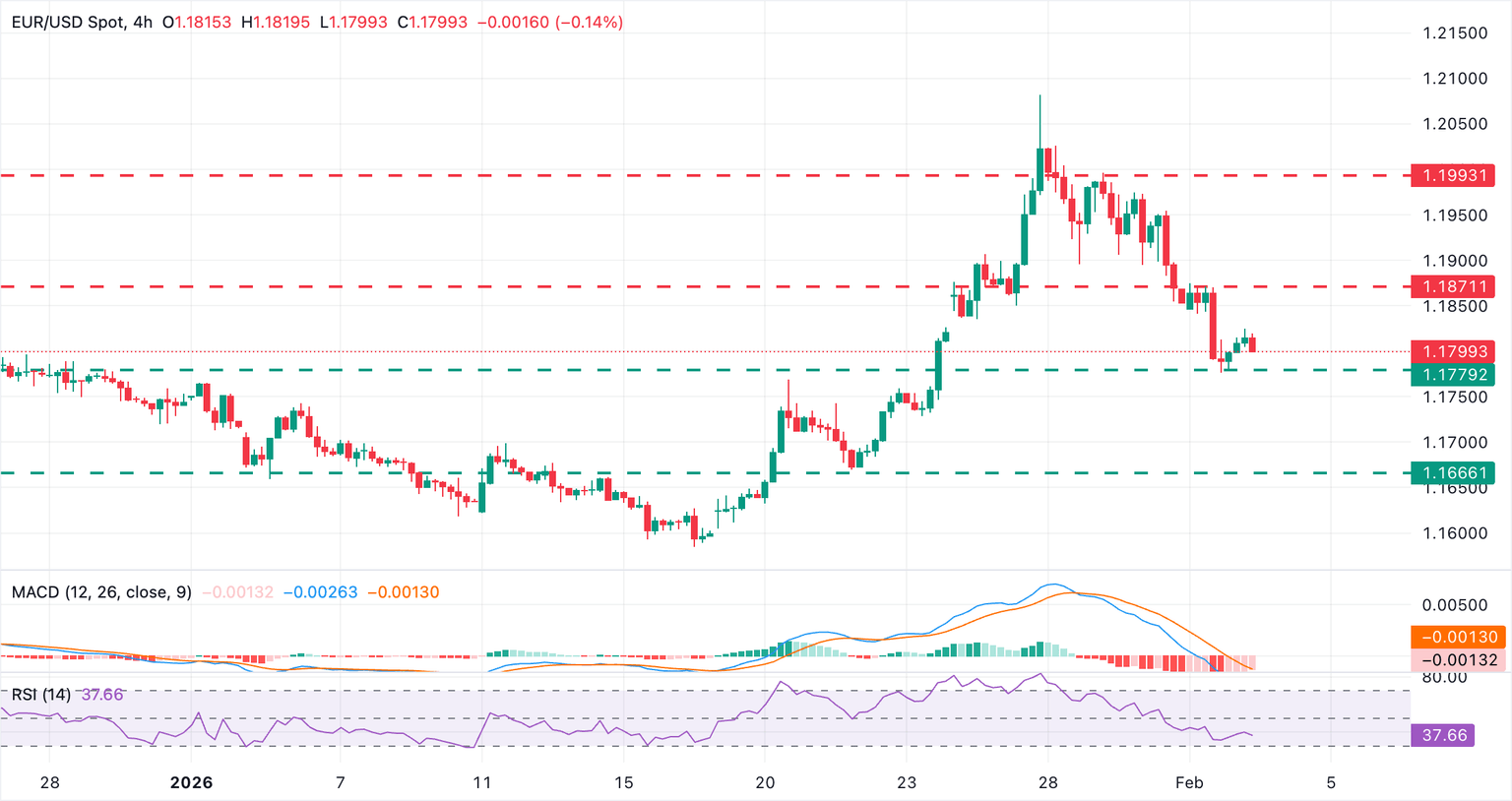

Technical Analysis: EUR/USD remains weak with 1.1770 support in play

(Click on image to enlarge)

The EUR/USD has bounced up from lows, but the immediate trend remains bearish. The Relative Strength Index (RSI) in the 4-hour chart is pointing upwards around 40, highlighting a fading bearish momentum. In the same line, the Moving Average Convergence Divergence (MACD) histogram is showing contracting red bars, which suggests that selling pressure has eased somewhat.

The pair has found some footing, although bulls are likely to be challenged at Monday's high of 1.1875. Further up, the target is the January 30 high near 1.1975, ahead of the 1.2000 round level.

On the downside, support at the 1.1770 area (January 20 high) remains on the bears' focus. A confirmation below that level would add pressure towards the January 21, 22 lows near the 1.1665 area.

More By This Author:

WTI Seems Vulnerable Near $61.75, One-Week Low Amid US-Iran De-EscalationUSD/CAD Rises As Strong US PMI And Falling Oil Prices Weigh On The Loonie

USD/JPY Treads Water Above 155.00 As BoJ Reinforces Gradual Tightening Path

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more