EUR/USD Holds Firm As The US Dollar Ends The Week With Losses

Image Source: Pixabay

EUR/USD is trading near 1.0806 on Friday, maintaining its position despite failing to extend its gains further. Investors are focused on the upcoming US employment data for February, which will be released later today.

Key factors influencing EUR/USD

The US dollar briefly found support after President Donald Trump temporarily excluded some Canadian and Mexican goods from the 25% tariffs imposed earlier this week. This move raised hopes for further trade concessions, easing concerns slightly.

However, despite this development, the USD is on track to close the first week of March with a loss of over 3%. The escalating trade war has increased fears of negative economic consequences for the US, particularly given the heavy reliance of US companies on free trade.

Meanwhile, the euro gained support from expectations of increased government spending in Germany and other European nations, particularly in defence investments.

The European Central Bank (ECB) cut its interest rate as expected, reducing it to 2.65% per annum. This move was widely anticipated and did not create market surprises.

Technical analysis of EUR/USD

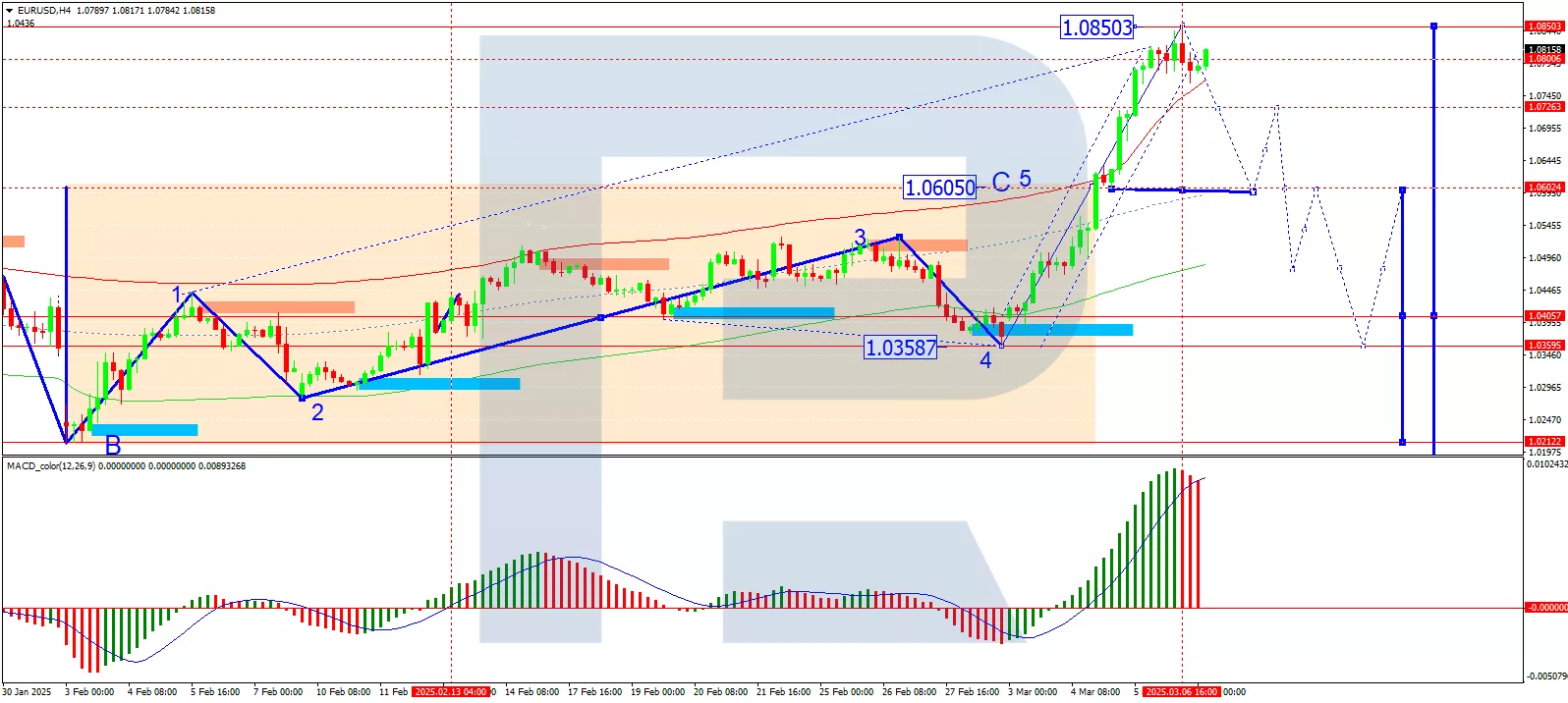

(Click on image to enlarge)

On the H4 chart, EUR/USD completed a growth wave to 1.0850 and is now forming a consolidation range around 1.0800. A downward breakout from this range is expected, potentially leading to a decline towards 1.0600. After reaching this level, a correction towards 1.0700 could follow. The MACD indicator supports this scenario, with its signal line above zero but turning downward, indicating potential weakness.

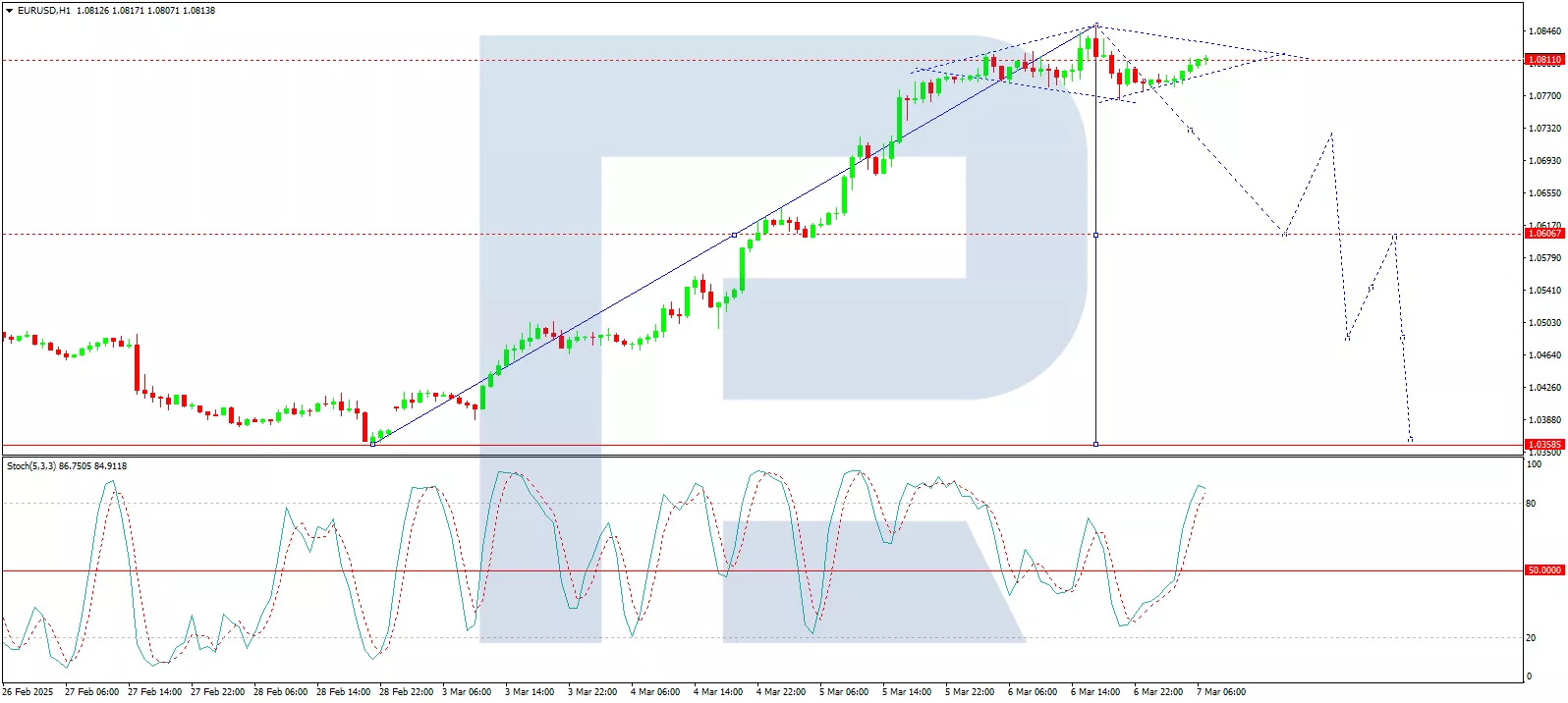

(Click on image to enlarge)

On the H1 chart, EUR/USD is consolidating around 1.0800. A move down to 1.0730 is expected, followed by a possible retest of 1.0800 from below before another decline towards 1.0600. If this trend continues, the next target could be 1.0400. The Stochastic oscillator confirms this outlook, with its signal line above 80 and preparing to decline towards 20, indicating a potential bearish shift.

Conclusion

EUR/USD remains elevated but faces increasing downside risks, particularly if US job data strengthens the dollar. While trade tensions and ECB policy support the euro, technical indicators suggest a potential decline towards 1.0600, with further downside possible. The US employment report will be a critical driver for the next major move in the pair.

More By This Author:

Gold Poised For A Rally As Support Builds From Multiple Factors

USD/JPY Steadies As The Market Consolidates After Fresh Lows

EUR/USD Appreciates As Optimism Builds Around Germany’s Fiscal Plans

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for ...

more