EURUSD Forex Analysis For Monday, July 2

EUR/USD Forex Analysis for July 2, 2018

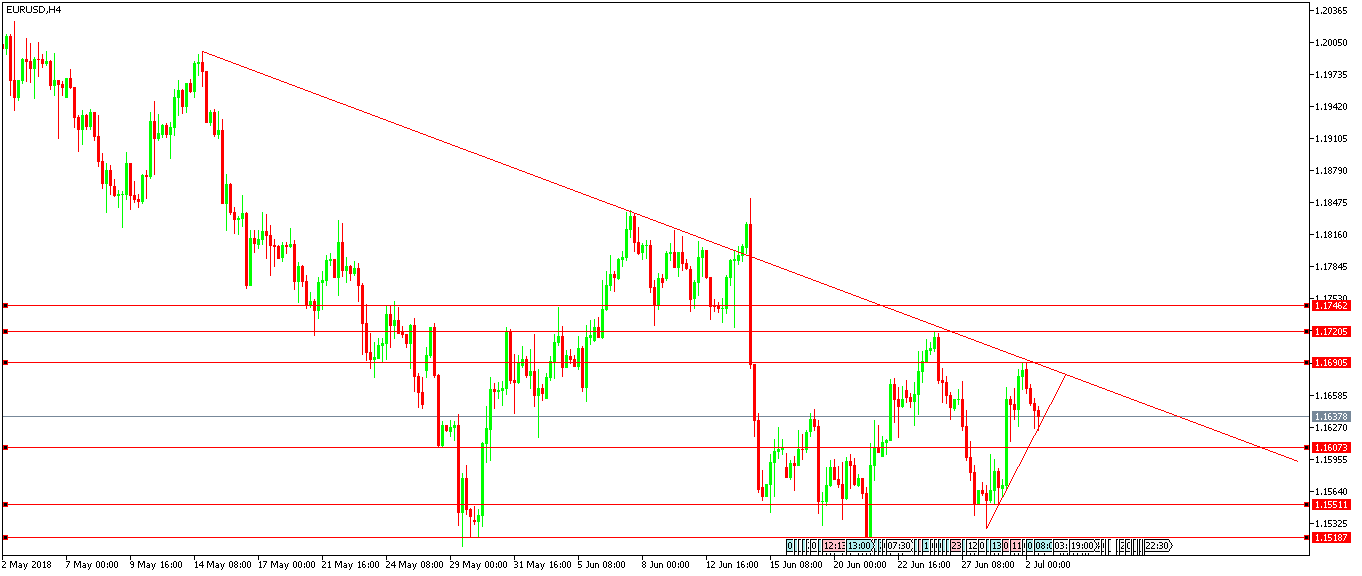

First, we look into the last week's trade and what happened on June 29, 2018, and it opens at 1.15674 and went high at 1.16898 and gone low 1.15575 and finally close at 1.16805. The calculated pivot point for the day is 1.1642

| LEVELS | FIRST LEVEL | SECOND LEVEL | THIRD LEVEL |

| BUY LEVELS | 1.1690 | 1.1720 | 1.1746 |

| SELL LEVELS | 1.1607 | 1.1551 | 1.1518 |

(Click on image to enlarge)

EUR/USD pair takes a bearish trend due to negative results in Markit manufacturing PMI's. Also, US Dollar holds stronger due to Germany political chaos.

Some of the Notable events occurred and impact the pair considerably, they are

-

EUR: Markit Manufacturing PMI (Spain) Act 53.4 Prev 53.4

-

EUR: Markit Manufacturing PMI (Italy) Act 53.5 Prev 52.7

-

EUR: Markit Manufacturing PMI (France) Act 52.5 Prev 53.1

-

EUR: Markit Manufacturing PMI (Germany) Act 55.9 Prev 55.9

-

EUR: Markit Manufacturing PMI Act 54.9 Prev 55.0

-

EUR: Markit Manufacturing PMI (Britain) Act 54.4 Prev 54.4

-

EUR: Unemployment Rate (Italy) Act 10.7% Prev 11.2%

-

EUR: Unemployment Rate Act 8.4% Prev 8.5%

-

USD: ISM Manufacturing PMI at 10:00 HRS EST - Prev 58.7

-

USD: ISM Price Paid at 10:00 HRS EST - Prev 79.5

So would action would you recommend here?

Right now, it breaks the support of my analysis. U can go with bearish trend. We have a strong support on 1.1565.