EUR/USD Fears American Tariffs On European Cars

EUR/USD is trading around the 1.1300 level, consolidating moves from previous days. US President Donald Trump repeated his satisfaction from progress in the US-Chinese trade talks. The negotiations resume today in Washington at a low level and will continue later at a senior level later in the week. Optimism about clinching an accord or at least postponing the March deadline support markets.

On the other hand, the US may turn its trade focus to Europe. The Trump Administration received a report regarding duties on cars. The President now has 90 days to decide on the matter. While the content of the report has not been made public, the purpose of it was to set the grounds for imposing duties under Article 232, which is related to security threats. The Administration made used the same mechanism to impose steel and aluminum tariffs last year.

European Commission President Jean-Claude Juncker said that if the US breaks its promise to enact a trade truce, the EU will also break its promise not to impose new levies on the US.

The rhetoric weighs on the pair and may turn into a tumble if things escalate.

Tariffs on vehicles could deal a blow to a European economy that is slowing down. The outgoing Chief Economist of the European Central Bank Peter Praet said that they might change the guidance regarding interest rates if the weak data persist.

We will get another indicator of the health of the German economy later. The ZEW Economic Sentiment is projected to remain below 0 in February, reflecting pessimism. The 300-strong survey stood at -15 points in January.

In the US, there are no top-tier economic gauges due today, but American traders return after a bank holiday on Monday, and this may result not only in higher trading volume but also more volatility.

EUR/USD Technical Analysis

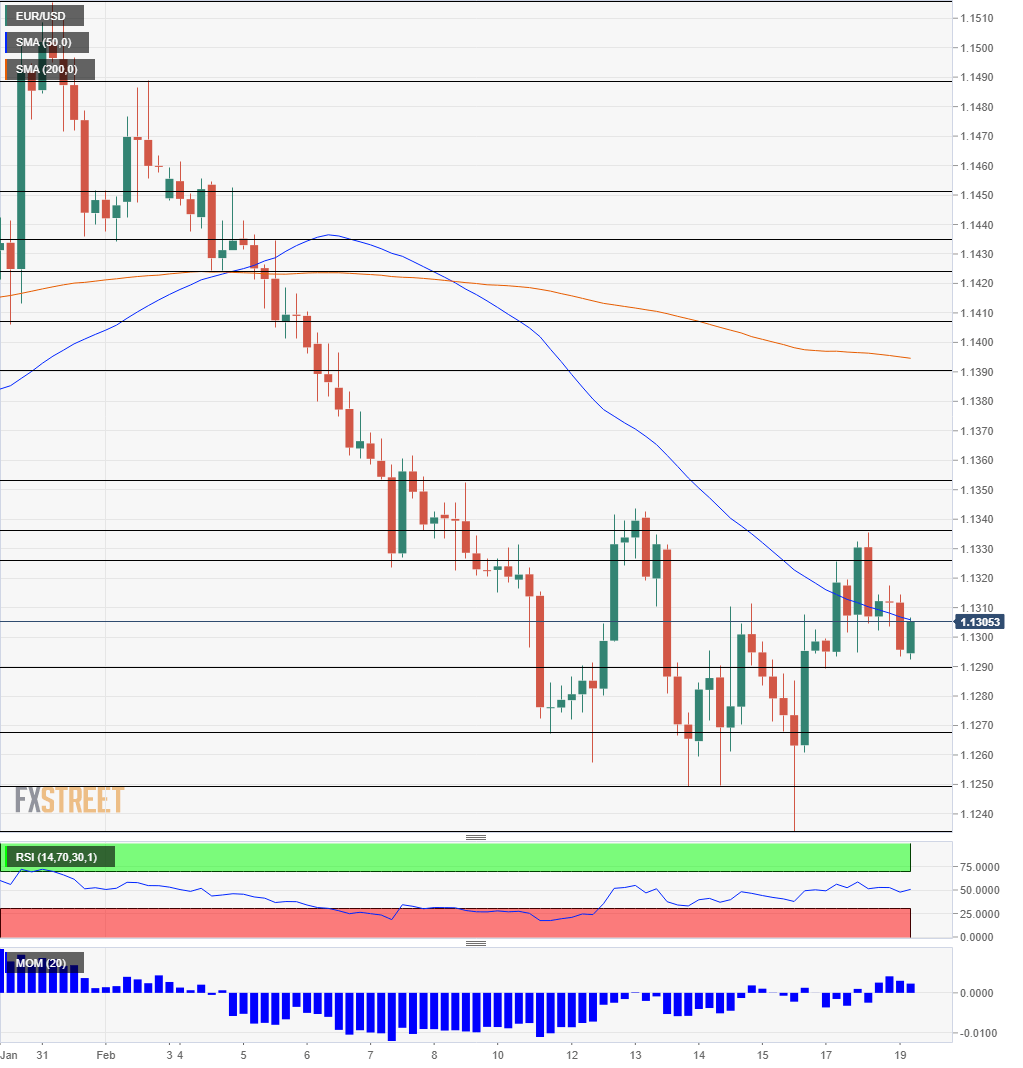

Setting a higher high on Monday did not result in a turnaround for the pair. However, Momentum has turned positive on the four-hour chart, a minor bullish sign. Otherwise, the pair is hugging the 50 Simple Moving Average, and the Relative Strength Index is around 50, indicating no inclination to either side.

Support awaits at 1.1290 which was the trough for 2019 and a support line in recent days. 1.1265 was a low point on the way down. It is followed by another trough at 1.1250, but the most important one is 1.1235 which is the current low for the year. The low for last year is 1.1215 and provides further support.

Looking up, resistance awaits at the 1.1325-1.1335 region which capped the pair in recent days. 1.1350 held EUR/USD down in early February and serves as the next cap. 1.1390 and 1.1405 served as support lines when euro/dollar was trading on higher ground and are now lines of resistance.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk appetite and ...

more

kindly elaborate your technical analysis

What specifically are you looking for?

m looking for technical perspectives