EUR/USD Eyes Gains As US Dollar Retreats And Euro Area Data Continues Improvement

EUR/USD Outlook

EUR/USD experienced some whipsaw price action in the Asian session as market participants digested the Bank of Japan’s unexpected policy adjustment which reverberated through markets. Initial gains were surrendered with EUR/USD back at the 1.0600 level as the European session began.

The Bank of Japan announcement overnight seemed to inject a fresh bout of liquidity with moves across the board. Markets are speculating further policy normalization by the BoJ following today’s adjustment by the Central Bank as it increased the upper limit band on the 10Y JGB to 0.5% from 0.25%. The move has had a negative impact on the US dollar and could boost the Yen as Japanese investors are given the incentive to bring money home while increasing the Yens haven appeal.

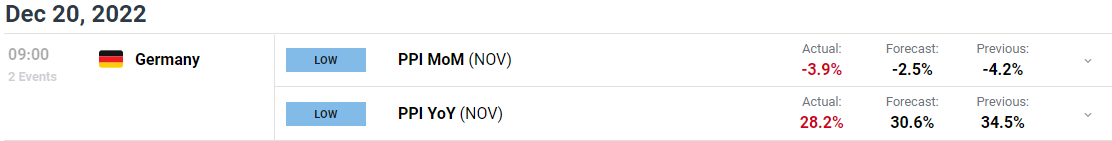

The Euro Area has seen continued improvement in data releases of late evidenced by yesterday’s upbeat German IFO survey on Business Climate and this morning's drop in German PPI, which hit a 9-month low. It will be interesting to see if the Euro Area flash consumer confidence due later today can keep the improvement going. This morning we heard comments from ECB policymaker Nagel who stated the Central Bank is still a long way from hitting its inflation goal reiterating that the ECB likewise needs to be persistent on rates. The improving data coupled with the ECB’s somewhat hawkish pivot last week, a case could be made for continued EUR/USD appreciation.

For all market-moving economic releases and events, see the DailyFX Calendar

The US Dollar index retreated following the BoJ policy announcement helping EUR/USD edge higher. The dollar index is likely to remain key for any future moves heading into 2023. Later in the day, we have US building permit data which could reignite some bullish behavior in the dollar.

Technical Outlook

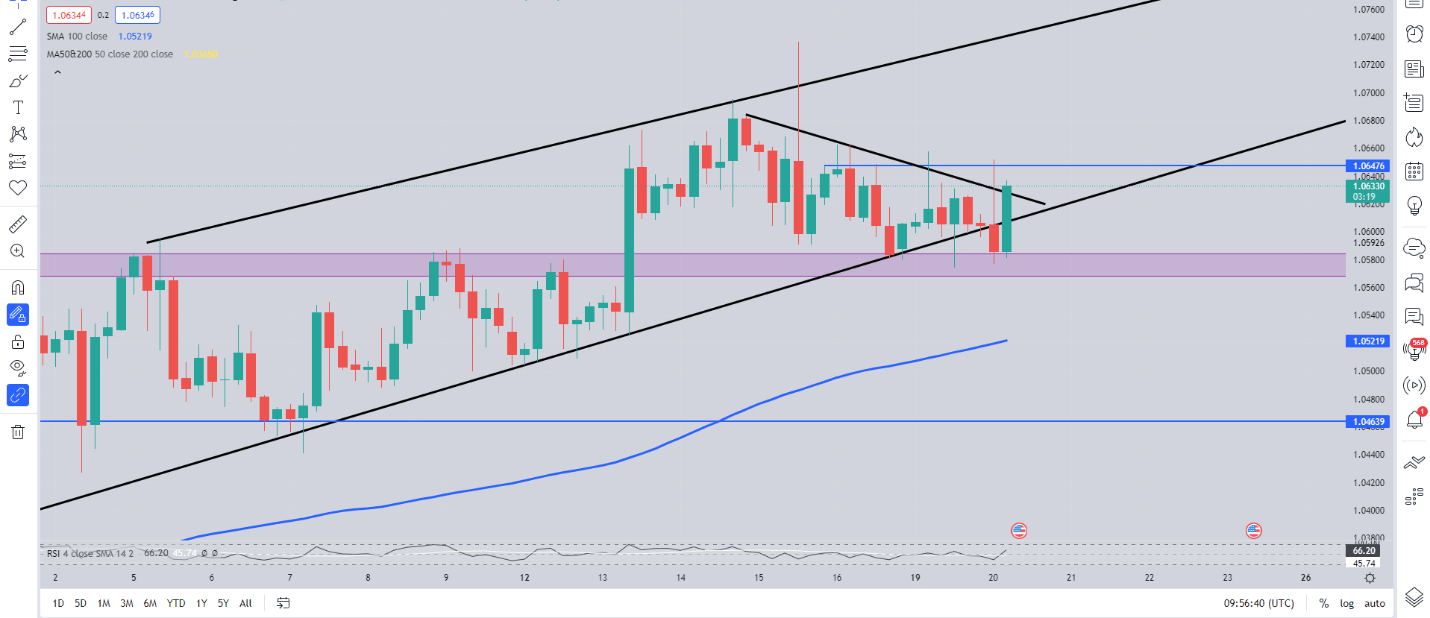

EUR/USD Four-Hour Chart

(Click on image to enlarge)

Source: TradingView

From a technical perspective, the 4H has been printing lower highs and lower lows eyeing a break of the ascending channel. We have seen a 4H candle close below the ascending trendline before bouncing off the support area around 1.0580-1.0600. A break below this support area is needed If EUR/USD is to push down further with the 1.0500 handle which currently lines up with 100-day MA providing support. A break below this area opening up a retest of the 200-day MA resting around the 1.0350 handle.

As we remain within the ascending channel, we could see a continued push higher toward the top of the channel and last week's high around 1.0740 which could provide a further opportunity for would-be-sellers to get involved once more.

IG Client Sentiment: Mixed

IG Client Sentiment Data (IGCS) shows that retail traders are currently SHORT on EUR/USD with 60% of traders currently holding short positions. At DailyFX we typically take a contrarian view to crowd sentiment, and the fact that traders are SHORT suggests EUR/USD prices may continue to rise.

More By This Author:

US Dollar Benefits As BoJ Capitulates To Tighter Policy, Sinking Risk AssetsS&P 500, Dow Jones, Nasdaq 100 Sink As Treasury Yields Climb, APAC Stocks At Risk

USDJPY, AUDJPY And CADJPY: Can The BOJ Trigger Loaded Technical Patterns?

Disclosure: See the full disclosure for DailyFX here.