EUR/USD Extends Rally As Risk Sentiment Improves

Image Source: Unsplash

On Wednesday, EUR/USD climbed to 1.1621, marking its fifth consecutive session of gains with little interruption. The upward momentum reflects easing geopolitical tensions, which in turn have reduced the demand for traditional safe-haven assets.

The US-brokered ceasefire between Israel and Iran remains largely intact despite isolated incidents, while oil prices have retreated significantly from recent peaks. However, lingering uncertainties persist – reports suggest recent US missile strikes only partially damaged Iran’s critical nuclear facilities, merely delaying rather than halting its nuclear program.

Market attention remains fixed on Federal Reserve Chair Jerome Powell’s latest remarks. Reaffirming his commitment to curbing inflation, Powell signalled that interest rates are likely to stay on hold until the impact of trade tariffs on prices becomes clearer. Nevertheless, markets still price in a 20% probability of a rate cut as early as July.

Traders now await Powell’s upcoming Senate testimony and the latest US new home sales data for further direction.

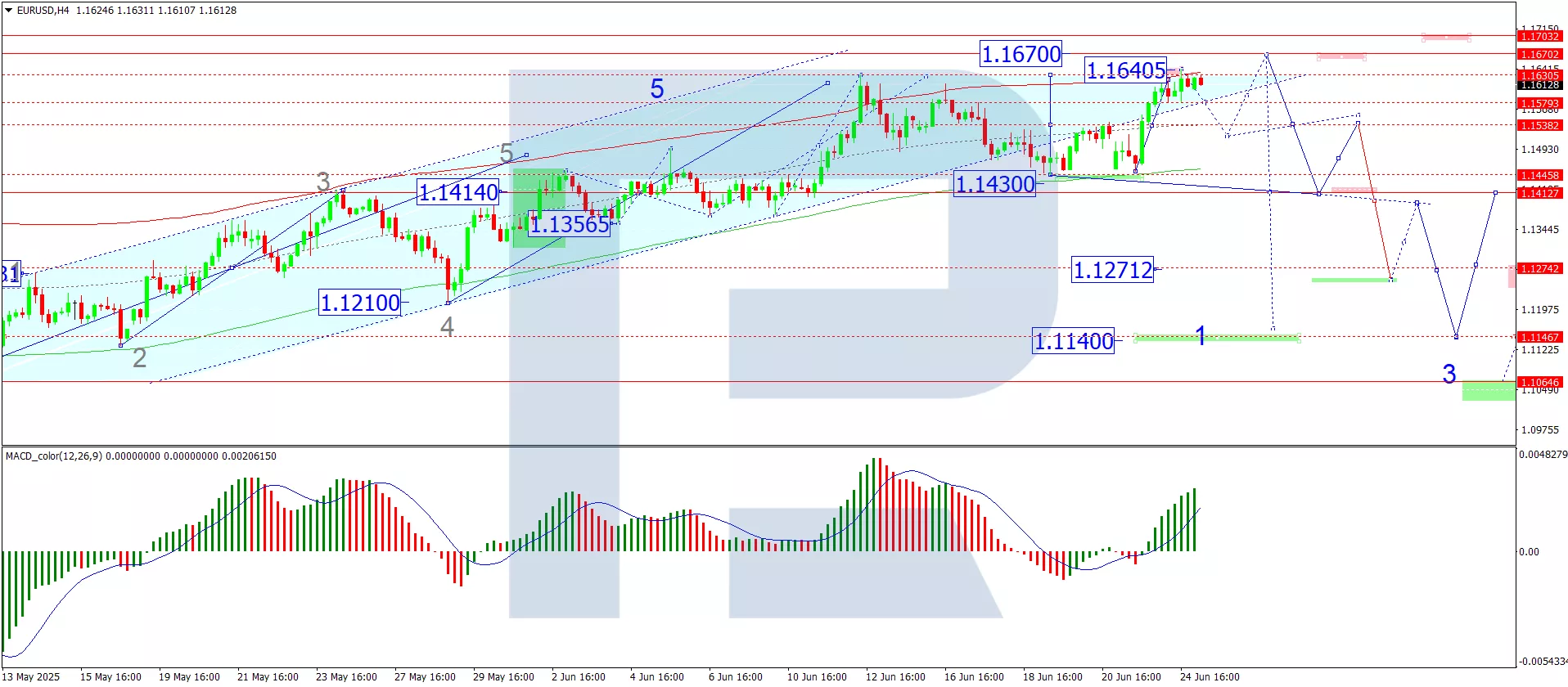

Technical Analysis: EUR/USD

H4 Chart:

(Click on image to enlarge)

The EUR/USD breakout above 1.1540 propelled the pair towards 1.1640. Today, we anticipate consolidation below this level. A downside exit could trigger a retracement towards 1.1540, while an upward breakout may extend gains to 1.1670. Beyond this, we expect a potential downward wave targeting 1.1414, supported by the MACD indicator. The signal line, currently above zero and exiting the histogram zone, suggests a likely decline towards the baseline.

H1 Chart:

(Click on image to enlarge)

After finding support at 1.1518, the pair rallied to 1.1640, where a tight consolidation range is forming. A downward breakout appears probable – should 1.1580 give way, a decline towards 1.1518 may follow. This scenario is corroborated by the Stochastic oscillator, with its signal line below 80 and trending sharply downward towards 20.

Conclusion

The EUR/USD uptrend persists amid improving risk sentiment, though technical indicators suggest a potential pullback. Traders should monitor Powell’s testimony and US housing data for near-term catalysts.

More By This Author:

USD/JPY Reverses Downwards: External Factors Reduce Support For The US Dollar

Gold Set To Rally All Eyes On The Middle East

Gold Falls To One-Week Low: What’s Behind The Drop?

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for ...

more