EUR/USD Edges Lower Amid Heightened Political Uncertainty

Image Source: Unsplash

The EUR/USD pair declined to 1.1706 on Tuesday, weighed down by a confluence of adverse political developments. In the US, the federal government shutdown entered its seventh day, with the Senate once again failing to pass competing funding bills proposed by Democrats and Republicans.

The political stalemate deepened after Democratic leader Chuck Schumer rejected President Donald Trump's claims that negotiations with Democrats were ongoing.

From a monetary policy perspective, recent economic data have reinforced market expectations for further easing by the Federal Reserve. Traders are now almost fully pricing in a 25-basis-point rate cut in October, with another expected in December.

Market participants are awaiting fresh guidance from central bank officials, including scheduled speeches by Governing Council member Stephen Miran on Wednesday and Chair Jerome Powell on Thursday.

The US dollar found additional support from the weakness of its major counterparts. The euro was pressured by political uncertainty in Europe, while the yen softened on the election of a new, moderate prime minister in Japan, who is known to advocate for further accommodative stimulus measures.

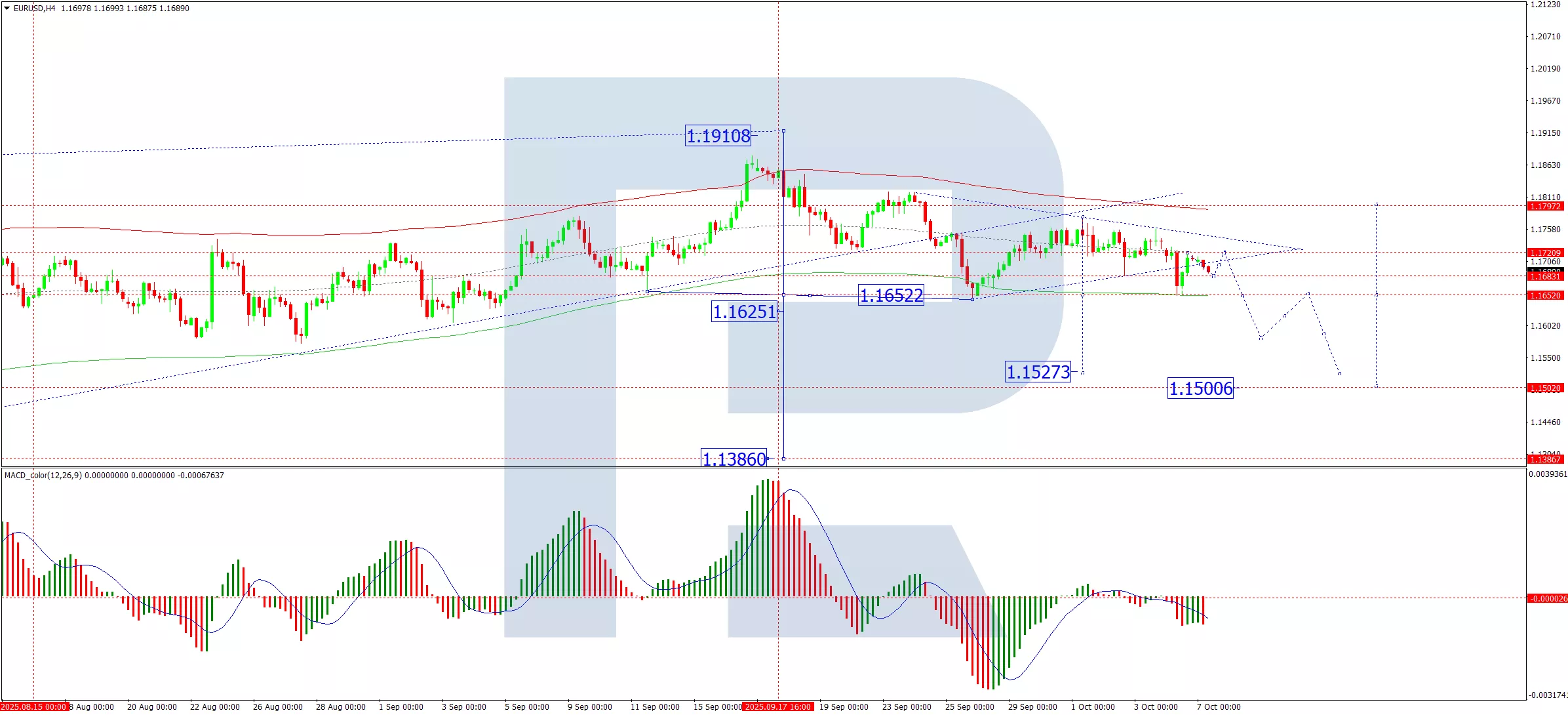

Technical Analysis: EUR/USD

H4 Chart:

(Click on image to enlarge)

On the H4 chart, the pair completed a downward impulse to 1.1652, followed by a corrective rebound to 1.1720. A subsequent decline towards 1.1685 is now forming. Later today, another rise towards 1.1723 is possible; however, the broader bearish structure suggests this will be followed by a further decline to 1.1650. A decisive break below this support level would open the potential for a move down to 1.1600, with a longer-term prospect of 1.1530. This bearish scenario is technically confirmed by the MACD indicator, whose signal line lies below zero and is pointing firmly downwards.

H1 Chart:

(Click on image to enlarge)

On the H1 chart, the market completed a corrective wave towards 1.1720. We anticipate a drop to 1.1680 today, followed by a potential rise to 1.1723. The overall trajectory, however, is expected to resume downwards, targeting 1.1650. A breach of this level would signal the potential for a downward wave to 1.1600, and if that level is breached, a third wave of decline towards 1.1530. This outlook is supported by the Stochastic oscillator, whose signal line is currently below 50 and is trending sharply downwards towards the 20 level.

Conclusion

The EUR/USD remains under pressure, caught between a resilient US dollar supported by Fed policy expectations and its own domestic political concerns. The technical structure remains predominantly bearish, suggesting further losses are likely if key support levels are breached.

More By This Author:

Gold Surges 50% Year-To-Date With Further Gains Expected

EUR/USD Holds Steady Amid Tense External Backdrop

USD/JPY On Hold, But Yen Rally Could Resume At Any Moment

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for ...

more