EURUSD And GBPUSD: Bearish Pressure Is More Noticeable

Image Source: Pixabay

- Yesterday, the pair EURUSD moved in the range of 1.01500-1.02000 levels.

- During the Asian trading session, the pound was in retreat, putting pressure on the 1.20000 support zone.

- The European currency continues to be undermined by growing concerns about energy supplies

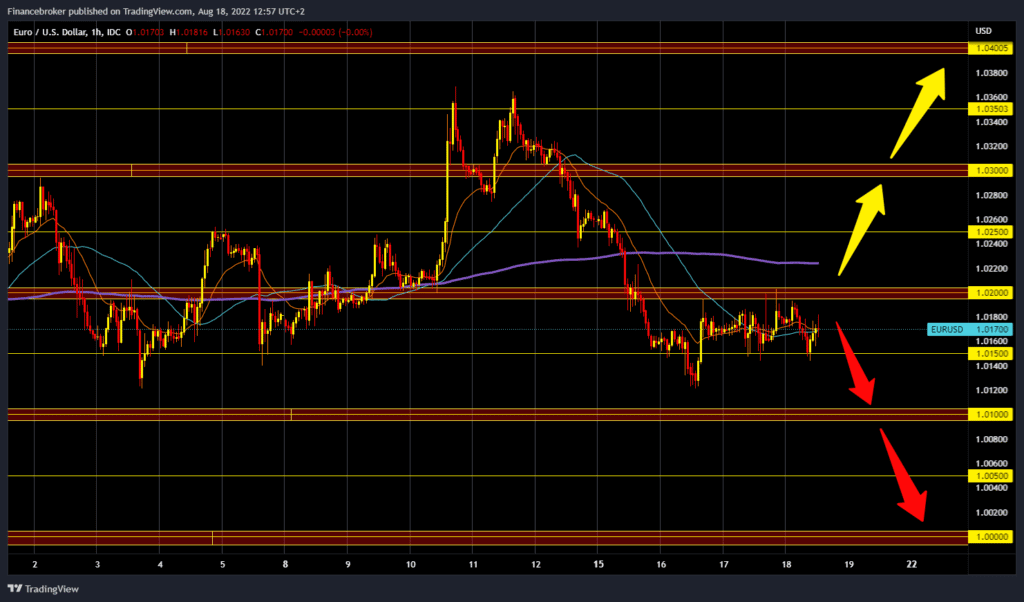

EURUSD chart analysis

Yesterday, the pair EURUSD moved in the range of 1.01500-1.02000 levels. Today we continue in the same range without major oscillations. We can say that the bearish pressure is more noticeable because we are in the support zone. We need a negative consolidation and a drop below the 1.01500 level for a bearish option. After that, the euro could drop to the 1.01000 support level. If the bearish pressure continues, the pair EURUSD could continue towards 1.00500 and 1.00000 levels. For a bullish option, we need a positive consolidation and a return of the euro above the 1.02000 level. In the zone around 1.02200, the MA200 moving average creates additional resistance for us. A break above the euro and the continuation of bullish consolidation takes us up to the 1.02500 level, and the potential higher target is the 1.03000 level.

(Click on image to enlarge)

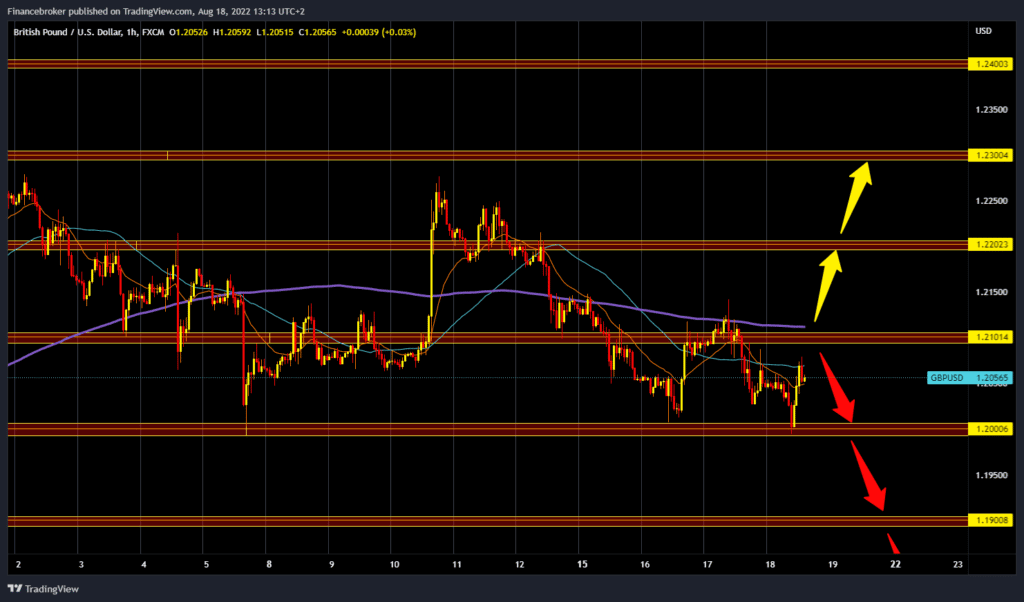

GBPUSD chart analysis

During the Asian trading session, the pound was in retreat, putting pressure on the 1.20000 support zone. For now, we are finding support at that level, and the pound has recovered to the 1.20550 level. We need a break above the 1.21000 level so that GBPUSD moves into a safer zone. The MA200 moving average can represent additional resistance. To continue the bullish option, we need a new bullish impulse above the 1.21000 level. Potential targets are 1.21500 and 1.22000 levels. For a bearish option, we need a negative consolidation that would bring us down to the 1.20000 level. A break below would add pressure on the pound to continue lower. Potential lower targets are 1.19500 and 1.19000 levels.

(Click on image to enlarge)

Market Overview

The European currency continues to be undermined by growing concerns about energy supplies, which could drag the economy faster and deeper into recession. Eurozone inflation jumped by 8.9% in July, on an annual basis, according to Eurostat’s final report. The Eurozone’s Harmonized Index of Consumer Prices (HICP) rose 0.1% in July, down sharply from June’s 0.8%. Compared to June, annual inflation fell in six member states, remained stable in three, and increased in eighteen. Construction output in the Eurozone has been falling for the fourth month in a row. Falling was 1.3% in July, after a 0.3% drop in June.

More By This Author:

US Oil Imports Into China Reached An 18-Month HighThe US Dollar Is Rising, Yuan Falls

Yields Dip: Is The Inflation Still Relevant?