EUR/USD Analysis: Will We See New Selling Pressure?

EUR/USD Analysis Summary Today

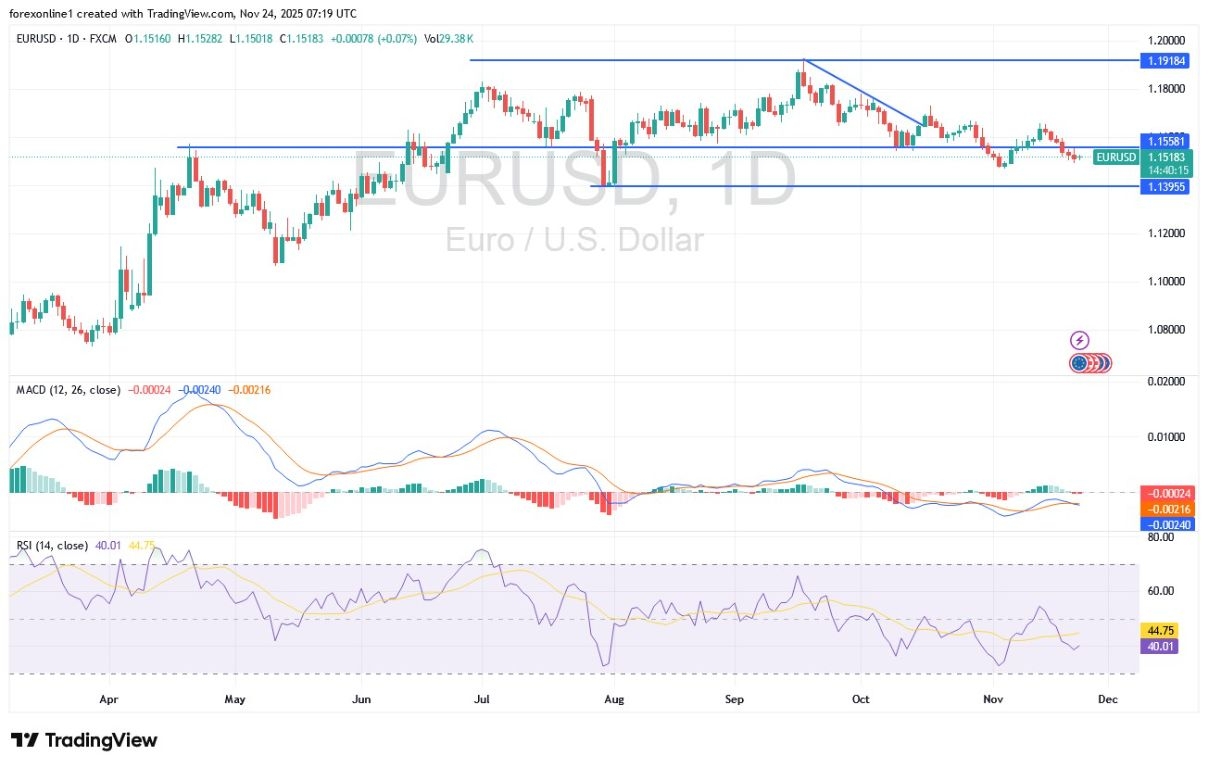

- Overall Trend: : Bearish.

- Support Levels for EUR/USD Today: 1.1470 – 1.1400 – 1.1320

- Resistance Levels for EUR/USD Today: 1.1600 – 1.1660 – 1.1780

(Click on image to enlarge)

EUR/USD Trading Signals:

- Buy EUR/USD from the support level of 1.1460 with a target of 1.1700 and a stop-loss at 1.1380.

- Sell EUR/USD from the resistance level of 1.1660 with a target of 1.1400 and a stop-loss at 1.1780.

Technical Analysis of EUR/USD Today:

Amid new selling pressure, the EUR/USD exchange rate fell during trading last week, with losses extending to the 1.1491 support level, near the currency pair's lowest point in over two weeks, and closed the week stable around the 1.1510 level. According to performance across trusted trading company platforms, attempts to rise above the 1.16 resistance level met with selling interest, while declines toward the 1.15 support attracted modest buying, reflecting traders' hesitation to commit before clearer economic signals emerge.

Concurrently, the technical indicators confirm the selling pressure. Tecnically, the 14-day Relative Strength Index (RSI) is around 38 and has further downside potential before reaching oversold levels. Meanwhile, the MACD indicator is trending downwards, supporting bearish sentiment and pushing the price down further. However, based on the daily chart, the EUR/USD pair will not find confirmation of a bullish turn without a return to the psychological resistance level of 1.1800.

Furthermore, Trading is expected to be range-bound at the start of the shortened trading week due to the US holidays.

Trading Advice:

The selling pressure on the EUR/USD hasn't subsided. Wait for a pullback to stronger levels before buying and never take risks.

Negative European Releases Weaken Appetite for the Euro

According to recent economic data results, a decline in Eurozone surveys added to the downward pressure: The November Composite Purchasing Managers' Index (PMI) fell to 52.4, with the manufacturing sector returning to contraction and German factory output deteriorating, reversing an initial mid-week bounce.

On the US side, the minutes of the FOMC meeting revealed a wide division regarding the need for further cuts. The delayed US payrolls report for September was also mixed: US companies added a total of 119,000 jobs, exceeding expectations, but the country's unemployment rate rose to a four-year high of 4.4%, leaving markets uncertain about how upcoming data will affect monetary policy.

Overall, the US government shutdown has created a data gap. The U.S. jobs report for October will not be released, and the November employment figures will not arrive until December 16, after the Federal Reserve meeting.

On the future policy front, new comments on Friday, November 21, saw a sharp rise in interest rate expectations. New York Fed President John Williams stated that monetary policy was only slightly restrictive and that a near-term rate cut could bring interest rates closer to neutral. His comments, coupled with a weakening labor market, pushed Fed funds futures to price in a 71% probability of a 25-basis-point rate cut at the December meeting, up from around 39% the previous day.

However, Boston Fed President Susan Collins and Dallas Fed President Lorie Logan warned against further easing, emphasizing the division within the FOMC. The rise in rate cut probabilities led to a decline in US bond yields but offered only slight relief for the Euro, which remains stable near 1.15 amid weak Eurozone data.

During the new trading week, according to the economic calendar, key releases from the Eurozone include the IFO Business Climate Survey today, the Q3 GDP revision tomorrow (Tuesday), and mid-week updates on manufacturing. The week concludes with regional inflation and employment figures in Germany and the Eurozone Retail Sales report. On the US side, financial markets will analyze data on Building Permits, Durable Goods Orders, Revised GDP, Personal Income and Spending, and the Fed's preferred Core Personal Consumption Expenditures (PCE) Index on Wednesday, followed by US Consumer Confidence on Thursday, and PMI indicators on Friday.

More By This Author:

Gold Analysis: Signaling A New Bullish Shift Ahead Of A Key EventEUR/USD Analysis and Signals: Is The Euro Ready For Further Gains?

EUR/USD Analysis: Fate Of US Interest Rates

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more