EUR/USD Analysis: Downward Correction Gains Strength

EUR/USD Analysis Summary Today

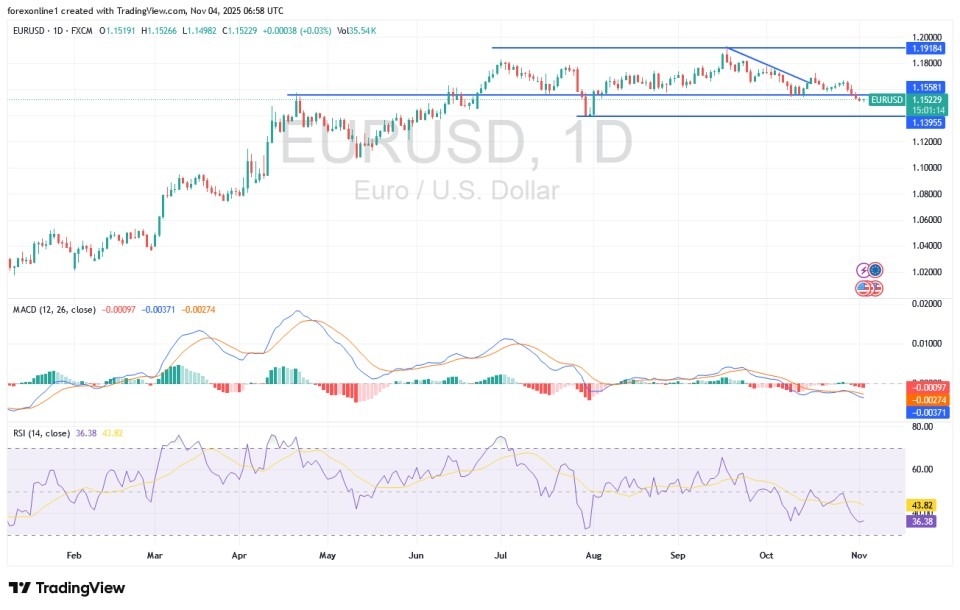

- Overall Trend: : Bearish

- Support Levels for EUR/USD Today: 1.1480 – 1.1410 – 1.1350

- Resistance Levels for EUR/USD Today: 1.1600 – 1.1680 – 1.1770

(Click on image to enlarge)

EUR/USD Trading Signals:

- Buy EUR/USD from the support level of 1.1440 with a target of 1.1700 and a stop-loss at 1.1370.

- Sell EUR/USD from the resistance level of 1.1700 with a target of 1.1500 and a stop-loss at 1.1780.

Technical Analysis of EUR/USD Today:

In light of persistent downward pressure, the EUR/USD exchange rate appears poised to test the psychological resistance level of 1.14 in the coming days. According to trusted trading company platforms, the Euro seems exposed to further short-term weakness against the US Dollar, and any rallies are likely to be met with renewed selling interest. As the chart shows, gains are capped by a downward trend line, and we do not rule out any minor rise that returns the market to that line, in line with the trading pattern since mid-September.

Technically, the Relative Strength Index (RSI) points to a level of 35, which supports the bears and aligns with firm downward momentum. Last week saw the exchange rate fall below the 100-day Exponential Moving Average (EMA), indicating increasing bearish momentum.

The downward target we are monitoring is the 1.14 support, which is a significant horizontal line that has influenced market movement since April, acting as both resistance and support since then.

More recently, this level halted the EUR/USD selling wave in late July, which preceded a sharp rebound. Interestingly, the 1.14 support is also the 200-day EMA level, meaning it is truly a critical level. If it holds, the broader, multi-month neutral phase will remain intact, and a rebound will follow. However, a breakdown here could confirm the end of the uptrend that started at 1.04 in late 2024 and peaked at 1.1918 on September 17.

The Future of Interest Rates Impacts Currency Prices

The European Central Bank's (ECB) decision last week was not a significant event, as the central bank was content with its success in pushing inflation to its 2.0% target and found no reason to provide guidance that might excite the markets. With the ECB achieving a rare accomplishment of its kind, the responsibility for managing their economies falls on other central banks. For its part, the US Federal Reserve cut interest rates last week and suggested it might do so again before the end of the year, although it would not provide a convincing commitment to such a move.

Trading Advice:

The EUR/USD downtrend is not over. Therefore, wait for a further decline before considering buying, but do so without risk and by diversifying your trades to avoid reacting to any currency price movements.

According to Forex market trading, this rejection helped boost the US dollar following the Federal Reserve's decision, and we are still experiencing this momentum. This week is usually important in terms of data, as the first Friday of the new month is typically dedicated to the crucial US jobs report. However, since US politicians seem content with the current partial government shutdown, we will not receive any official statistics this week.

This means that private sector reports must take the lead. With this in mind, we await the ISM (Institute for Supply Management) PMI (Purchasing Managers' Index) surveys for the private sector of the US economy in October. Surveys had indicated that the economy was on the verge of stagnation in September, and confirmation of this is likely to strengthen the likelihood of the Fed making further rate cuts, which would hurt the US Dollar's performance.

However, any signs of economic recovery would keep the Federal Reserve on the sidelines and support the dollar. The economic calendar includes the manufacturing Purchasing Managers' Index (PMI) due on Tuesday (consensus forecast 49.2) and the services PMI due on Thursday (consensus forecast 51.0). In this regard, a preliminary report from Lloyds Bank indicates that "particular attention will be paid in the report to employment indicators, which may point to further weakness in the labor market, and to the price components, which remain elevated and will be closely watched for any signs of a slowdown."

Ultimitaly, any slowdown in the data could help the EUR/USD pair halt its selling and potentially pave the way for a recovery.

More By This Author:

EUR/USD Analysis: Bears Gain Momentum For Stronger LossesEUR/USD Analysis: Price Seeking Positive Momentum

EUR/USD Analysis: Selling Pressure May Persist Pending US Inflation Figures

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more