EUR/USD Analysis: Bullish Shift Looms After Fed Rate Cut?

EUR/USD Analysis Summary Today

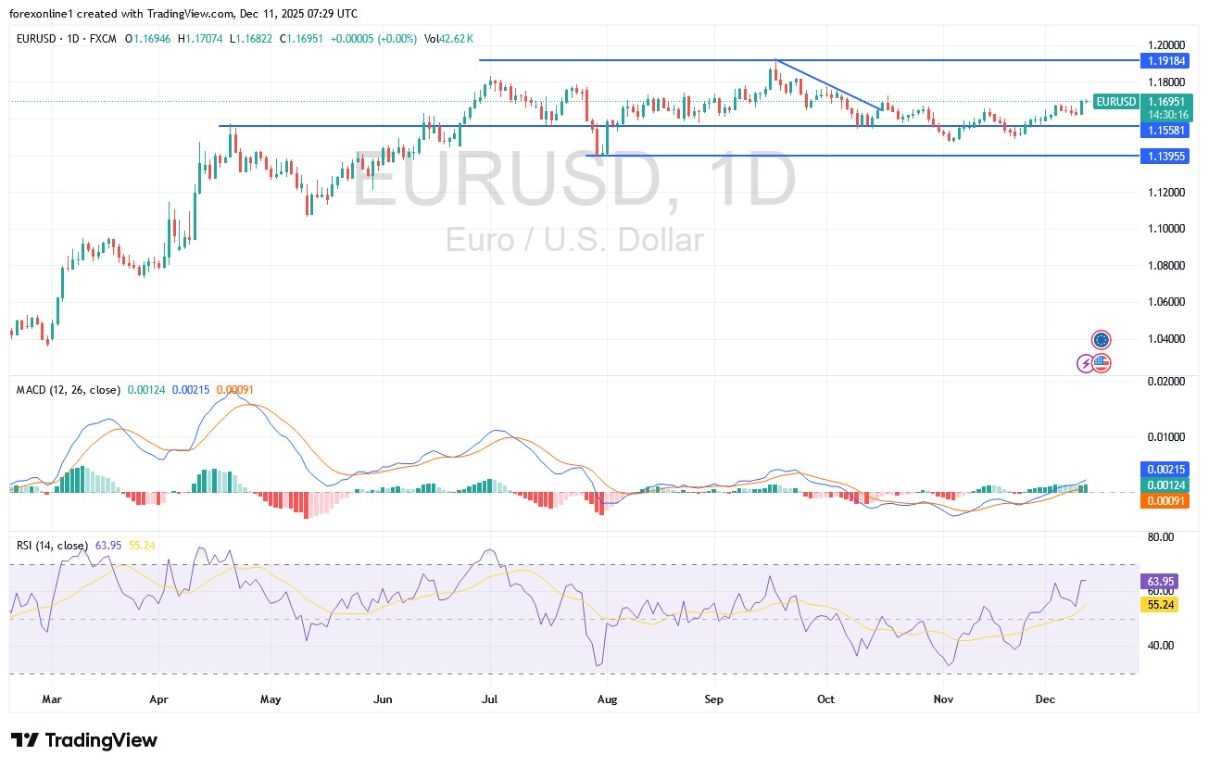

- Overall Trend: : Neutral with an upward bias.

- Support Levels for EUR/USD Today: 1.1620 – 1.1570 – 1.1490

- Resistance Levels for EUR/USD Today: : 1.1720 – 1.1800 – 1.1880.

(Click on image to enlarge)

EUR/USD Trading Signals:

- Buy EUR/USD from the support level of 1.1570 with a target of 1.1800 and a stop-loss at 1.1490.

- Sell EUR/USD from the resistance level of 1.1800 with a target of 1.1500 and a stop-loss at 1.1900.

Technical Analysis of EUR/USD Today:

Currency prices moved positively against the US Dollar after the Federal Reserve cut the key US interest rate for the third consecutive time on Wednesday, though it signaled the possibility of keeping it unchanged in the coming months—a move that could anger President Donald Trump, who has demanded sharp reductions in borrowing costs. According to reliable trading platforms, the EUR/USD pair rebounded to the 1.1680 resistance level at the time of writing this analysis. These gains may push the EUR/USD trend out of the neutral zone that dominated trading recently while awaiting the Fed announcement.

The bullish scenario for EUR/USD requires more work to confirm the strength of the bulls' control. On the daily chart, the psychological resistance of 1.1800 remains the key to a confirmed bullish shift. The pair's recent gains pushed the Relative Strength Index (RSI) to the 61 level, which supports a technical correction upward, but it still has more room for stronger gains before reaching the overbought zone. The MACD indicator is also moving positively. The echoes of the Fed's decisions, its policy statement, and updated projections will continue to influence EUR/USD trading in the coming days.

The scenario for a EUR/USD pullback over the same timeframe is linked to the bears bringing the currency prices back toward the vicinity of the psychological support of 1.1500 once again.

Trading Advice

Be cautious. The EUR/USD's upward trend is still in its early stages. We await confirmation of this and recommend buying from the 1.1500 support level again, but never take unnecessary risks.

The Future of US Interest Rates in the New Year

Following the widely anticipated announcement of a US interest rate cut, the Federal Reserve's interest rate-setting committee indicated in a statement released after a two-day meeting that it is likely to keep US interest rates unchanged in the coming months. In a series of quarterly economic projections, Federal Reserve officials indicated they expect to cut US interest rates only once next year. Overall, yesterday’s rate cut brought the federal funds rate down by a quarter of a percentage point to around 3.6%, its lowest level in nearly three years. Lower interest rates by the Federal Reserve can reduce borrowing costs for mortgages, auto loans, and credit cards over time, although market forces may also influence these rates.

At the final meeting of 2025, three Fed officials opposed the move, the most dissenting votes in six years, indicating deep divisions within a committee that traditionally operates by consensus. Two officials voted to keep the U.S. interest rate unchanged, while Stephen Miran, appointed by Trump in September, voted for a half-point cut.

The December meeting may well signal a more tense period for the Fed. Officials are divided between those who favor lowering U.S. interest rates to stimulate employment and those who favor keeping them unchanged because inflation remains above the central bank’s 2% target. Unless there are clear signs of full control over inflation, or unemployment worsens, these divisions are likely to persist.

More By This Author:

Gold Analysis: Bullish Trend Remains StrongGold Analysis: New Record Bullish Path

Gold Analysis: Decline In Gold Index Prices Is A Buying Opportunity

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more