EUR/USD Analysis And Signals: Is The Euro Ready For Further Gains?

EUR/USD Analysis Summary Today

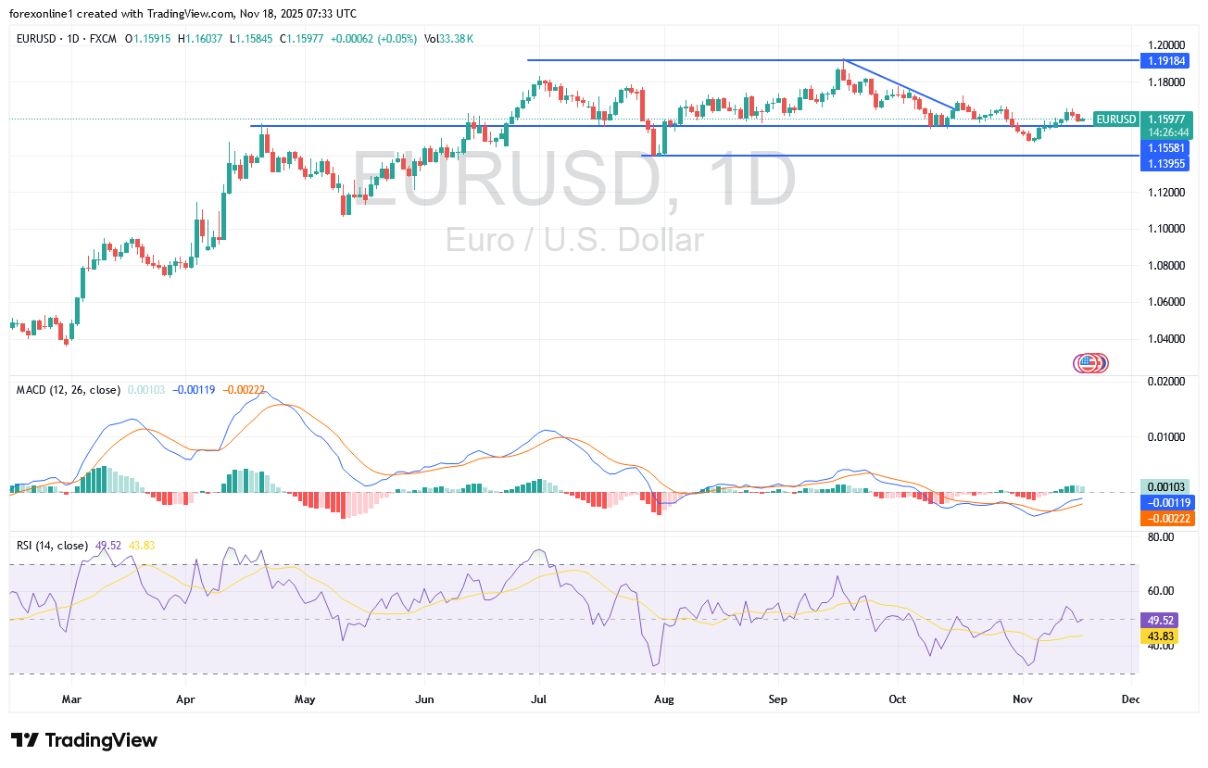

- Overall Trend: : Neutral.

- Support Levels for EUR/USD Today: 1.1555 – 1.1480 – 1.1400

- Resistance Levels for EUR/USD Today: 1.1650 – 1.1720 – 1.1800

(Click on image to enlarge)

EUR/USD Trading Signals:

- Buy EUR/USD from the support level of 1.1520 with a target of 1.1800 and a stop-loss at 1.1430.

- Sell EUR/USD from the resistance level of 1.1730 with a target of 1.1480 and a stop-loss at 1.1800.

Technical Analysis of EUR/USD Today:

Following the recent upward rebound gains, the Euro price appears ready to continue its recent gains against the US Dollar this week. Based on performance across trusted trading company platforms, the EUR/USD exchange rate is recovering from the selling wave seen in October, and is likely to breach the 1.1650 level in the coming days as confidence increases.

According to Forex currency market trading, momentum is shifting in favor of Euro buyers, as the EUR/USD pair broke the 21-day Exponential Moving Average (EMA) last week—a first step in turning the trend from down to up, breaking a ceiling that had been in place since early October. However, currency market experts caution that the 50-day and 100-day EMAs, clustered around $1.1660, still pose significant obstacles. The chart shows the 21-day and 50-day EMAs, in addition to a descending trend line that led the market lower during September and October. The breakout above the trend line and the 21-day signal show some improved resilience, but it is clear that overcoming the 50-day resistance level at $\mathbf{1.1620}$ is essential to signal a more convincing comeback.

Therefore, the EUR/USD's upward movement remains uncertain. if a breakout occurs, it will likely target 1.1650 and then the 1.1700 resistance.

Euro/Dollar Trading Awaits Important and Exciting Events

Dear reader, keep in mind that this will be an interesting week for the EUR/USD pair due to the return of official US statistics, which will determine important shifts in expectations for the Federal Reserve's policy. US labor market data for September is scheduled for release next Thursday. Consensus expects US employment to accelerate to 50,000 jobs from 22,000 jobs in August, and the unemployment rate to remain unchanged at 4.3%.

Be cautious, as any rise above this level will negate a December rate cut and put the Euro/Dollar pair under severe pressure. Overall, US interest rate markets now estimate a third consecutive 25-basis point cut to be close to 50/50, meaning a strong reading in employment indicators could have a tangible impact on these expectations. If the probability of a US interest rate cut in December falls further, the Dollar will rise, and the EUR/USD pair will fall.

However, private-sector economic surveys, released in the absence of official US statistics, suggest that the US economy is still experiencing a slowdown in the labor market, increasing the likelihood of a disappointing jobs report. Therefore, if Thursday's data falls short of expectations, the probability of a December US interest rate cut will rise, and the dollar will weaken further. If the US Federal Reserve adheres to a series of interest rate cuts, the US dollar could weaken significantly by the beginning of 2026, potentially opening the door for the EUR/USD pair to reach its highs near the 1.19 resistance level.

Trading Tips:

Dear TradersUp trader, please note that the EUR/USD pair may remain range-bound with a slight downward bias until the market reacts to key US economic releases. Finallu, today's session is expected to be relatively quiet.

More By This Author:

EUR/USD Analysis: Fate Of US Interest RatesEUR/USD Analysis: Currency Traders Await Trend Reversal

Gold Analysis: Amid Increasing Purchase Of Gold As A Safe Haven

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more