EUR/USD Analysis And Signals: Euro Trading Needs A Return Of Investor Confidence

EUR/USD Analysis Summary Today

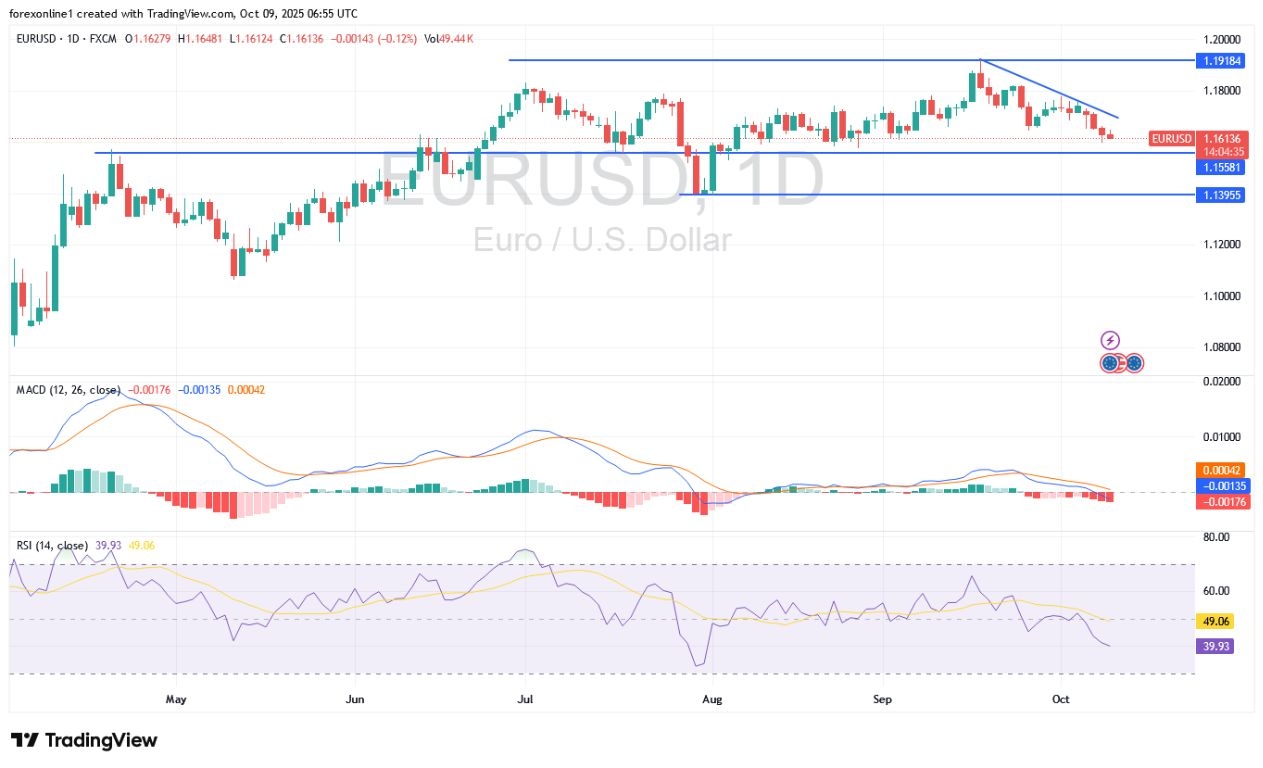

- General Trend: Bearish.

- EUR/USD Support Levels Today: 1.1580 – 1.1520 – 1.1440.

- EUR/USD Resistance Levels Today: 1.1680 – 1.1740 – 1.1800.

EUR/USD Trading Signals:

- Buy the EURUSD from the support level of 1.1540, target 1.1700, and stop 1.1480.

- Sell the EURUSD from the resistance level of 1.1720, target 1.1500, and stop 1.1800.

(Click on image to enlarge)

Technical Analysis of EUR/USD Today:

French political uncertainty has dominated sentiment, alongside a renewed recovery of the US dollar amid demand for it as a safe haven. Consequently, according to currency market trading, the EUR/USD pair tumbled to the 1.1598 support level, the currency pair's lowest in over a month. However, a temporary respite in Paris later provided short-term support, but bond market risks still loom over the Euro. According to reliable trading platforms, the EUR/USD price is stabilizing around the 1.1630 level at the beginning of today's session, Thursday.

Technical indicators confirm the bearish bias for EUR/USD trading on the daily chart. We can see that the 14-day Relative Strength Index (RSI) has reached a reading of 41, well below the neutral line, confirming the bears' control. At the same time, the MACD indicator lines are steadily trending downwards. The bearish outlook will not dissipate without the bulls succeeding in pushing the EUR/USD pair back towards the 1.1800 resistance.

The EUR/USD price will be affected today by European political developments and market expectations for the future of the US Federal Reserve's policies. On the economic data front, the German trade balance figures will be announced at 09:00 AM Egypt time. This will be followed by the announcement of the weekly US jobless claims at 03:30 PM Egypt time, and at the same time, new statements from the Chairman of the US Federal Reserve.

Trading Tips:

Keep in mind that the continued weakness in investor sentiment due to the French political situation will increase the Euro's struggles in the currency markets, especially against the US dollar.

The Future of the Euro Amid French Unrest

After the resignation of French Prime Minister Lecornu on Monday, French President Macron succeeded in convincing him to stay in his post for another 48 hours in a final attempt to find a consensus. Generally, if he fails to achieve a breakthrough, his resignation will take effect, and President Macron will face difficult choices. ING bank commented on the developments, saying: "Calls for new legislative elections are growing across the political spectrum. From our point of view, the probability of new elections has increased significantly, although it may not solve the underlying problem: a highly fragmented parliament, where multiple parties believe they have a mandate to govern alone."

For its part, according to MUFG Bank; "The downside risks for the Euro will increase if parliamentary elections are called before the end of this year, prolonging the period of political uncertainty."

ING bank expects more upward pressure on the deficit. "We expect debt levels to reach at least 116.7% of GDP next year, up from 113.1% in 2024. This trajectory places France in the worst financial position compared to its EU peers. Therefore, there is a risk of additional pressure on the bond market." Scotiabank had commented, saying: "The Eurozone government bond market is showing signs of renewed fragmentation, suggesting the possibility of headwinds from sentiment."

In the event of further bond market pressure, the European Central Bank has a tool called the Transition Protection Instrument (TPI), which intervenes when the currency's transmission is at risk. According to ING, "The prevailing perception that the ECB would intervene in such a scenario suggests that any negative reaction in the euro is likely to be isolated and short-lived, in our view."

More By This Author:

EUR/USD Analysis And Signals: Euro Breaks A Key Support—Will A Breakout Happen Soon?EUR/USD Analysis: Euro Heads Towards Key Support

Gold Analysis: US Dollar Gains Halt Gold's Rally

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more