EUR/USD Analysis And Signals: Euro Breaks A Key Support—Will A Breakout Happen Soon?

EUR/USD Analysis Summary Today

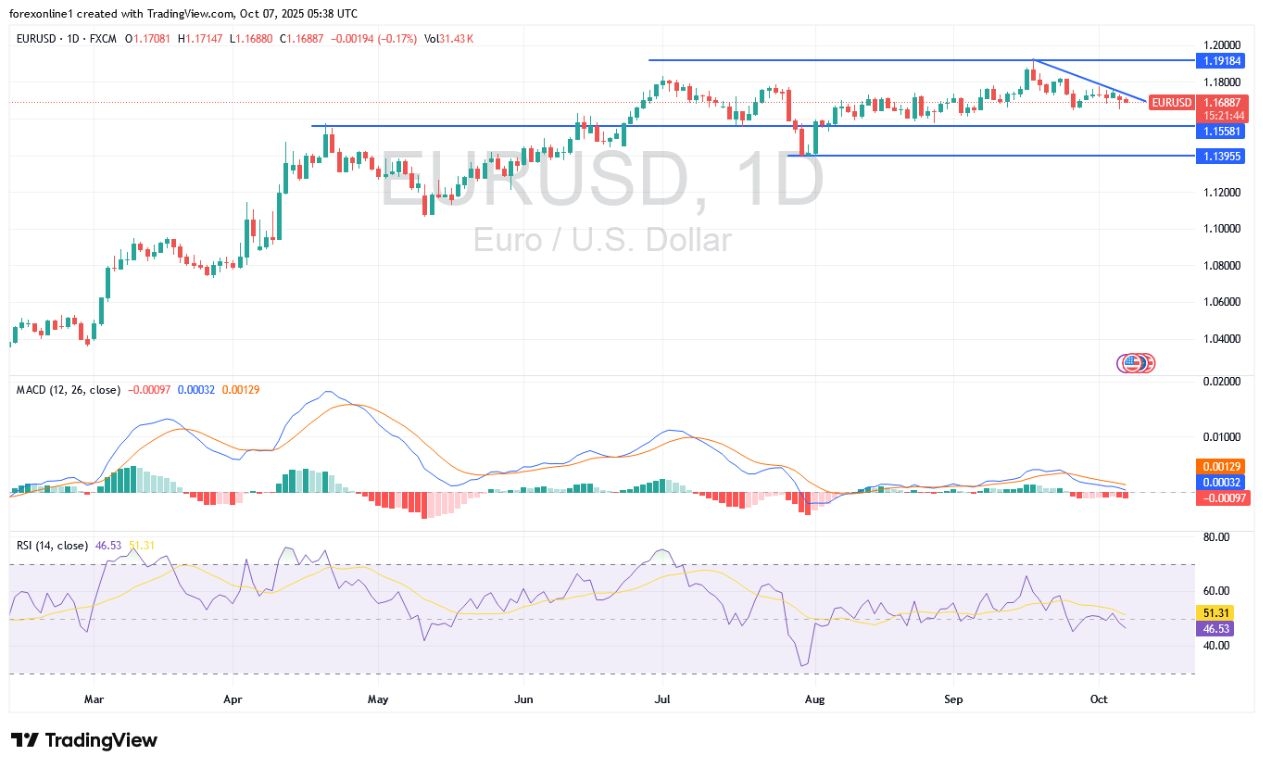

- General Trend: Bearish bias.

- EUR/USD Support Levels Today: 1.1660 – 1.1580 – 1.1500.

- EUR/USD Resistance Levels Today: 1.1750 – 1.1810 – 1.1880.

EUR/USD Trading Signals:

- Buy EUR/USD from the support level of 1.1590. Target 1.1780, Stop-Loss 1.1500.

- Sell EUR/USD from the resistance level of 1.1800. Target 1.1600, Stop-Loss 1.1900.

Technical Analysis of EUR/USD Today:

Dear reader, based on recent trades, the EUR/USD pair has formed a short-term descending triangle pattern, characterized by lower highs connected by a falling resistance line and a flat support base around the secondary psychological level of 1.1650. The price is currently testing the triangle's resistance level, and it may see another decline toward the base. Continued selling pressure could lead to a bearish trend, while an upward breakout could lead to a rise equivalent to the pattern's height.

Based on the measurement of the triangle pattern, the EUR/USD pair could drop by about 200 pips from the breakout point, targeting the secondary psychological level of 1.1450 or lower in the upcoming sessions. Technically, the 100-day Simple Moving Average (SMA) is below the 200-day SMA, which confirms that the stronger path is to the downside, or that selling is likely to gain momentum rather than reverse. Both moving averages are located above the current price action, so they could act as dynamic resistance if the EUR/USD attempts a recovery.

The widening gap between the two indicators reflects increasing bearish pressure, although any bullish breakout above both SMAs would signal a shift in market sentiment. At the same time, the Stochastic indicator is rising from the oversold region, suggesting that buyers might attempt a short-term correction. However, the oscillator has ample room to rise before reaching the overbought area, so any rebound may be limited unless momentum significantly improves. The Relative Strength Index (RSI) is also heading up from oversold levels, indicating some buying interest at current levels. However, the oscillator will need to cross the midpoint at 50.00 to signal that the bulls have regained control of the trend.

Overall, and based on performance across reliable trading platforms, the EUR/USD pair appears to have been negatively affected by the political instability in France, but the losses were quickly limited as the ongoing US government shutdown is preventing investors from buying the dollar.

Trading Tips:

As we expected, the EUR/USD gains will remain vulnerable to rapid selling, and the currency pair will remain under pressure until investor sentiment improves.

The Euro Price is Impacted by Political Developments

In Forex currency market trades, the recent decline caused the Euro/Dollar exchange rate to hit 1.1654, placing it on the verge of a prominent support area at 1.1650, which shifts the near-term outlook to a clear bearish trend. The Euro is recording losses against all of its G10 currency peers—except for the Yen, which is also being driven by its own political situation on Monday—indicating specific concerns about the Euro.

France is delivering a strong performance, having again witnessed the departure of yet another Prime Minister

Sébastien Lecornu—whom, like us, you may not have recognized the name of yet—submitted his resignation on Monday after it became clear that the government he was set to lead would not be able to function. French President Emmanuel Macron had announced a new government on Sunday evening, and the strong political response clarified that it would not secure the required number of deputies in the National Assembly to be enacted. This is because the new cabinet was too similar to the previous lineup.

Generally, France has been left adrift, which is a problem for two reasons: 1) Political uncertainty will significantly impact the government's attempts to bring France's debt path back onto a sustainable track. 2) Political uncertainty negatively affects businesses and households, slowing the economy and making the ability to finance debt more difficult.

(Click on image to enlarge)

According to the currency market's performance, the US Dollar is proving to be the main beneficiary of the Euro's decline, as the EUR/USD pair dropped below the 21-day Moving Average (at 1.1723). This shifts the near-term outlook to negative, and our weekly forecasts point to a drop below the 1.1650 level, with the key support level at 1.16 coming into effect in the coming days. It is also worth noting that the US Dollar is the main beneficiary of the decline in the Japanese Yen, which is linked to Sanae Takaichi's unexpected victory in the Liberal Democratic Party leadership race.

More By This Author:

EUR/USD Analysis: Euro Heads Towards Key SupportGold Analysis: US Dollar Gains Halt Gold's Rally

EUR/USD Analysis and Signals: Euro Attempts To Rise Despite Confirmation Of US Rate Path

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more