EURUSD: 1:5 Risk/Reward Target Hit

Image Source: Pixabay

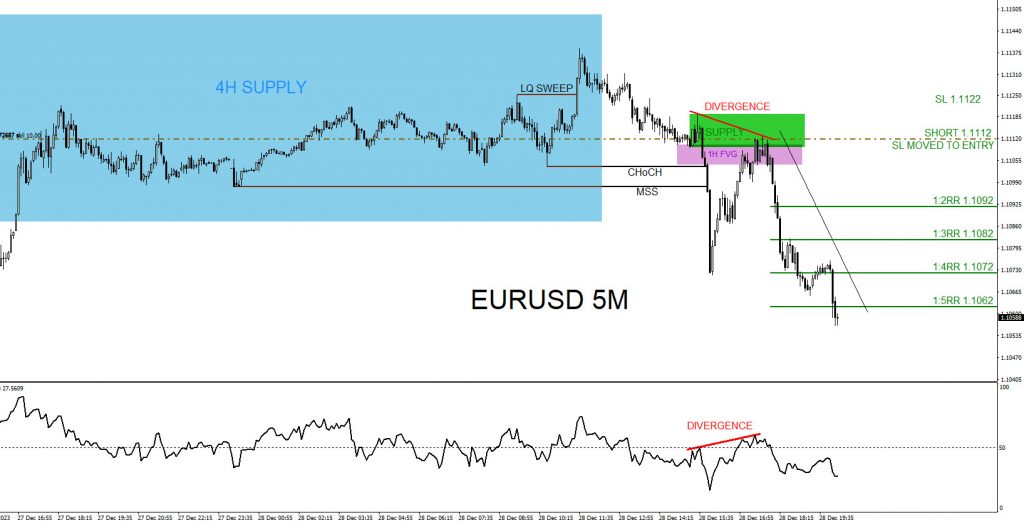

December 28 2023 I entered the sell entry on the EURUSD pair at 1.1112 with a 10 pip stop loss at 1.1122 and eyeing for a move lower to the 1:5RR target at 1.1062.

Sell Trade Setup

1. Price entered the 4 hour supply zone where price can reverse lower. (Blue box)

2. Price breaks below internal structure lower low (Black Lines) signalling a change of character (CHoCH) and a bearish market structure shift (MSS).

3. Price pullbacks to the supply zone (Green box) where sellers/bears are waiting to push the pair lower.

4. RSI divergence pattern (Red) forms in the supply zone (Green box) adding more confidence to enter sells.

EURUSD 5 Minute Chart December 28 2023

EURUSD moves lower and hits 1:5RR target hit at 1.1062 from 1.1112 and closed trade for +50 pips (+5% gain risking 1% on every trade)

A trader should always have multiple strategies all lined up before entering a trade. Never trade off one simple strategy. When multiple strategies all line up it allows a trader to see a clearer trade setup. If you followed me on social media you too could have caught the EURUSD move lower. We at EWF never say we are always right. No market service provider can forecast markets with 100% accuracy. Only thing we at EWF 100%, is that we are RIGHT more than we are WRONG.

More By This Author:

XPO INC Looking To End Impulsive RallyPalantir Rally Is Not Ready To Show Up Again

Buying Guangzhou EHang Stock In A Zig-Zag Pullback

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more