EUR/USD – The Main Currency Pair Awaits The Fed’s Decision

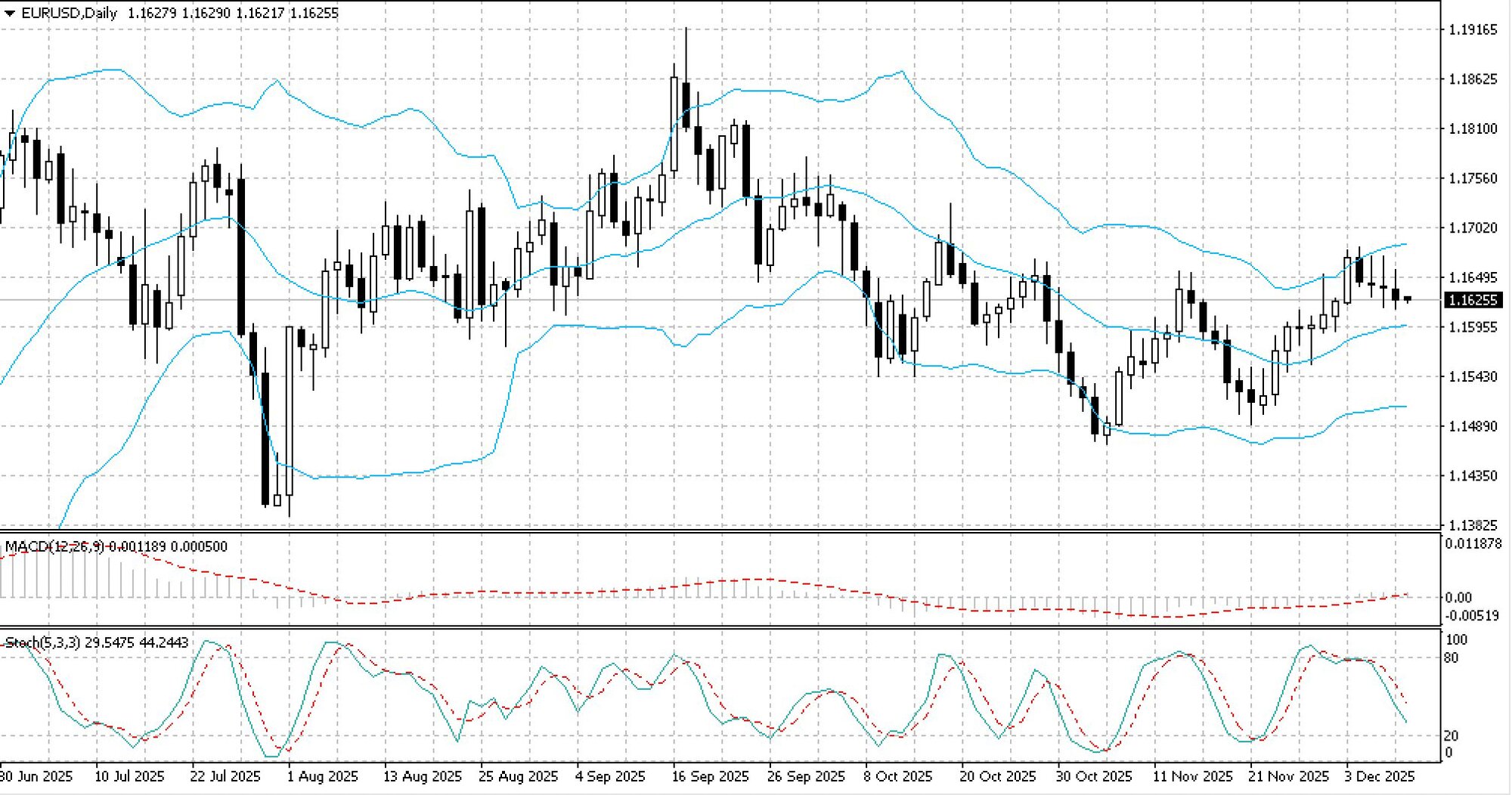

- EUR/USD moves sideways in the 1.1610–1.1700 range on the daily chart

- The Fed is preparing a 25 bp rate cut, opinions remain divided

- The market awaits Powell’s signals on the future rate path

- JOLTs and ADP data show a resilient labor market

EUR/USD slipped to 1.1625 on Wednesday.

On the daily chart, the euro/dollar pair is trading sideways within the 1.1610–1.1700 corridor.

The dollar index is holding near 99.2 points on Wednesday after two days of gains. Markets are awaiting the Fed’s decision, where the regulator is widely expected to cut the rate by 25 bp for the third time this year.

However, disagreement persists within the Fed. Some members support further easing to bolster a cooling economy, while others warn that cutting too quickly could reignite inflation. This is why investors are closely watching Jerome Powell’s comments – particularly his signals regarding the rate trajectory in 2026.

Tuesday’s data showed the labor market remains more resilient than expected. Job openings rose by 12,000 to 7.670 million in October, after a 431,000 jump in September. Both figures exceed forecasts around 7.2 million.

The ADP report also added optimism. According to the institute, the U.S. private sector added an average of 4,750 jobs per week over the four weeks through November 22 – a rebound after three consecutive periods of decline.

Against this backdrop, the market remains cautious ahead of the Fed’s decision and the subsequent press conference.

EURUSD Dynamics

More By This Author:

Bitcoin’s Tentative Bounce Amid Fragile SentimentThis Week: EURUSD, AUDUSD And USDInd In Focus

Brent Touches Below $63 As Glut Looms