EURUSD : 1:7 Risk/Reward Target Hit

Image Source: Pixabay

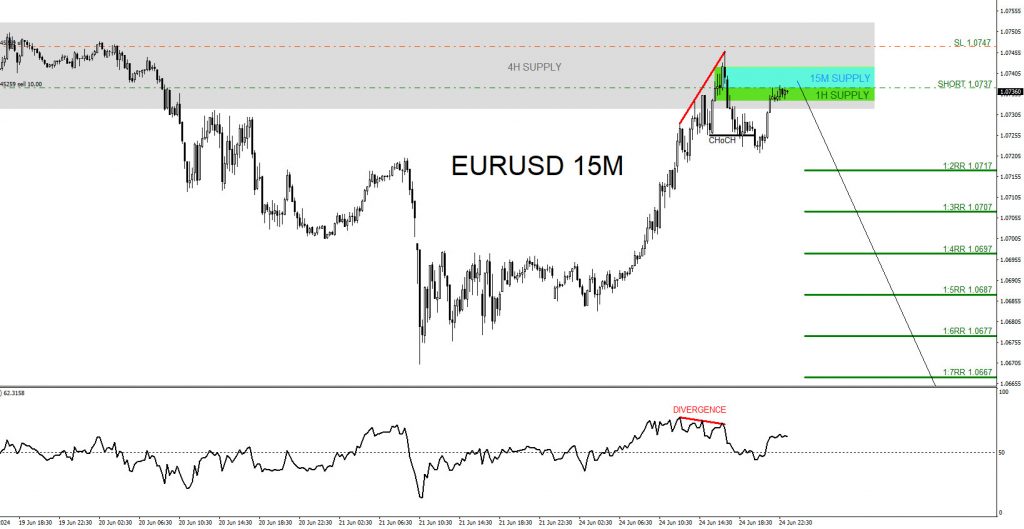

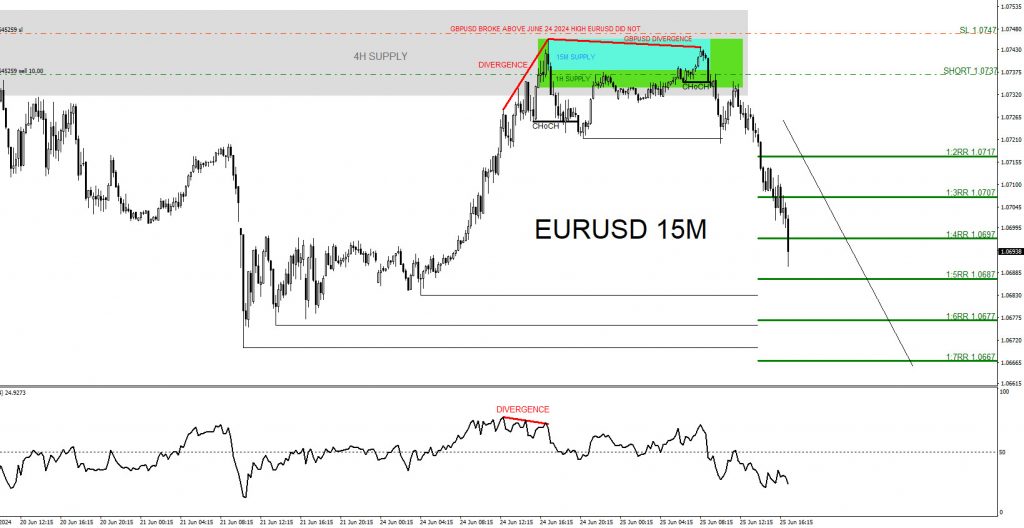

On June 24 2024 I posted on social media @AidanFX “EURUSD will be watching for sells as long as price remains below 1.0761. Will be targeting the 1.07 area if see sell opportunity.” I also posted the EURUSD 15-minute sell setup chart. The pair entered the 4-hour, 1-hour, and 15-minute bearish supply zones while the RSI showed a bearish divergence pattern signaling the pair would reverse lower. Added confirmation that EURUSD would push lower was the GBPUSD correlation divergence when GBPUSD broke above the June 24 2024 high and EURUSD did not. This divergence was another signal the pair would push lower.

EURUSD 15 Minute Chart June 24, 2024 (Entry)

EURUSD 15 Minute Chart June 25, 2024 (1:4 RR Target HIT. 1/2 of position closed +2%)

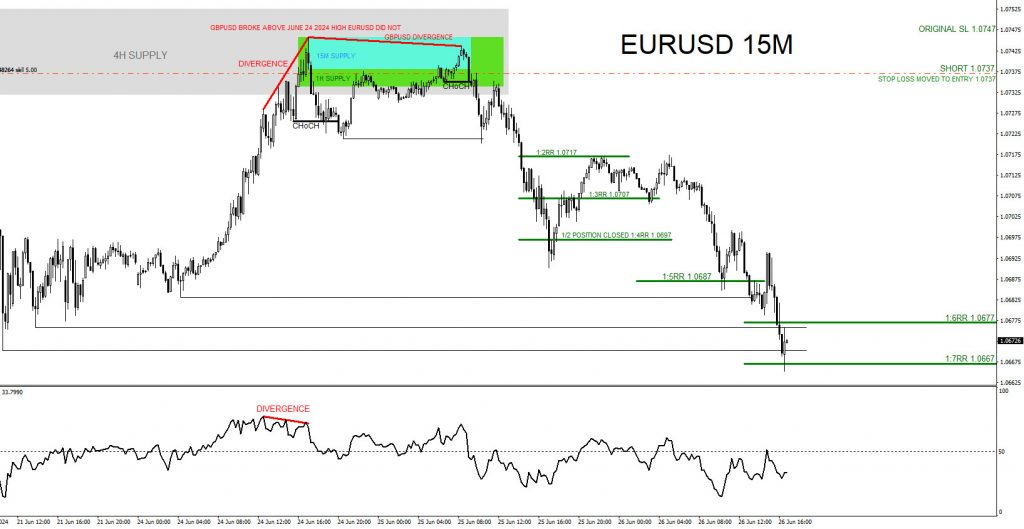

EURUSD 15 Minute Chart June 26, 2024 (1:7 RR Target HIT. Remaining 1/2 position closed +3.5%)

Entered the SELL trade June 24 2024 at 1.0737 with a 10 pip stop loss at 1.0747. EURUSD moved lower to the proposed targets. June 25 2024 1st 1/2 position closed at the 1:4RR target at 1.0697 for +40 pips +2%. June 26 2024 remaining 1/2 closed at the 1:7RR target at 1.0667 for +70 pips +3.5%. Sell trade closed for a total of +70 pips and a total of +5.5% gain (Risking 1% on every trade).

A trader should always have multiple strategies all lined up before entering a trade. Never trade off one simple strategy. When multiple strategies all line up it allows a trader to see a clearer trade setup. If you followed me on social media you too could have caught the EURUSD move lower.

More By This Author:

Netflix Stock Buying The Dips At The Blue Box AreaAIOZ Network Looking To End A corrective Decline

Elliott Wave Analysis On Silver Expects Further Correction Lower

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more