Euro Remains Under Pressure Below 1.0900, Looks At FOMC Minutes

Image Source: Pixabay

- Euro fails to surpass the 1.0900 level vs. the US Dollar.

- Stocks in Europe navigate a “sea of red” on Wednesday.

- EUR/USD appears capped by the 1.0900 region so far.

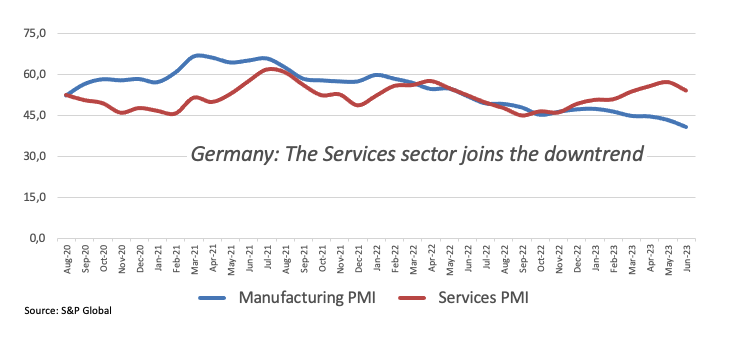

- Germany, EMU final Services PMI eased in June.

- US markets slowly return to normal activity.

The Euro (EUR) adds to the weekly bearish note following an unsuccessful effort to convincingly surpass the significant barrier at 1.0900 vs. the US Dollar (USD) earlier on Wednesday. A breakout of this key resistance area would restore the positive bias in EUR/USD and open the door for further gains in the short-term horizon.

Meanwhile, the US dollar fluctuates near the 103.00 level amidst favorable risk appetite trends despite the Chinese Services sector experiencing a significant decline in June compared to the previous month, propping up the idea that a strong economic recovery in the country still remains elusive.

In terms of monetary policy, there are no major updates, and investor expectations remain stable regarding an anticipated 0.25% interest rate hike from both the European Central Bank (ECB) and the Federal Reserve at their respective upcoming meetings later this month.

The central banks' efforts to combat inflation and normalize their monetary policies continue to be a subject of ongoing debate, as speculations about an economic slowdown on both sides of the Atlantic continue to grow.

Shifting the focus to the euro area, the final figures reveal the HCOB Services PMI for Germany at 54.1 and for the broader Eurozone at 52.0, both recorded in June. Additionally, Producer Prices for the euro bloc will be released later in the session.

In the United States, Factory Orders for May will be announced, followed by the IBD/TIPP Economic Optimism Index, the FOMC Minutes, and a speech by NY Fed John Williams, a permanent voter known for centrist views.

Daily digest market movers: Euro leaves behind part of the recent weakness

- The EUR briefly surpasses the 1.0900 barrier earlier on Wednesday.

- US traders are back to their desks following July 4th holiday.

- Chinese Caixin Services PMI came in at 53.9 in June (from 57.1).

- Bets on a Fed, ECB rate hike in July remain steady.

- Investors’ attention will likely be on the FOMC Minutes.

Technical Analysis: Euro still risks further downside

Despite Wednesday’s bullish attempt, EUR/USD remains under pressure and the door remains open to a probable retracement in the short term. Spot needs to clear the June high around 1.1010 to mitigate the current selling bias.

Against that, the loss of the weekly low at 1.0835 (June 30) could pave the way to a test of the transitory 100-day SMA at 1.0823. The breakdown of the latter should meet the next contention area not before the May low of 1.0635 (May 31) ahead of the March low of 1.0516 (March 15) and the 2023 low of 1.0481 (January 6).

If bulls regains the upper hand, the next hurdle is then expected at the June peak of 1.1012 (June 22) prior to the 2023 high of 1.1095 (April 26), which is closely followed by the round level of 1.1100. North from here emerges the weekly top of 1.1184 (March 31, 2022), which is supported by the 200-week SMA at 1.1180, just before another round level at 1.1200.

The constructive view of EUR/USD appears unchanged as long as the pair trades above the crucial 200-day SMA, today at 1.0608.

More By This Author:

EUR/USD Price Analysis: A More Convincing Upside Needs To Clear 1.1012USD Index Treads Water Around The 103.00 Region

EUR/USD Price Analysis: Further Upside Targets The 1.1010 Area

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more