EURJPY : 1:2.5 Risk/Reward Target Hit

Image Source: Unsplash

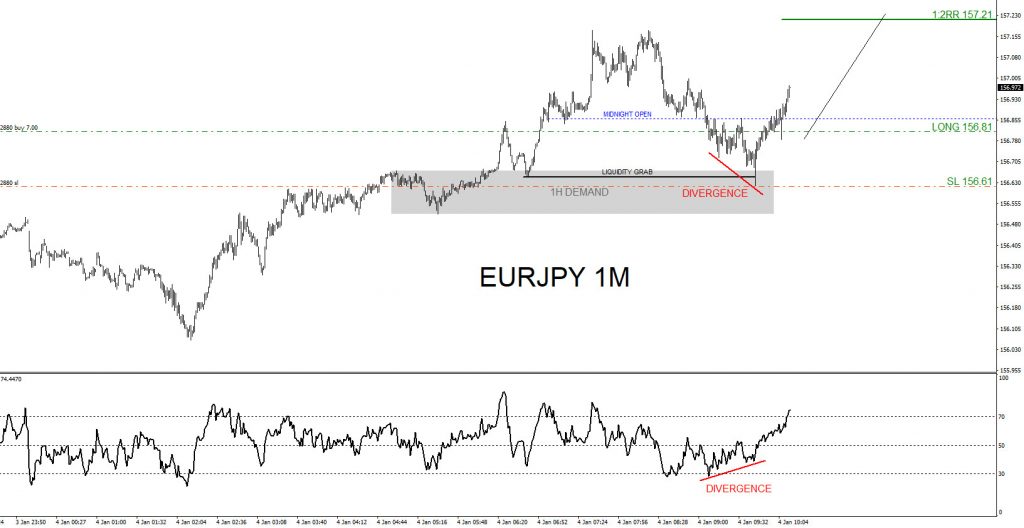

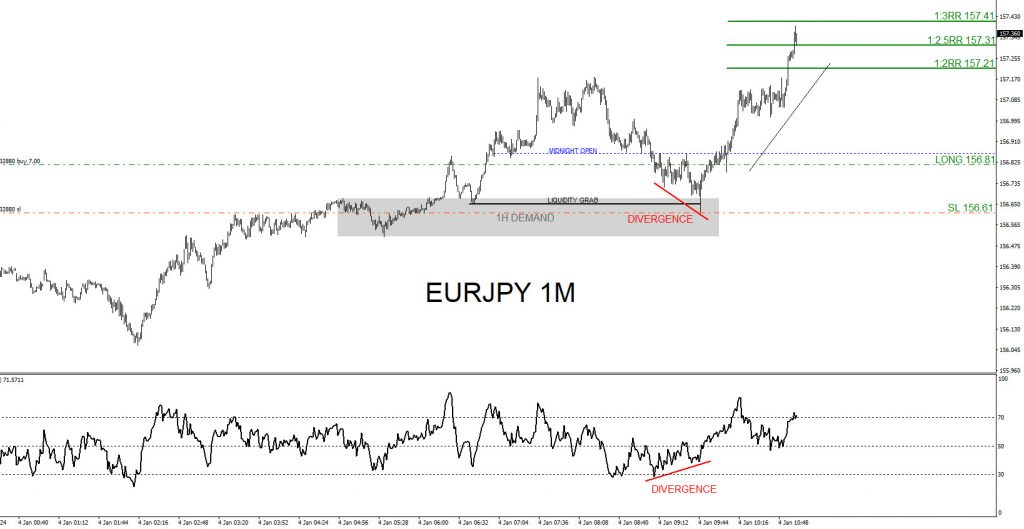

On January 4 2024 EURJPY was showing signals that the pair would extend higher. Below I will explain the reasons why I entered the BUY/LONG trade.

Buy Trade Setup

1. Price enters the 1-hour bullish demand zone. (Gray box)

2. Price sweeps a liquidity level faking out sellers and fuelling the buyers. (Black line/Liquidity Grab)

3. A bullish divergence pattern forms on RSI and in the demand zone signalling a price reversal higher. (Red)

4. Buy/Long trade entered after a clear visible bounce higher confirming a higher low formed and where stops was set looking for targets above the days high.

EURJPY 1 Minute Chart January 4, 2024

Entered the BUY trade at 156.81 with a 20 pip stop loss at 156.61. EURJPY moves higher and hits the proposed 1:2RR target at 157.21 and I closed the buy trade at the 157.31 1:2.5RR Target for +50 pips +2.5% gain (Risking 1% on every trade).

A trader should always have multiple strategies all lined up before entering a trade. Never trade off one simple strategy. When multiple strategies all line up it allows a trader to see a clearer trade setup.

More By This Author:

AT&T One More Low Is Expected to Complete a Bearish SequenceExxon Mobil Corp Found Buyers From Extreme Area

Nasdaq 100 Looking To Do Correction Within Bullish Trend

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more