EURGBP Stumbles: Uptrend Stalled Or Reversal In Sight?

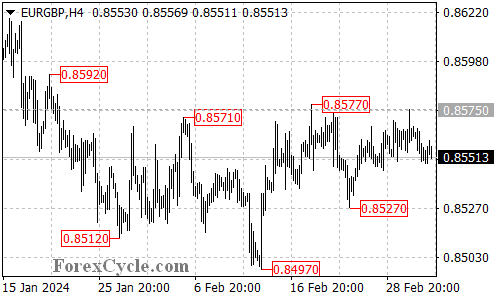

EURGBP attempted to push higher but failed to overcome resistance at 0.8577, leading to a pullback. This analysis explores the technical situation and potential future scenarios for the currency pair.

Uptrend Challenged: Is the Momentum Lost?

- 0.8577 Resistance Rejected: EURGBP’s recent attempt to break above the 0.8577 resistance level proved unsuccessful, resulting in a pullback from 0.8575. This failed breakout suggests a potential weakening of the uptrend that began earlier.

- Downside Risks: If the bearish momentum persists, we could see another fall in the coming days. A breakdown below the 0.8545 support level could trigger a further decline towards the 0.8527 support level. Breaching this level could even lead to a retest of the previous low at 0.8497.

Potential Rebound: Can the Bulls Regroup?

- 0.8565 Initial Resistance: While the immediate outlook appears bearish, a break above the 0.8565 initial resistance level could signal a potential rebound. This could lead to another attempt at breaking through the 0.8577 resistance.

- Beyond 0.8577: Uptrend Resumption?: If the bulls can decisively overcome 0.8577, it would indicate a resumption of the uptrend. This could open the door for a rise towards the 0.8600 area and potentially further strengthen the uptrend.

Overall Sentiment:

The technical outlook for EURGBP is currently uncertain. The failed breakout at 0.8577 and the potential for further downside raise concerns about the uptrend’s sustainability. However, a break above the initial resistance at 0.8565 could signal a potential revival of the uptrend. Monitoring the price action around these key levels will be crucial in determining the pair’s next move.

More By This Author:

USDJPY: Rebound or Reprieve? Uptrend At A CrossroadsEURUSD Stalemate: Uptrend On Hold Or Finding Footing?

AUDUSD Under Pressure: Downtrend In Control Or Potential Reversal?

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more