EURCAD: Two Sell Trades Hit Targets

Image Source: Unsplash

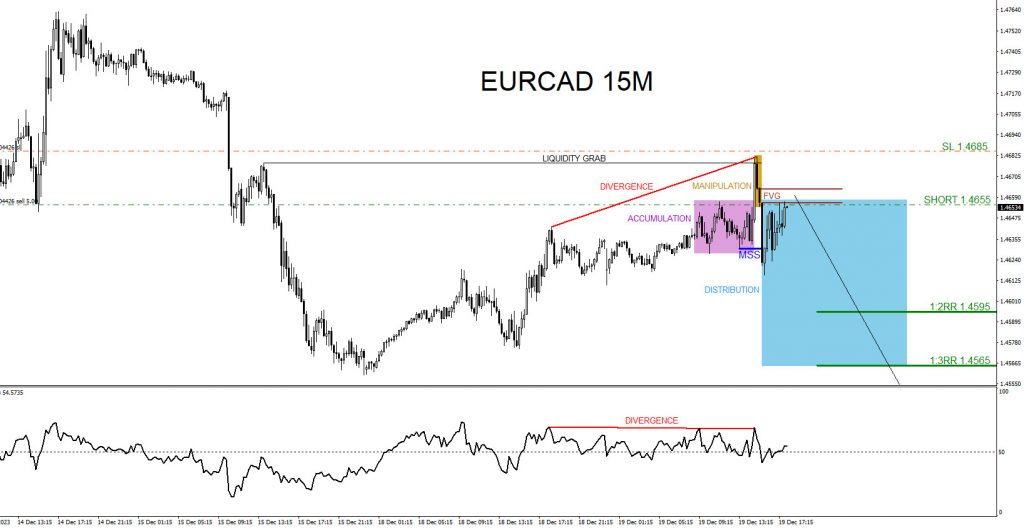

On December 19 2023 I posted on social media @AidanFX ” Sold EURCAD at 1.4655 Stop Loss at 1.4685 Target at the 1.4595 – 1.4565 area.”

SELL Trade Setup

1. Price grabs buyside liquidity faking out buyers. (Black line)

2. Bearish Accumulation, Manipulation, Distribution pattern. (Purple,Yellow, Blue boxes)

3. Price forms a bearish divergence pattern after grabbing buyside liquidity adding more confidence the pair will move lower. (Red line)

4. Price breaks below internal structure higher low (Blue line/MSS Market Structure Shift) signalling bullish weakness and a shift for bearish strength.

5. Price pullsback to FVG/Fair Value Gap (Brown) where sell was triggered.

EURCAD 15 Minute Chart December 19 2023

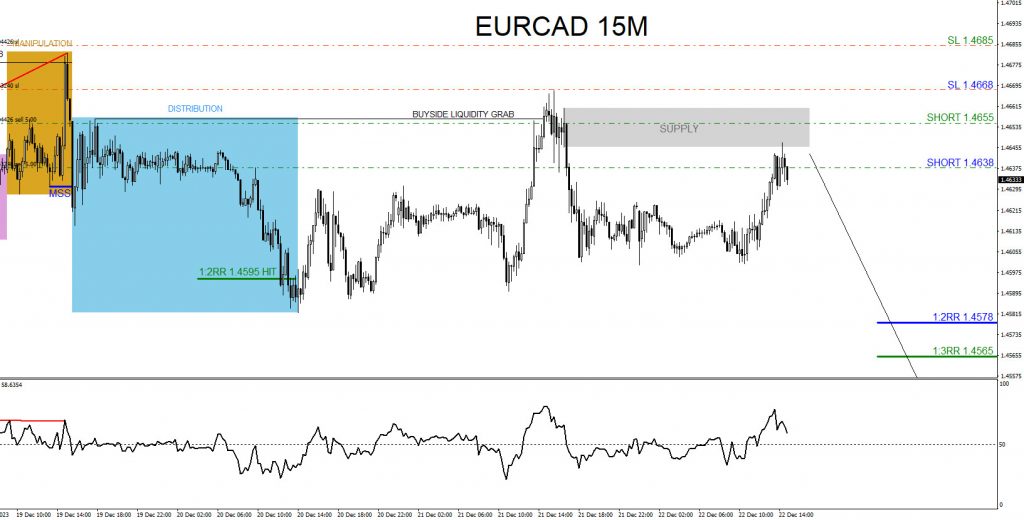

EURCAD 15 Minute Chart December 22 2023

Price made a pullback to the supply zone (Gray box) and respected this zone which triggered the 2nd sell entry (Blue) at 1.4638 with stop loss at 1.4668 and target at 1.4578.

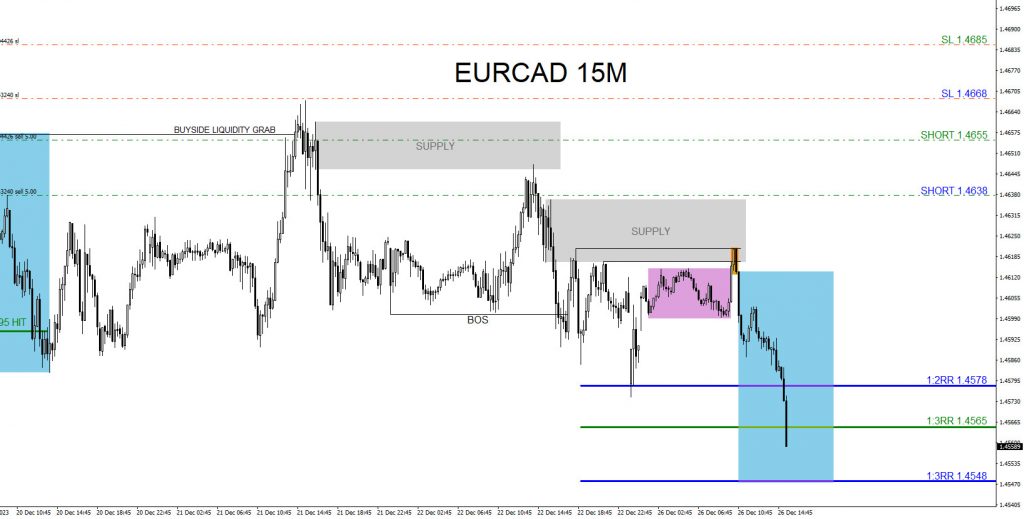

EURCAD 15 Minute Chart December 26 2023

A 2nd bearish Accumulation, Manipulation, Distribution pattern forms and sends price lower to the proposed targets.

EURCAD moves lower and hits the 1:3 Risk/Reward target 1.4565 for the first entry (Green) and also hits the 1:2 Risk/Reward target 1.4578 for the 2nd sell entry (Blue) for over +150 pips combined. (Approximately +5.5% gain risking 1% on every trade)

A trader should always have multiple strategies all lined up before entering a trade. Never trade off one simple strategy. When multiple strategies all line up it allows a trader to see a clearer trade setup. We at EWF never say we are always right. No market service provider can forecast markets with 100% accuracy. The only thing we at EWF 100%, is that we are RIGHT more than we are WRONG.

Of course, like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade.

More By This Author:

S&P 500 ETF Looking To End Impulsive RallyWest Pharmaceutical Services Bullish Daily Cycle

XLI Elliott Wave: Buying The Dips At The Blue Box Area

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more