EUR/AUD Forecast: Rallies After Bounce Against The Aussie Dollar

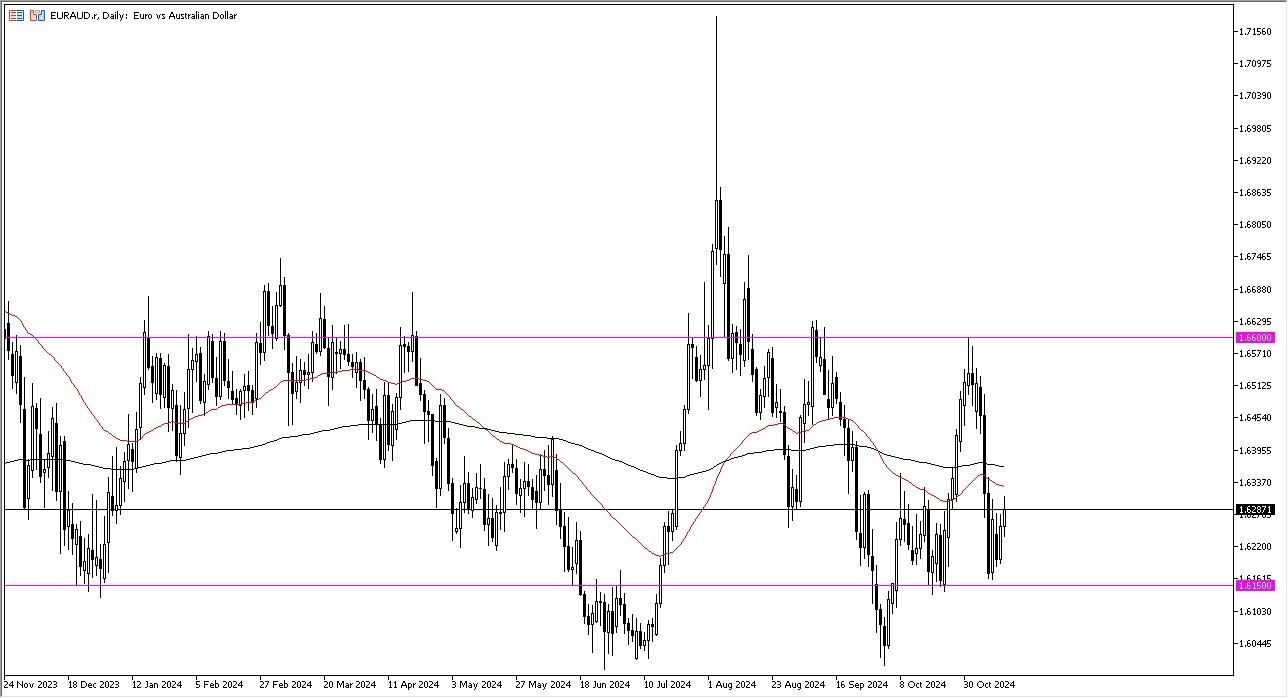

- The euro have been a little bit positive during the trading session on Wednesday against the Australian dollar as it looks like we are threatening the 50 day EMA.

- If we can break above the 50 day EMA, then it is possible that we can break above the 200 day EMA as well, sending the euro much higher.

- It's also worth noting that we recently plunged to the 1.6 150 level only to turn around and bounce.

The 1.6150 level has been significant support more than once, and therefore I think you need to look at it as a potential short-term floor in the market. Although, I would be the first person to suggest that perhaps that floor extends all the way down to the 1.60 level.

With that being said, EUR/AUD is a pair that is rather noisy most of the time, and with that being said also, you have to keep it in mind that a lot of choppiness and volatility is to be expected. With this setup, I think a lot of traders will be looking at the stochastic oscillator and other sideways indicators to determine whether or not they should be buyers or sellers. According to the stochastic oscillator, we are in the midst of bottoming, so we could rally all the way to the crucial 1.66 level again, and simply stay in the same pattern we've been in for several months.

(Click on image to enlarge)

Which is Riskier?

Keep in mind that the Australian dollar is considered to be a little bit riskier than the euro, although, you know, that's a relative term. It's not necessarily that the Australian economy itself is risky, but the Australian economy is sensitive to global demand for commodities. And that is something that you need to be aware of. So, with this being said, I think you've got a situation where the market is trying to bounce. And if we get any bit of momentum, it's probably a decent trade setup just waiting to happen.

More By This Author:

EUR/CHF Forecast: Consolidating Against FrancGold Forecast: Plunges On Monday Morning

EUR/USD Forecast: Holds Support Amid Market Fluctuations

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more