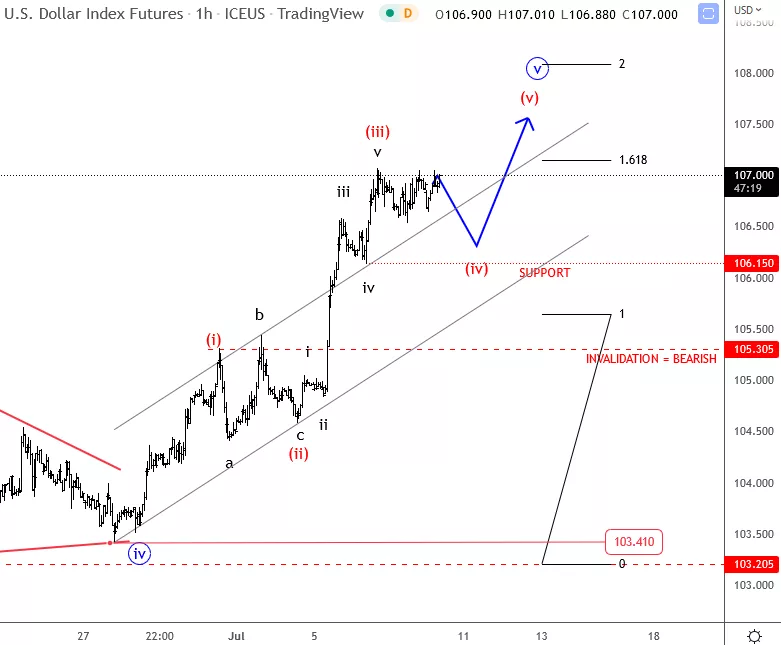

Elliott Waves On DXY Ahead Of NFP Data

Photo by Giorgio Trovato on Unsplash

Stocks have some positive momentum possibly due to news that China considers a $220 billion stimulus which can have a positive impact on global economic activity. However, today's focus will be on NFP. We will see if the numbers will be strong or weak and if the US is headed towards recession, meaning that Fed will not be able to ignore it for a long time. Keep in mind that there was absolutely no word "recession" from the Fed on Wednesday. But on the other hand, strong job numbers will suggest that Fed will stick to the current hawkish policy and will continue to try to fight inflation. In such a case, stocks may fall further and USD can rise.

Technically speaking we see room for more upside on DXY as recovery from 103.41 is not in five waves yet. The invalidation level is at 105.30; a drop below here will put a temporary high in place.

More By This Author:

Elliott Wave Analysis: AMD Stock Can Be Supportive For Bitcoin

USDJPY Can Be Finishing Wedge Pattern

Recovery On Treasury Bonds Signals Temporary Top On USDJPY

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All of our work is for educational purposes only.