Elliott Wave Technical Analysis: U.S. Dollar/Swiss Franc - Wednesday, April 16

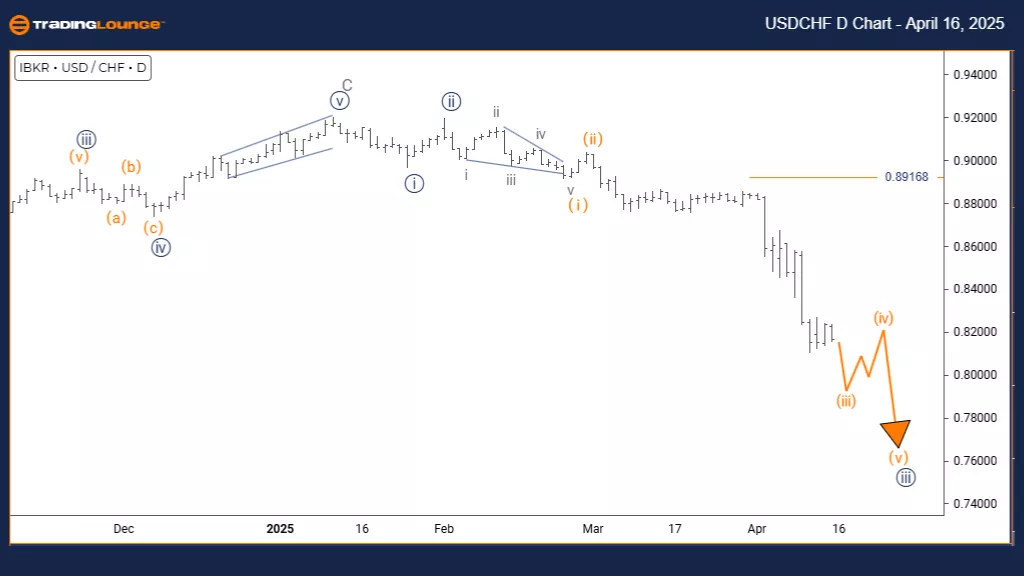

U.S. Dollar / Swiss Franc (USDCHF) Day Chart

USDCHF Elliott Wave Technical Analysis

FUNCTION: Bearish Trend

MODE: Impulsive

STRUCTURE: Orange wave 3

POSITION: Navy blue wave 3

DIRECTION NEXT HIGHER DEGREES: Orange wave 4

DETAILS: Orange wave 2 appears completed; orange wave 3 now in progress.

Wave Cancel Invalid Level: 0.89168

The USDCHF daily chart displays a strong bearish trend forming through an impulsive Elliott Wave structure. The pair has finished its orange wave 2 correction and entered orange wave 3 within the broader navy blue wave 3. This suggests the pair is now in the strongest segment of its downtrend, often marked by strong momentum and large price movements.

Orange wave 3 is usually the most forceful wave in a bearish sequence. With wave 2 completed, this sets up a dynamic decline in wave 3, which often extends beyond wave 1 in magnitude. The current setup indicates further downside pressure before the next correction begins.

The next expected phase is orange wave 4, which is typically corrective. This wave could provide a temporary pullback before the bearish trend resumes. The daily timeframe offers critical insights into this trend, showing that the pair is in a significant phase of its longer-term downtrend.

Key Level to Watch:

The 0.89168 mark serves as the invalidation level for this bearish wave outlook. If prices rise above this point, the current wave structure becomes invalid, and the pattern must be reassessed. This level acts as resistance, guarding the wave 2 high.

Traders should observe the characteristics of wave 3, which often include consistent momentum and direction. This analysis supports a bearish view while wave 3 unfolds, but it's important to watch for signals indicating its end. Technical indicators and price patterns will be essential in confirming the wave's progress, especially signs of weakening momentum.

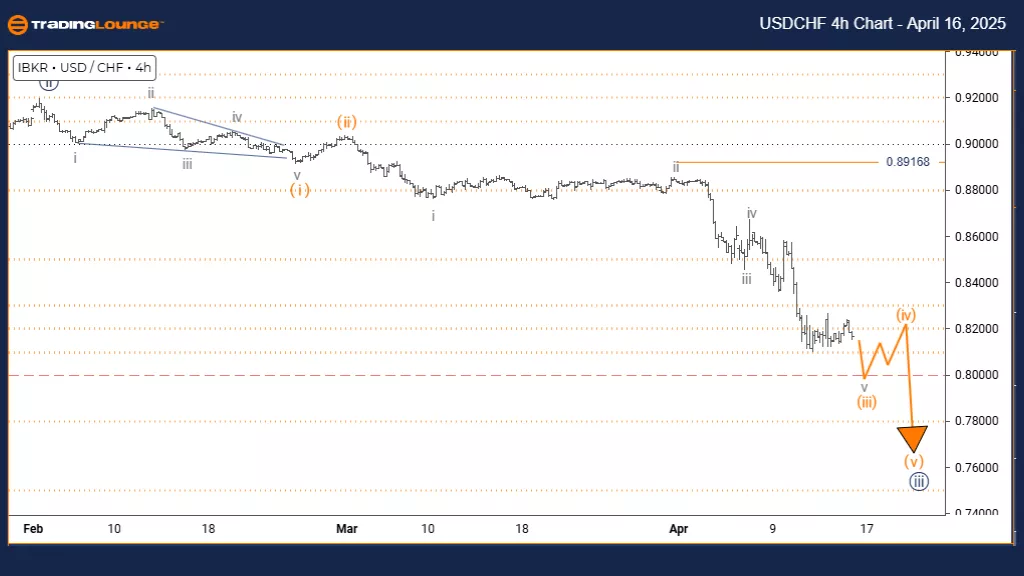

U.S. Dollar / Swiss Franc (USDCHF) 4-Hour Chart

USDCHF Elliott Wave Technical Analysis

FUNCTION: Bearish Trend

MODE: Impulsive

STRUCTURE: Gray wave 5

POSITION: Orange wave 3

DIRECTION NEXT HIGHER DEGREES: Orange wave 4

DETAILS: Gray wave 4 seems completed; gray wave 5 is underway.

Wave Cancel Invalid Level: 0.89168

The USDCHF 4-hour chart shows a bearish trend evolving through an impulsive Elliott Wave pattern. The pair has finished its gray wave 4 correction and entered gray wave 5, continuing within the broader orange wave 3 structure. This phase indicates the final leg of the current bearish sequence before a likely corrective upward move.

Gray wave 5 typically marks the end of the trend phase, often displaying either accelerating momentum or signs of weakening. The end of wave 4 paves the way for this last push, which may retest or fall below previous lows before it finishes.

This structure implies the downtrend could soon end as wave 5 progresses. Following this, orange wave 4 is expected—a corrective move that might offer short-term bullish setups. One critical level to observe is 0.89168, which acts as the invalidation point. If the price climbs above this level, the current wave count becomes invalid and must be reevaluated.

What Traders Should Watch:

Look for signs of wave 5 completion, including possible bullish divergence on momentum indicators or reversal signals. The 4-hour chart provides key insights, suggesting that the pair might be near the end of its short-term decline. While wave 5 can occasionally extend, signs of exhaustion should prompt traders to prepare for a correction.

Technical indicators and price action cues will be essential to confirm the weakening of this downward momentum and the potential start of wave 4. Traders should stay alert for completion signals and respect the 0.89168 invalidation level, which, if breached, negates the current analysis.

Technical Analyst: Malik Awais

More By This Author:

Elliott Wave Technical Analysis: Solana Crypto Price News For Wednesday, April 16

Unlocking ASX Trading Success: Amcor Plc - Tuesday, April 15

Elliott Wave Technical Analysis: Fortinet Inc. - Tuesday, April 15

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more