Elliott Wave Technical Analysis: U.S. Dollar/Japanese Yen - Monday, April 7

U.S. Dollar / Japanese Yen USDJPY Elliott Wave Technical Analysis

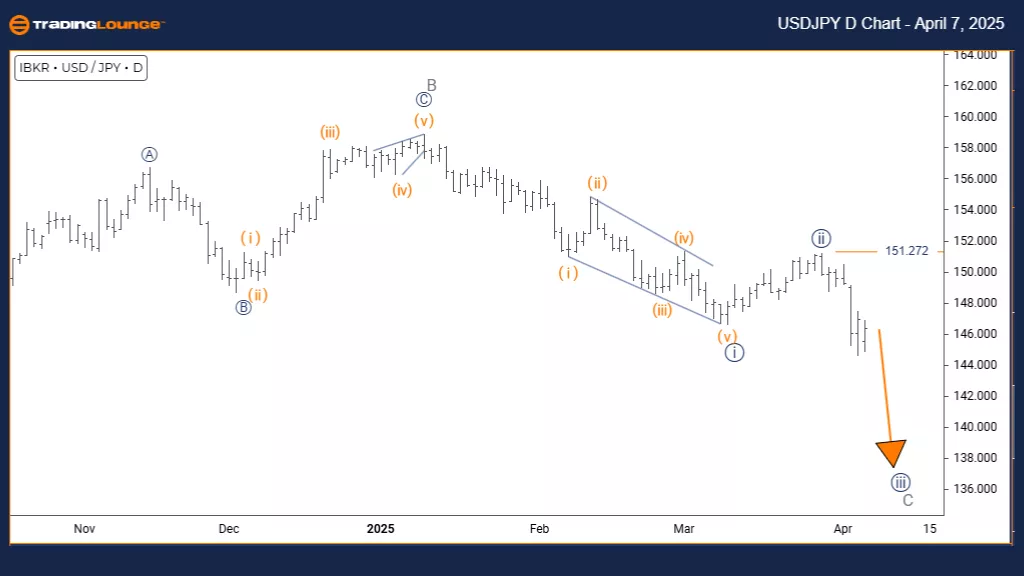

Chart Type: Daily Chart

Technical Overview

- Function: Counter-Trend

- Mode: Impulsive

- Wave Structure: Navy Blue Wave 3

- Current Position: Gray Wave C

- Higher Degree Direction: Navy Blue Wave progression

- Invalidation Level: 151.272

USDJPY Elliott Wave Summary – Daily Perspective:

The USDJPY is currently in a counter-trend formation within a complex Elliott Wave structure. The active pattern highlights navy blue wave 3 forming the core of the current movement, part of a broader gray wave C. The corrective navy blue wave 2 appears completed, initiating a new impulsive phase with wave 3 now unfolding.

This setup suggests a medium-term directional shift in USDJPY, influenced by wave momentum and structural alignment. If price breaches 151.272, the existing wave count may be invalidated, requiring reassessment of the scenario.

Analytical Insights:

- The impulsive movement in navy blue wave 3 typically features stronger price action, aligning with expectations for increased momentum.

- The position of wave 3 within wave C provides context for both immediate and extended price forecasts.

- Traders should remain alert for impulsive wave characteristics and react accordingly to key levels.

Trading Implications:

Market participants are advised to monitor this phase closely, evaluating both short-term trades and strategic longer-term positions. The daily chart acts as a reliable reference for tracking USDJPY's development within the larger Elliott Wave hierarchy.

U.S. Dollar / Japanese Yen (USDJPY)

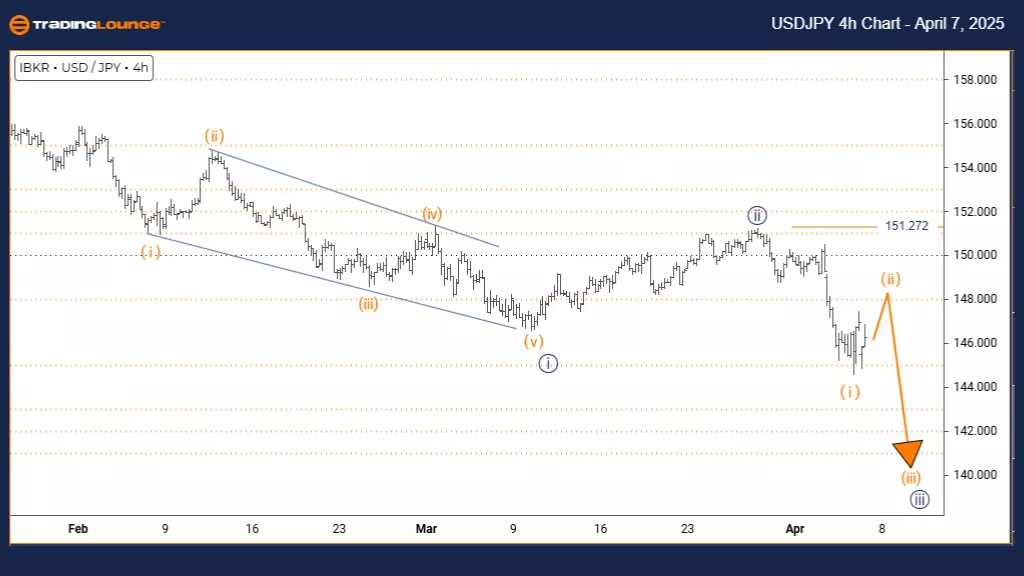

Chart Type: 4-Hour Chart

Technical Overview

- Function: Counter-Trend

- Mode: Corrective

- Wave Structure: Orange Wave 2

- Current Position: Navy Blue Wave 3

- Next Lower Degree: Orange Wave 3

- Invalidation Level: 151.272

USDJPY Elliott Wave Summary – 4H Perspective:

In the 4-hour timeframe, USDJPY is undergoing a corrective phase, currently developing within orange wave 2. This correction follows the completion of orange wave 1, which itself was an impulsive move under the broader navy blue wave 3 formation.

Traders are now watching the pair as it advances through wave 2's retracement, awaiting confirmation of its conclusion before the start of orange wave 3’s impulsive leg. If the price crosses above 151.272, the existing Elliott Wave outlook will need revision.

Analytical Insights:

- The corrective phase of orange wave 2 often includes patterns such as three-wave structures or sideways consolidation, consistent with counter-trend characteristics.

- Its placement within the larger navy blue wave 3 provides medium-term directional guidance while also identifying short-term trade setups.

- Completion of this phase may serve as a launch point for renewed bullish movement in orange wave 3.

Trading Implications:

This structure offers actionable setups for both short-term traders capitalizing on pullbacks and longer-term investors seeking re-entry into the main trend. Monitoring for completion signals in orange wave 2 is essential for timing entries into the anticipated impulsive leg.

Technical Analyst: Malik Awais

More By This Author:

Elliott Wave Technical Forecast: News Corporation - Friday, April 4

Elliott Wave Technical Analysis: MercadoLibre Inc.

Elliott Wave Technical Analysis: U.S. Dollar/Swiss Franc - Friday, April 4

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more