Elliott Wave Technical Analysis: U.S. Dollar/Japanese Yen - Friday, Jan. 10

U.S. Dollar / Japanese Yen (USDJPY) Day Chart

USDJPY Elliott Wave Technical Analysis

- Function: Bullish Trend

- Mode: Impulsive

- Structure: Orange Wave 1

- Position: Navy Blue Wave 3

- Direction Next Lower Degrees: Orange Wave 2

- Details: Orange wave 1 is still in play and appears to be nearing completion.

- Wave Cancel Invalid Level: 156.186

The USDJPY currency pair demonstrates a strong bullish trend based on the Elliott Wave analysis of the daily chart. Currently, the market is in an impulsive mode, with orange wave one actively progressing as part of the larger navy blue wave three structure. This phase indicates robust upward momentum within the broader trend.

As orange wave one approaches its conclusion, the next anticipated phase is orange wave two, which would likely represent a corrective pullback. This transition is typical within Elliott Wave structures and provides an opportunity to evaluate the market’s strength before further impulsive advancements.

Key Insights:

-

Orange Wave 1 Progression:

This wave highlights a phase of strong upward momentum, integral to the early development of the impulsive structure. -

Transition to Orange Wave 2:

Following the completion of orange wave one, a temporary corrective phase (orange wave two) is expected, serving as a natural retracement within the bullish trend. -

Invalidation Level:

An invalidation level at 156.186 has been identified. If the price drops below this threshold, the current wave count will be invalidated, necessitating a revised wave analysis. This level is critical for confirming the wave scenario’s accuracy.

Conclusion:

The USDJPY currency pair remains firmly in a bullish trend, with orange wave one nearing its final stages within the navy blue wave three framework. A corrective phase, represented by orange wave two, is likely to follow before the continuation of the broader upward trend. Monitoring the invalidation level of 156.186 is crucial, as it acts as a key reference point for validating the current wave structure.

This phase of Elliott Wave progression provides traders with valuable insights into the sustainability of the bullish momentum and helps anticipate future market movements.

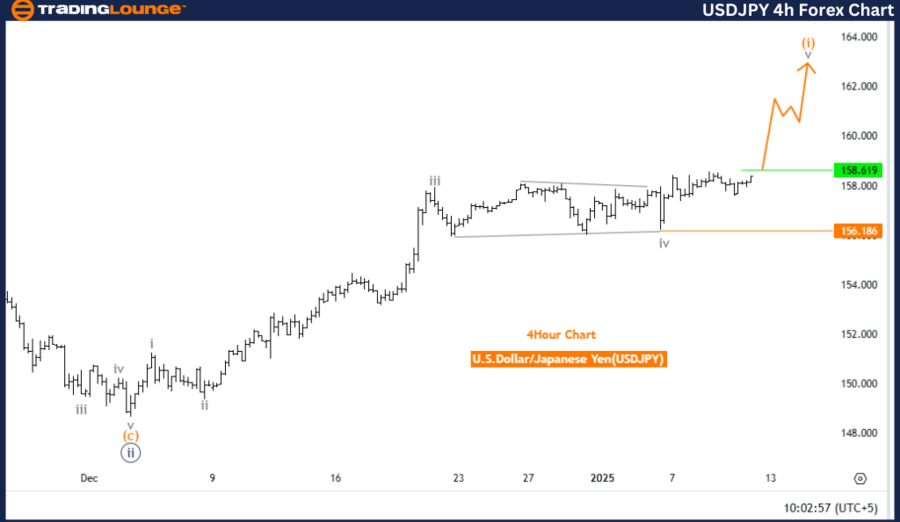

U.S. Dollar / Japanese Yen (USDJPY) 4 Hour Chart

USDJPY Elliott Wave Technical Analysis

- Function: Bullish Trend

- Mode: Impulsive

- Structure: Gray Wave 5

- Position: Orange Wave 1

- Direction Next Lower Degrees: Orange Wave 2

- Details: Gray wave 4 appears completed; gray wave 5 of orange wave 1 is now in play.

- Wave Cancel Invalid Level: 156.186

The USDJPY currency pair exhibits a strong bullish trend as revealed by Elliott Wave Analysis on the 4-hour chart. The market is currently advancing in an impulsive phase, represented by gray wave five, which forms part of the larger orange wave one structure.

The recent completion of gray wave four has paved the way for gray wave five, signaling the continuation of upward momentum. This phase marks the culmination of the impulsive sequence within the current wave count.

Key Insights:

-

Gray Wave 5 Progression:

Gray wave five is the final impulsive wave within the sequence, reinforcing the bullish trend. Its conclusion will set the stage for the next phase in the wave structure. -

Transition to Orange Wave 2:

Following the completion of gray wave five, the market is expected to enter orange wave two, a corrective phase that provides a natural pullback before the bullish trend resumes. -

Invalidation Level:

The 156.186 price level is the key invalidation benchmark. If the market moves below this level, the current wave structure will no longer be valid, necessitating a reassessment of the Elliott Wave count.

Conclusion:

The USDJPY currency pair remains firmly in a bullish impulsive phase, with gray wave five currently progressing within the broader orange wave one framework. This stage reflects strong upward momentum, with the subsequent transition to orange wave two expected to bring a temporary corrective phase.

The 156.186 invalidation level is crucial for ensuring the accuracy of the wave analysis and provides a critical point of reference for traders. As gray wave five unfolds, monitoring its completion will offer key insights into the sustainability and direction of the ongoing bullish trend.

Technical Analyst: Malik Awais

More By This Author:

Elliott Wave Technical Analysis: UNIUSD Crypto Price News For Friday, Jan 10

Elliott Wave Analysis: S&P 500, Nasdaq 100, DAX 40, FTSE 100, ASX 200, NIFTY 50

Elliott Wave Technical Analysis - NextEra Energy Inc.

Analyst Peter Mathers TradingLounge™ Australian Financial Services Licence - AFSL 317817

.thumb.png.7cb73577993b6767a0197ac60784e865.png)