Elliott Wave Technical Analysis: Ripple Crypto Price News For Wednesday, April 23

Image by WorldSpectrum from Pixabay

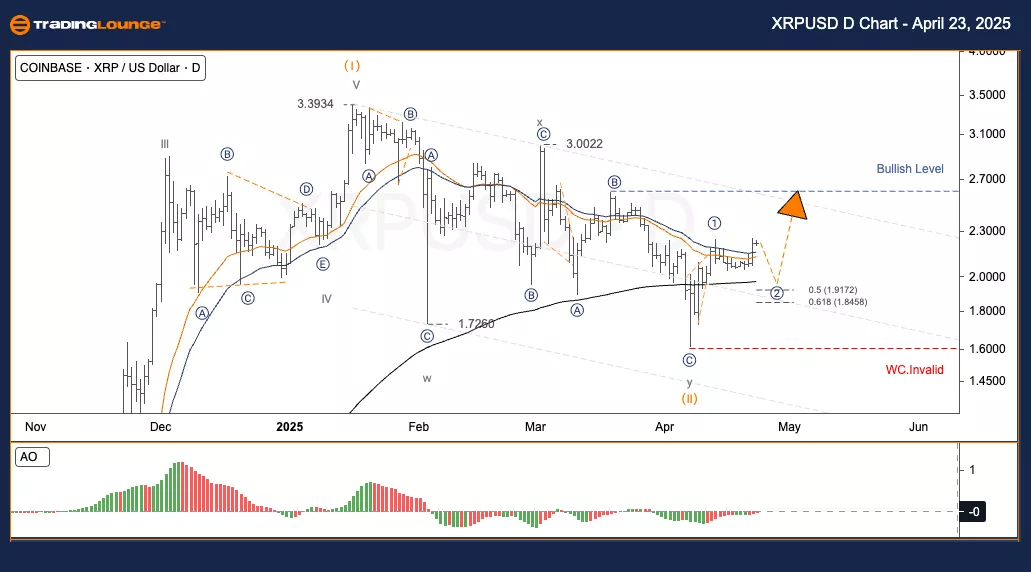

Elliott Wave Analysis – TradingLounge Daily Chart

XRP/U.S. Dollar (XRPUSD)

XRPUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave 3

Direction Next Higher Degrees:

Wave Cancel Invalid Level:

XRP/U.S. Dollar (XRPUSD) – Trading Strategy (Daily Chart)

Following an extended corrective phase, XRP seems to have fully concluded wave (II). It now appears to be entering wave (III), traditionally the strongest and most rapid phase within the five-wave Elliott structure. Wave (I) concluded at the level of 3.3934. The corrective wave (II) developed a Double Zigzag (WXY) formation and reached its end at 1.7260. Currently, price movements suggest the formation of sub-waves 1 and 2 within the advancing wave (III). The retracement levels of wave 2 are seen at:

50% = 1.9172

61.8% = 1.8458

Trading Strategies

Strategy:

For Short-Term Traders (Swing Trade):

Wait for the reversal of wave 2 to initiate entry into wave 3.

Risk Management:

Structural Cancellation Point (W.C. Invalid) is identified below 1.60.

Elliott Wave Analysis – TradingLounge H4 Chart

XRP/U.S. Dollar (XRPUSD)

XRPUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave 3

Direction Next Higher Degrees:

Wave Cancel Invalid Level:

XRP/U.S. Dollar (XRPUSD) – Trading Strategy (H4 Chart)

After a prolonged correction, XRP seems to have ended wave (II) and is showing signs of starting wave (III), which typically exhibits the most momentum in the five-wave sequence. Wave (I) concluded at 3.3934, while wave (II), in the form of a Double Zigzag (WXY), terminated at 1.7260. Price activity now reflects the formation of the first two sub-waves of wave (III). The current retracement of wave 2 has key levels at:

50% = 1.9172

61.8% = 1.8458

Trading Strategies

Strategy:

For Short-Term Traders (Swing Trade):

Monitor wave 2 reversal before entering wave 3.

Risk Management:

Structural Cancellation Point (W.C. Invalid) lies below 1.60.

TradingLounge Analyst: Kittiampon Somboonsod, CEWA

Source: TradingLounge.com

More By This Author:

Elliott Wave Technical Analysis: Computershare Limited

Elliott Wave Technical Analysis: Fortinet Inc. - Tuesday, April 22

Elliott Wave Technical Analysis: Australian Dollar/U.S. Dollar - Tuesday, April 22

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more