Elliott Wave Technical Analysis: Euro/U.S. Dollar - Wednesday, May 14

EURUSD Elliott Wave Analysis – Trading Lounge

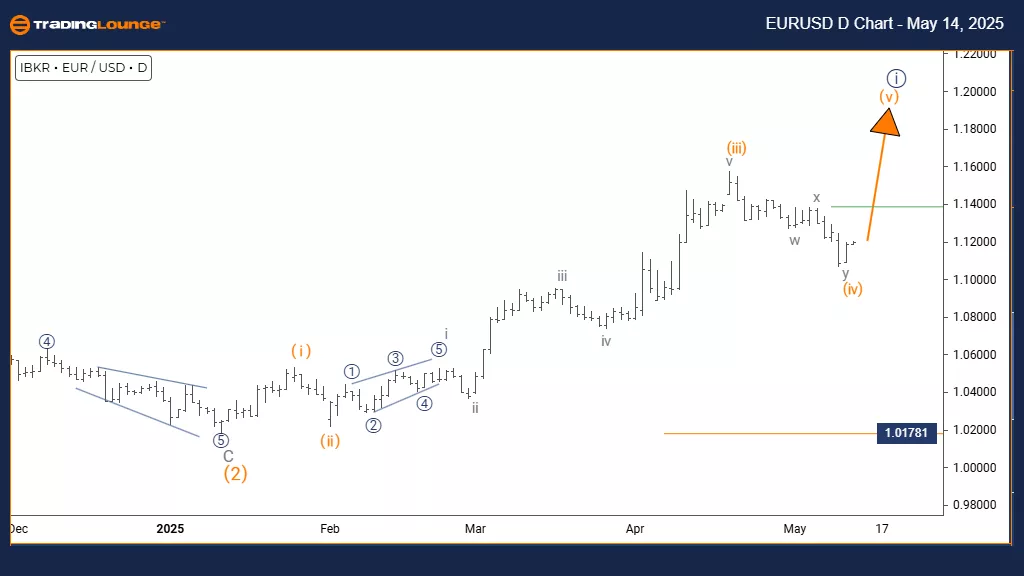

Euro/ U.S. Dollar (EURUSD) – Day Chart

EURUSD Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 5

POSITION: Navy Blue Wave 1

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 2

DETAILS: Orange wave 4 appears to have completed, initiating orange wave 5.

Wave Cancel Invalid Level: 1.01781

The daily chart reflects a bullish outlook for the EURUSD pair, with notable upward movement within an impulsive wave framework. Present analysis identifies that orange wave 5 is forming within the broader structure of navy blue wave 1. This indicates the currency pair has finalized the correction seen in orange wave 4 and has entered the final phase of upward movement within this impulse wave. This development often marks the last segment of upward momentum before a likely trend reversal or deeper correction begins.

The technical analysis confirms the end of orange wave 4 and the initiation of orange wave 5. A key invalidation level has been set at 1.01781. A break below this point would negate the current bullish wave count and could indicate the premature end of the upward move or require a reassessment of the wave structure. The current impulsive pattern points to sustained buying activity. However, traders should observe for signs of slowing momentum as this final wave advances.

Looking ahead, the market is expected to enter navy blue wave 2, which is projected to be a corrective phase once orange wave 5 concludes. This Elliott Wave setup provides insights into the pair's position in its longer-term bullish cycle and highlights potential reversal areas. It suggests limited remaining upside before completing the current five-wave structure, followed by the likelihood of a broader correction.

Market participants are advised to monitor closely for signs that wave 5 has concluded and to stay vigilant about the invalidation level, which may necessitate updates to the current outlook.

Euro/ U.S. Dollar (EURUSD) – 4 Hour Chart

EURUSD Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 5

POSITION: Navy Blue Wave 1

DIRECTION NEXT HIGHER DEGREES: Orange Wave 5 (started)

DETAILS:

Orange wave 4 appears completed, and orange wave 5 is currently underway.

Wave Cancel Invalid Level: 1.01781

On the 4-hour chart, EURUSD shows a bullish trend, driven by a clearly defined impulsive wave structure. The analysis indicates that orange wave 5 is forming within the context of navy blue wave 1, following the completion of the corrective orange wave 4. This current wave movement marks the final leg in the ongoing bullish sequence, often preceding a potential correction or trend shift.

The chart analysis confirms that orange wave 4 has ended, and orange wave 5 is now advancing. A critical invalidation point is set at 1.01781; any drop below this level would nullify the bullish wave count, indicating either an early end to the upward move or the need for structural reassessment. With continued upward movement and impulsive momentum, buyers remain active, although signs of trend fatigue should be monitored as wave 5 nears its peak.

This technical framework gives traders a clear structure to evaluate exit strategies for long positions or prepare for potential reversals. The current setup implies only modest upside potential remains before the five-wave sequence concludes, possibly giving way to a broader correction. Traders are advised to watch for price divergences or reversal signals near resistance levels and keep a close eye on the invalidation point to adjust strategies accordingly.

Technical Analyst: Malik Awais

More By This Author:

Elliott Wave Technical Analysis: Chainlink Crypto Price News For Wednesday, May 14

Unlocking ASX Trading Success: Cochlear Limited - Tuesday, May 13

Elliott Wave Technical Analysis: Exxon Mobil Inc. - Tuesday, May 13

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more