Elliott Wave Technical Analysis: Euro/U.S. Dollar - Thursday, April 17

EURUSD Elliott Wave Analysis Trading Lounge

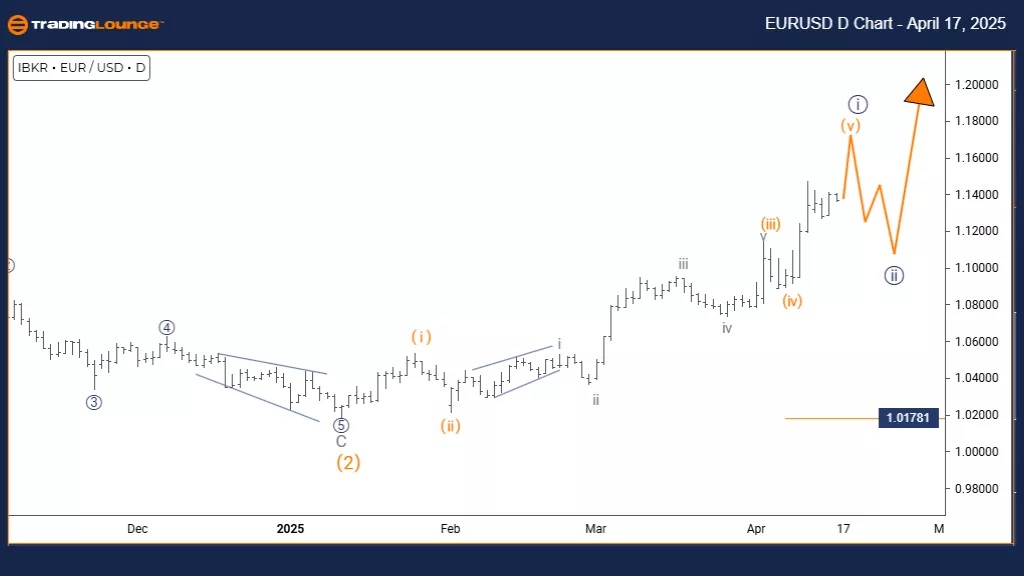

Euro/ U.S. Dollar (EURUSD) Day Chart

EURUSD Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 1

POSITION: Gray Wave 1

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 2

DETAILS: Navy Blue Wave 1 within Gray Wave 1 remains active and is nearing completion.

Wave Cancel Invalid Level: 1.01781

The EURUSD daily chart indicates a developing bullish trend structured within an impulsive Elliott Wave format. The current progression is in navy blue wave 1 of the larger gray wave 1, marking the early phase of a potential multi-wave upward trend. This formation implies that the currency pair may be establishing the groundwork for a full five-wave impulse sequence in both the short and medium-term perspectives.

Navy blue wave 1 initiates this upward trend and typically sets the tone for price movement. Although not as forceful as later impulse waves, wave 1 is essential for establishing directional momentum. Current market action suggests wave 1 is close to completing, after which a pullback is expected. This scenario is common before the emergence of stronger price advances in wave 3.

The following stage is likely navy blue wave 2, which would act as a corrective phase after wave 1 concludes. This provides a pullback opportunity within the broader trend. The daily chart’s perspective highlights that the current structure could serve as the foundation for a more extended bullish sequence.

A key technical level to monitor is 1.01781. If the price falls below this point, it would invalidate the current wave count and necessitate a reassessment of the pattern. This level functions as a strong support line, anchoring the structure of the bullish trend.

Traders should observe the final moments of wave 1 for traditional signs of completion. Afterward, attention shifts to the potential setup of wave 2 and subsequent entry opportunities. Wave 3 often exhibits greater momentum and stronger price movement. Confirmation from indicators and price action will be critical as the structure transitions into the corrective phase.

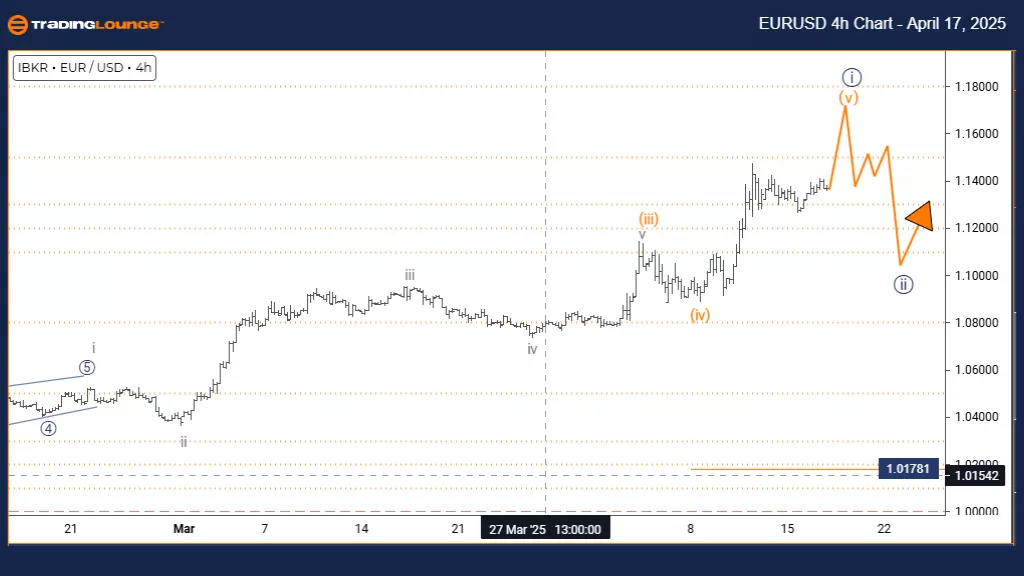

Euro/ U.S. Dollar (EURUSD) 4 Hour Chart

EURUSD Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 5

POSITION: Navy Blue Wave 1

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 2

DETAILS: Orange Wave 4 appears completed. Orange Wave 5 is now active.

Wave Cancel Invalid Level: 1.01781

The EURUSD 4-hour chart reveals a bullish trend developing through an impulsive Elliott Wave pattern. Orange wave 4 has likely ended, and the market is now advancing into orange wave 5, all within the broader framework of navy blue wave 1. This marks the final upward movement of the current short-term bullish sequence before a potential broader correction emerges.

Orange wave 5 typically serves as the last stage of an impulsive rally. It may demonstrate either strong continuation or diminishing momentum. The completion of wave 4 has opened the door for this final push, which could retest or slightly exceed recent highs before the overall pattern completes. Current structure indicates the end of the fifth wave might be approaching.

The expected next phase is navy blue wave 2 after orange wave 5 concludes. This wave is corrective by nature and could offer a pullback within the larger bullish structure. It's crucial to monitor the 1.01781 level as the invalidation threshold. A move below this level would disqualify the current wave count and necessitate a reevaluation.

Traders should watch for traditional signs of wave 5 completion, such as bearish divergence on momentum indicators or reversal price patterns. The 4-hour chart provides vital insights, indicating a likely approach toward the end of the upward movement. While some extensions in wave 5 are possible, the focus should be on identifying exhaustion signals.

As the wave sequence shifts from completion to correction, traders should prepare for the transition into wave 2. Technical indicators and market structure will guide this analysis. Remaining attentive to the invalidation level helps safeguard against misinterpretation, ensuring the strategy stays aligned with market behavior.

Technical Analyst: Malik Awais

More By This Author:

Elliott Wave Technical Analysis: Ethereum Crypto Price News For Thursday, April 17

Elliott Wave Technical Forecast: Newmont Corporation - Wednesday, April 16

Elliott Wave Technical Analysis: Palo Alto Networks Inc. - Wednesday, April 16

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more