Elliott Wave Technical Analysis Day Chart: British Pound/Australian Dollar

Image Source: Pixabay

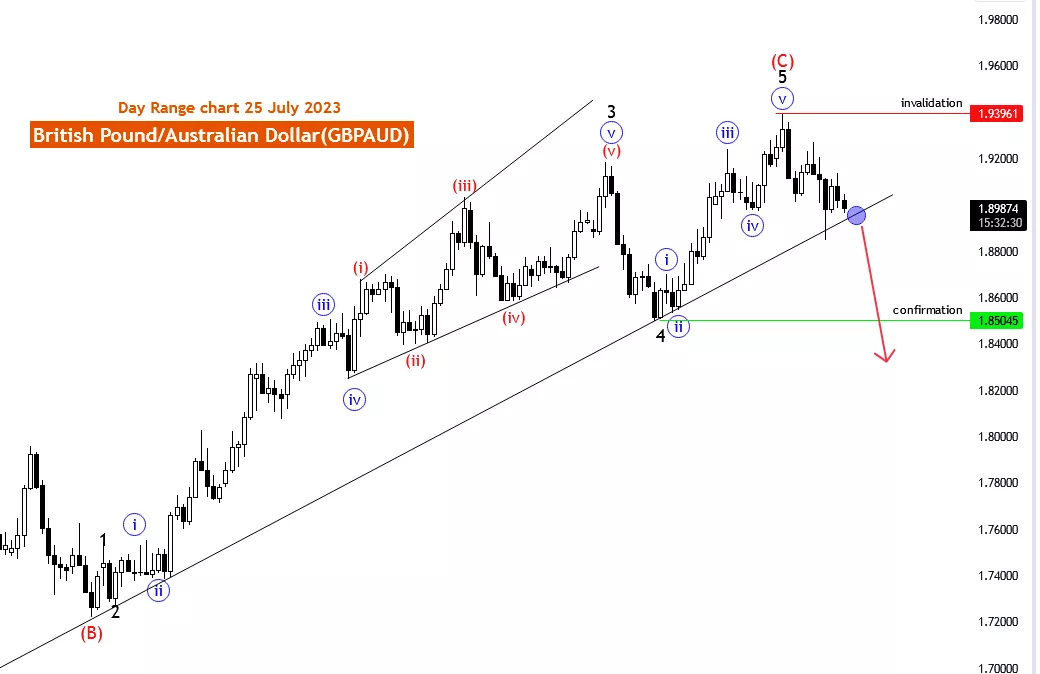

GBPAUD Elliott Wave Analysis Trading Lounge Day Chart, 25 July 2023.

British Pound/Australian Dollar (GBPAUD) Day Chart

GBPAUD Elliott Wave Technical Analysis

Function: Trend(new)

Mode: impulsive

Structure: New motive 1

Position: New Motive Wave 1

Direction Next Lower Degrees: Subwave wave (1 of 1) of Motive go more down After confirmation

Details: Confirmation level for new downward trend at 1.85045. Now market trying to break trendline. Wave Cancel invalid level: 1.93961

On 25th July 23, the day chart of the British Pound/Australian Dollar (GBPAUD) pair is analyzed using Elliott Wave theory, indicating a trending market with a new impulsive mode. The function of the price movement is identified as a trend, while the mode is characterized as impulsive.

The current structure is recognized as a New Motive 1, with the position of the price wave designated as a New Motive Wave 1. The projected direction for the next lower degrees is Subwave wave (1 of 1) of a larger Motive wave pattern.

The analysis provides further details, suggesting that a confirmation level for the new downward trend is set at 1.85045. The market is currently attempting to break the trendline in order to validate the new impulsive downward movement.

It is essential to note that the wave count provided will lose its validity if the GBPAUD price exceeds the level of 1.93961.

As of the specified date, 25th July 23, traders in the GBPAUD market should closely observe the impulsive trending movement and wait for confirmation of the new downward trend. Impulsive waves often provide significant directional momentum, making them favorable for trend-following strategies.

The analysis also suggests that after the confirmation of the new downward trend, the market could experience further downside movement in Subwave wave (1 of 1) of the larger Motive wave pattern. This implies the potential for extended bearish movement in the GBPAUD market.

While Elliott Wave analysis offers valuable insights into potential market patterns and price movements, traders should complement it with other technical indicators and fundamental factors to form a comprehensive trading strategy. Economic data releases, geopolitical events, and shifts in market sentiment can significantly impact currency pairs like GBPAUD, making it crucial for traders to stay informed and adaptive to changing market conditions.

(Click on image to enlarge)

More By This Author:

Global Major Indices: Elliott Wave Analysis And Long Trades

Elliott Wave Technical Analysis Day Chart: U.S. Dollar/Japanese Yen

Elliott Wave Technical Analysis 4 Hour Chart: U.S. Dollar/Canadian Dollar

Analyst Peter Mathers TradingLounge™ Australian Financial Services Licence - AFSL 317817