Elliott Wave Intraday Analysis: USDCHF Is Slowing Down

Today we will talk about the USDCHF pair. We will show you price action from a technical point of view and wave structure from an Elliott wave perspective.

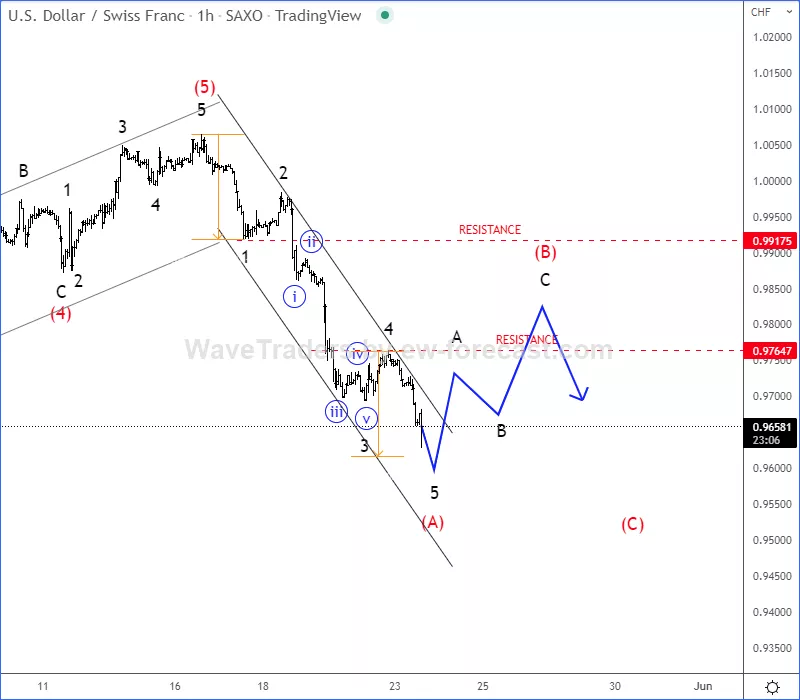

USDCHF came higher very aggressively back in April and at the start of May, but after the recent slowdown for the US dollar, we can see USD is the weakest against CHF currency. So, the USDCHF pair can be now trading in an Elliott wave (A)-(B)-(C) corrective decline.

In Elliott waves, we always have to expect corrections to be made by three waves A-B-C, especially if we get a five-wave impulse in the first leg A.

With the current sharp and impulsive decline, USDCHF can be now finishing an Elliott wave five-wave cycle within first leg (A). So, bounce and Elliott wave three-wave A-B-C corrective recovery in wave (B) can be around the corner before we will see another decline for wave (C). Resistance can be anywhere between 0.98 – 0.99 area.

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All of our work is for educational purposes only.