DXY Price Analysis: Correction Supported By 93.19 Ahead Of FOMC

The DXY price analysis is bullish despite a minor correction. The index plunges at the time of writing after failing to close above the 93.43 static resistance. Technically, the index was somehow expected to drop after registering an amazing rally. Still, the current retreat could only be temporary before resuming its rise.

The Dollar Index has accelerated its upside in the short term after the United States retail sales data came better than expected. Personally, I’m waiting for a temporary decline as this could bring new long opportunities in USD. Today, the NAHB Housing Market Index increased from 75 points to 76 points exceeding 74 points expected.

Tomorrow, the US is to release the Housing Starts, Current Account, and the Building Permits. First, though, the traders may wait for the FOMC, which will take place on Wednesday. The Federal Reserve is expected to keep its monetary policy unchanged also after a drop in inflation growth. The FOMC Statement, FOMC Economic Projections, and the FOMC Press Conference could really shake the markets and change the sentiment. The FOMC is seen as a high-impact event. The volatility will be huge these days.

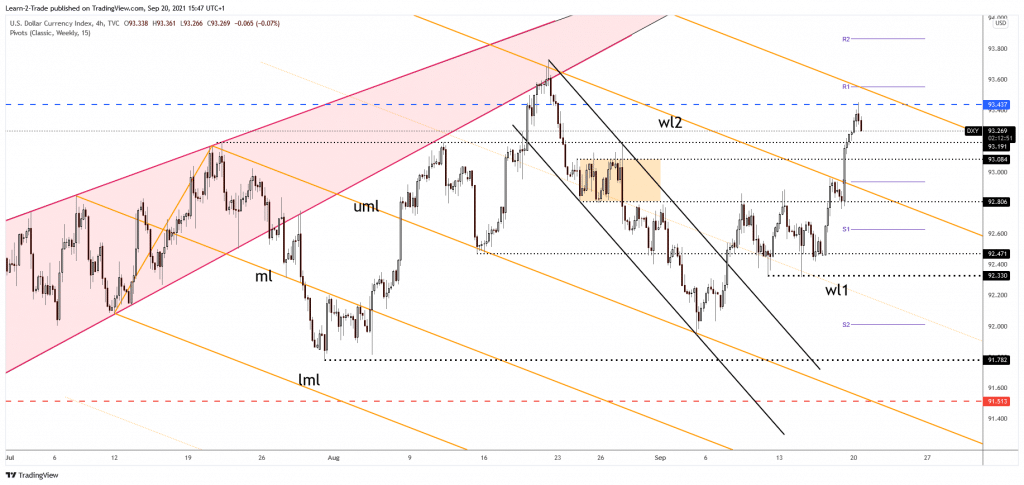

DXY Price technical analysis: False breakout

DXY 4-hour chart analysis

As you can see on the 4-hour chart, DXY ignored the 93.19 static resistance and climbed near the 93.45 level. Now is located at 93.25, and it may hit and retest the 93.19 former resistance. Technically, it could only test and retest the immediate support levels before jumping higher. 93.08 level is seen as support as well. A new leg higher after ending its current retreat could help us catch new longs in the USD. As you already know, the US Dollar appreciates versus its rivals when the index grows.

The Greenback drops versus the other major currencies as long as the index drops. From the technical point of view, DXY’s failure to approach and reach the weekly R1 (93.55) may signal a potential decline even towards the weekly pivot point of 92.93.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more