Dollar Rally: Is It Ready To Rumble?

Image Source: Pexels

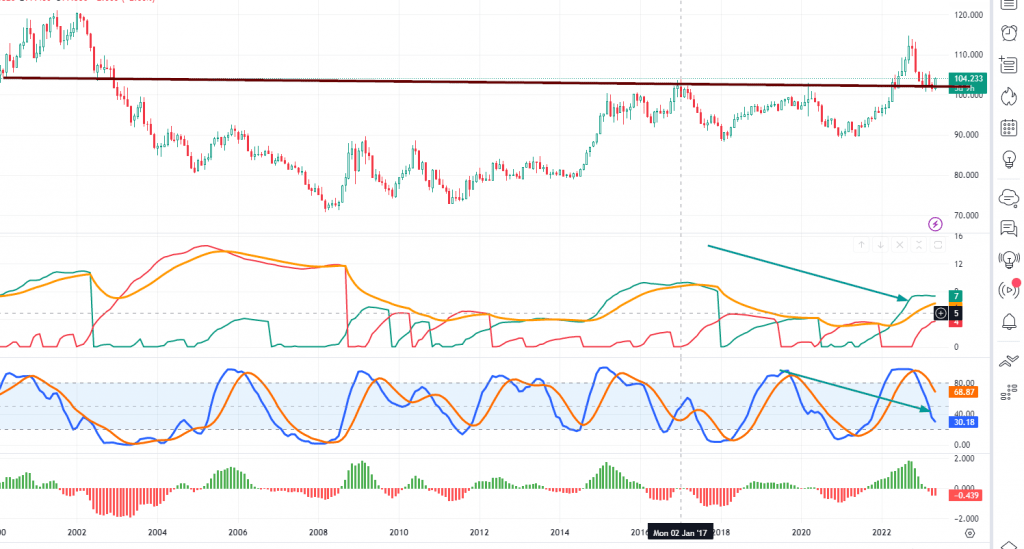

The weekly chart (below) shows a positive divergence signal triggered by the Dollar. It traded below its Jan 2023 lows, but the MACDs put in a higher low. There appears to be a triple bottom formation in the Dollar and double bottom in the MACDs.

(Click on image to enlarge)

This indicates a potential reversal in the Dollar’s trend, which could affect the broader market. A stronger dollar is generally not good for the markets over the short-term timelines, especially for overextended stocks pushed higher by a frenzied crowd infatuated with AI but does not understand anything about it other than the word itself.

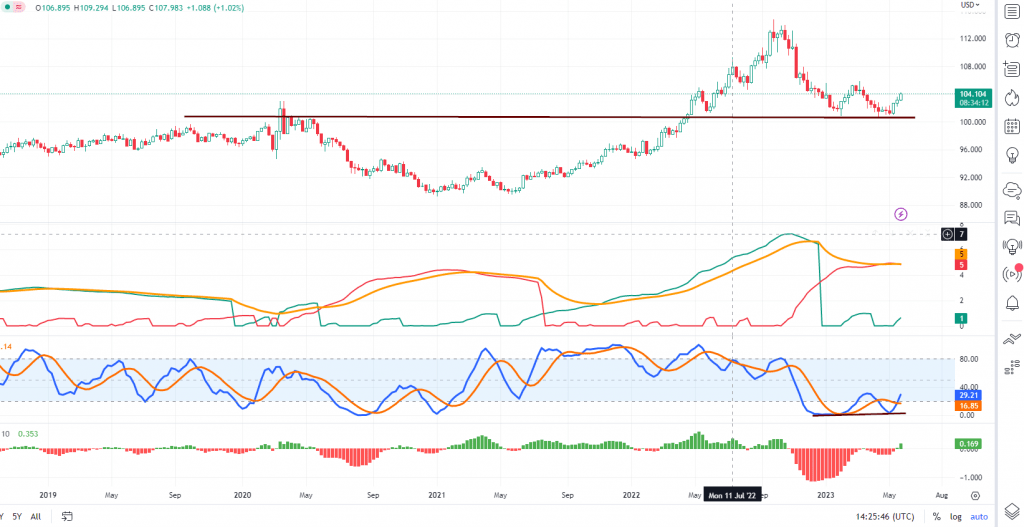

The monthly chart of the dollar

(Click on image to enlarge)

The monthly chart reveals an intriguing outlook. The MACDs are trading in the oversold range and could dip into the highly oversold zone. What’s noteworthy is that this shouldn’t have happened. Typically, the MACDs should have undergone a slight pullback. The Dollar should have rallied, triggering a negative divergence signal (a higher high in the Dollar followed by a lower high in technical indicators like MACDs) and subsequently entering a multi-year correction. However, the Dollar’s behavior indicates that the next rally phase could last longer than initially projected.

Suppose the Dollar can close above 105.50 on a monthly basis, and the MACDs experience a bullish crossover. In that case, the odds of the Dollar testing 120 would rise significantly. Despite the world’s talk of the Dollar’s demise, this potential reversal could surprise many. The last component, mass psychology, is the most important. If the masses and the world at large believe the Dollar is doomed, then the opposite will come to pass. Massive change often occurs when no one expects it. Similar to the unexpected debut of ChatGPT, a significant reversal in the Dollar would come as a surprise to everyone.

However, we discussed this massive AI trend years before it started, and what we see now is that companies only need to mention the word AI and the stock jumps. Marvel is a perfect example of this phenomenon, and when they highlighted their focus on AI, the stock soared. This is a classic example of FOMO (fear of missing out).

The Dollar has experienced a noteworthy multi-year rally, but what we have observed so far is just a pop. To indeed confirm a significant reversal, we need a big bang.

More By This Author:

Netflix Saw As Much As 100,000 Daily Sign-Ups Post Password-Sharing BanUnlocking Growth Investing: Accelerate Your Wealth Potential

Unraveling Market Psychology: Impact On Trading Decisions