Dollar Momentum Slows As Markets React To Fresh Tariff Headlines

Photo by Niconor Brown on Unsplash

We saw a shakeout in the markets at the start of the week following renewed tariff measures announced by the Trump administration, which weighed on risk sentiment. As a result, metals are trading higher, supported by increased demand for safe havens, while equities and the US dollar remain under pressure.

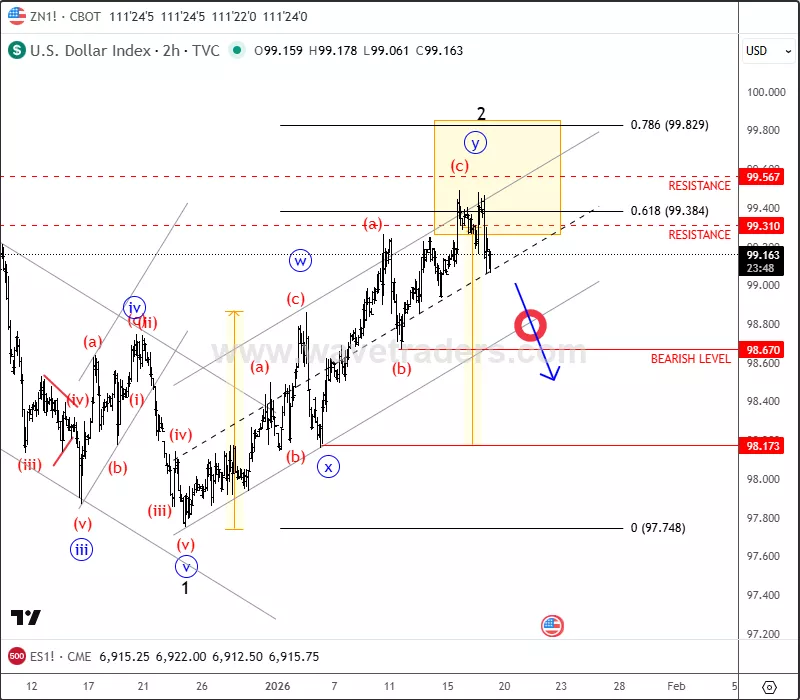

Stocks and the US dollar have continued to move with a positive correlation, but this relationship looks increasingly stretched, suggesting that one of them may soon give way. The US dollar is already showing early signs of fatigue, with the Dollar Index (DXY) attempting to turn lower from the resistance area highlighted last week. This increases the probability of further downside, particularly if equities manage to stabilize after the gap lower seen at the beginning of the week.

DXY 2H Chart

That said, with US markets observing a holiday today, liquidity is likely to be thinner than usual, which may limit follow-through and keep price action muted. Patience is required, as more meaningful moves may only develop once full participation returns tomorrow.

On the macro front, Canada’s CPI is scheduled for release today and could inject volatility into USDCAD. However, after the pair’s recent sharp and impulsive rebound, some consolidation or a slowdown in momentum would not be surprising, even in the presence of a data-driven move.

For a detailed view and more analysis like this, you may want to join our live webinar today on Monday January 19 @ 15.00CET: DIRECT LINK

More By This Author:

Zcash: Triangle Consolidation Points To Wave 5 Breakout Toward 2018 Highs

TRON Shows Bullish Recovery As Wave 5 Targets New Highs

Adobe: Bearish Structure Signals Final Leg Lower