Dollar Index Elliott Wave: Forecasting The Decline

Image Source: Pixabay

In this technical article we’re going to look at the Elliott Wave charts of Dollar index DXY. US Dollar has recently given us Double Three pull back and found sellers again precisely at the equal legs area as we expected. In this discussion, we’ll break down the Elliott Wave pattern and forecast.

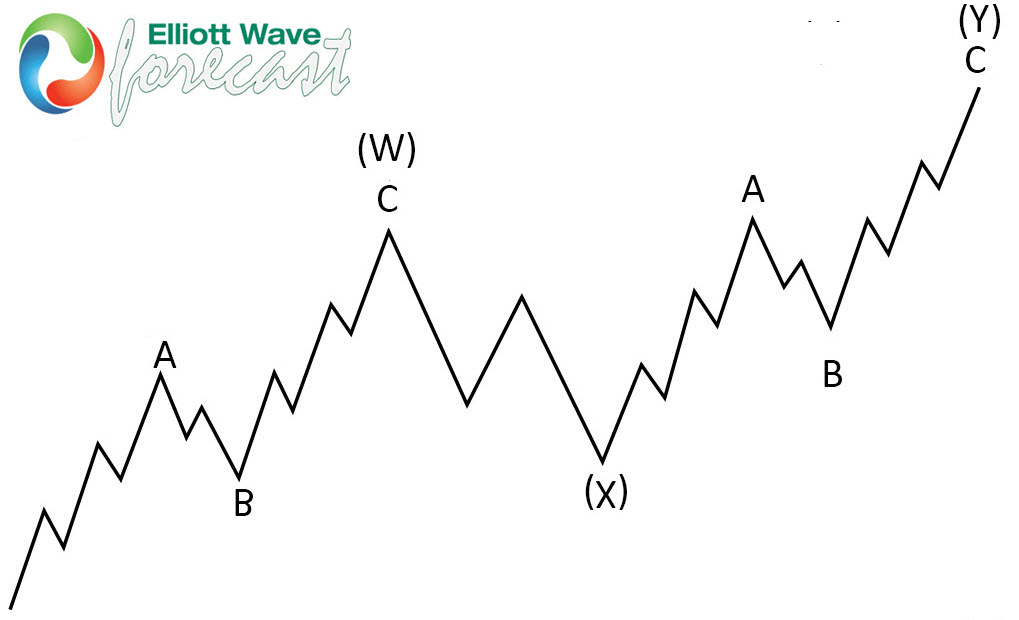

Elliott Wave Double Three Pattern

Double three is the common pattern in the market , also known as 7 swing structure. It’s a reliable pattern which is giving us good trading entries with clearly defined invalidation levels.

The picture below presents what Elliott Wave Double Three pattern looks like. It has (W),(X),(Y) labeling and 3,3,3 inner structure, which means all of these 3 legs are corrective sequences. Each (W) and (Y) are made of 3 swings , they’re having A,B,C structure in lower degree, or alternatively they can have W,X,Y labeling.

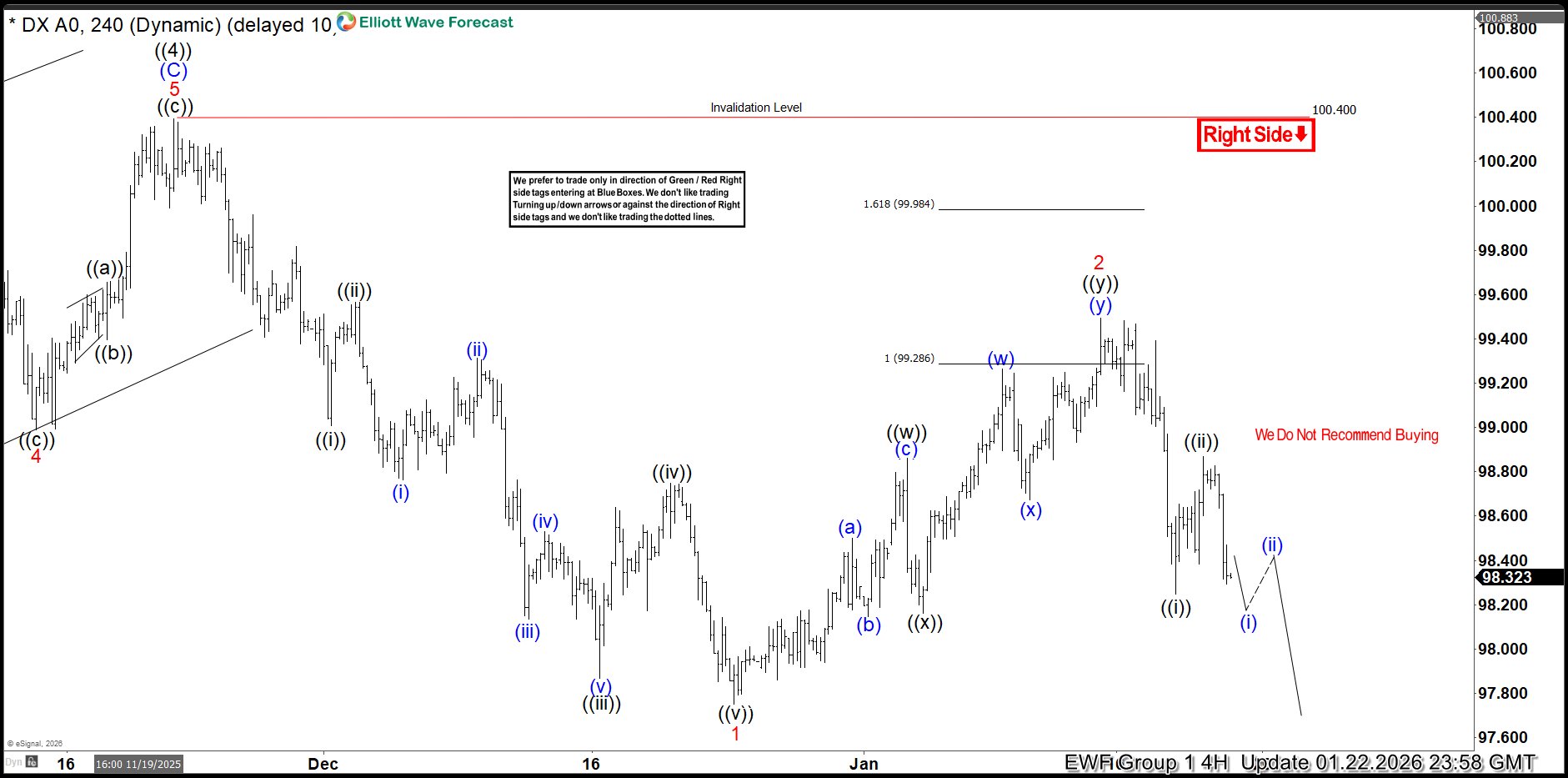

DXY Elliott Wave 4 Hour Chart 01.12.2026

DXY is forming a Double Three pattern. As our members know, we identify potential reversal zones using the Equal Legs technique — in this case, the sellers’ area lies at 99.286–99.984. The correction looks incomplete at the moment. We expect the Dollar to make another wave up to complete a 7-swing pattern. As long as the price stays within this region, we expect sellers to take control and push it down toward new lows. We recommend that members avoid buying the Dollar at this stage, while favoring the short side.

DXY Elliott Wave 4 Hour Chart 01.12.2026

The Dollar found sellers at the marked Equal Legs zone, as expected. DXY made a sharp drop from the sellers’ zone. The recovery peaked at 99.492. As long as it remains below that high, the next leg down should be in progress toward new lows. We expect to see break of December 23rd low in upcoming days.

Remember, the market is dynamic, and the presented view may have changed in the meantime. For the most recent charts and target levels, please refer to the membership area of the site. The best instruments to trade are those with incomplete bullish or bearish swing sequences.

More By This Author:

Silver Elliott Wave: Strong Impulsive Rally UnfoldingElliott Wave View: Light Crude Oil Looking For Larger Degree Correction

Elliott Wave Outlook: Dow Futures Correcting Cycle From Nov 2025

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more