Daily Market Outlook - Wednesday, Nov. 20

Image Source: Pixabay

On Tuesday, global markets were roiled by geopolitical tensions; however, the situation stabilised as the U.S. trading session progressed, resulting in a more optimistic atmosphere in Asia on Wednesday. Although tensions between the United States and Russia regarding Ukraine continue to be a source of concern, the global landscape appears to be relatively positive. This evening, Nvidia's earnings announcement is eager;y anticipated by investors. Markets predict that Nvidia, the world's largest company, will report robust financial results, with a projected 82.8% increase in revenue from the previous year. Expectations are high as the company's shares have already surged 5% overnight. Trading in options suggests a potential swing of nearly $300 billion in market value, which could lead to a potentially chaotic trading session ahead. Bitcoin surpassed $94,000 for the first time, driven by expectations that the incoming U.S. President-elect Donald Trump's administration will be favourable towards cryptocurrencies. Trump is yet to announce his choice for Treasury secretary, but the announcement could come as early as Wednesday.

In the UK October CPI inflation rate of 2.3% y/y was 0.1% higher than the market and BoE's 2.2% forecast. Core CPI climbed to 3.3% y/y from 3.2%, below the consensus expectation of 3.1%, although services CPI grew to 5.0%, matching the BoE staff forecast from the November MPR. This CPI report's major indicators somewhat exceeded forecasts. The well-flagged quarterly reset of the OFGEM energy price cap concentrated energy price impacts on the headline rate.Flights and used automobiles were the second largest contributor to the annual rate, according to the ONS. This shows that some core-level news is due to volatile items, which the BoE filters out, especially services. An already unlikely December rate decrease seems even less likely given today's inflation data.

Ahead of the Nvidia earnings event, there are several Federal Reserve officials scheduled to speak later, as well as European Central Bank President Christine Lagarde, all of whom are worth monitoring to see how interest rates in Europe and the U.S. may continue to diverge.

Overnight Newswire Updates of Note

- UK Oct CPI Rise Likely To Keep MPC On Gradual Easing Path

- Citadel Securities Aims As Big Player In Eurozone Bond Trading

- China Leaves Benchmark LPRs Unchanged, As Expected

- Chinese Ship Spotted Where Baltic Sea Cables Were Cut

- US Commission: Strip China's Privileges, Let Trump Impose Tariffs

- Japan PM Ishiba Hopes To Work With Trump, Not Confront Him

- Japan’s Exports Grow Amid Global Risks, Supporting Recovery

- Aussie Budget Faces Smaller Revenue Gains, Less Corporate Tax

- Fed's Schmid: Uncertain How Far Interest Rates Can Fall

- Hurricanes, Boeing Strike Likely Cut At Least 100K Jobs, US Oct Payrolls

- Options Pricing Shows “Nvidia Earnings Outweigh Fed, Jobs Data”

- US-Russia Fright Fades, Nvidia Vigil Almost Over

- France’s Macron Urges Putin To ‘Be Reasonable’ On Nuclear Weapons

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0500 (1BLN), 1.0525-30 (821M), 1.0540-50 (2.4BLN)

- 1.0585 (814M), 1.0620-25 (2BLN), 1.0640-50 (925M)

- GBP/USD: 1.2575 (350M), 1.2775 (400M), 1.2850-60 (300M)

- AUD/USD: 0.6450-55 (568M)

- NZD/USD: 0.5850 (250M), 0.5945-50 (505M)

- USD/CAD: 1.3860 (1BLN), 1.4000 (616M)

- USD/JPY:154.00 (330M), 154.75-82 (1BLN), 155.00 (1BLN), 156.00 (1BLN)

CFTC Data As Of 15/11/24

- Bitcoin net short position is -1,798 contracts

- Swiss franc posts net short position of -32,694 contracts

- British pound net long position is 56,050 contracts

- Euro net short position is -7,437 contracts

- Japanese yen net short position is -64,902 contracts

- Equity fund managers raise S&P 500 CME net long position by 86,527 contracts to 1,079,480

- Equity fund speculators increase S&P 500 CME net short position by 94,124 contracts to 288,809

- Speculators trim CBOT US 2-year Treasury futures net short position by 62,488 contracts to 1,423,871

- Speculators trim CBOT US 10-year Treasury futures net short position by 2,469 contracts to 815,801

Technical & Trade Views

SP500 Bullish Above Bearish Below 5960

- Daily VWAP bearish

- Weekly VWAP bullish

- Below 5790 opens 5700

- Primary support 5795

- Primary objective 6100

(Click on image to enlarge)

EURUSD Bullish Above Bearish Below 1.0650

- Daily VWAP bullish

- Weekly VWAP bearish

- Above 1.07 opens 1.08

- Primary resistance 1.0950

- Primary objective 1.0380

(Click on image to enlarge)

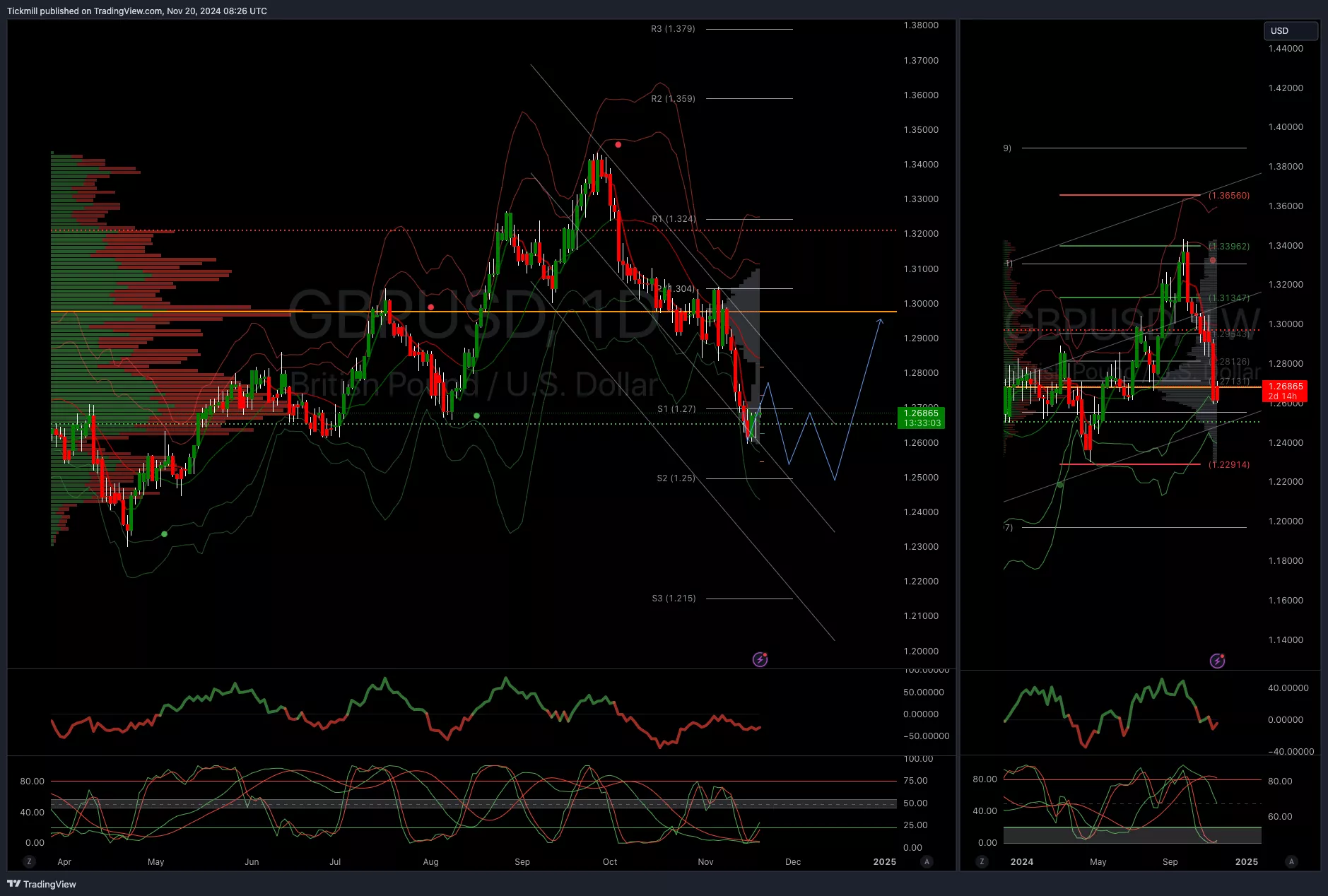

GBPUSD Bullish Above Bearish Below 1.2750

- Daily VWAP bullish

- Weekly VWAP bearish

- Above 1.28 opens 1.30

- Primary resistance 1.3050

- Primary objective 1.25

(Click on image to enlarge)

USDJPY Bullish Above Bearish Below 154

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 154 opens 152

- Primary support 148

- Primary objective is 157.50

(Click on image to enlarge)

XAUUSD Bullish Above Bearish Below 2600

- Daily VWAP bullish

- Weekly VWAP bearish

- Below 2590 opens 2530

- Primary support 2530

- Primary objective is 2800

(Click on image to enlarge)

.webp)

BTCUSD Bullish Above Bearish Below 85000

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 84000 opens 80000

- Primary support is 64000

- Primary objective is 100,000

(Click on image to enlarge)

.webp)

More By This Author:

FTSE Softens As Geopolitical Tensions Soar

DXY, EURUSD & GBPUSD Structural & Seasonal Trade Setups

Daily Market Outlook - Tuesday, Nov. 19