Daily Market Outlook - Wednesday, July 24

Image Source: Pexels

On Wednesday, most Asian stock markets are experiencing a decline, influenced by the negative performance of Wall Street. Traders are feeling uncertain about the market's future due to recent fluctuations and are hesitant to make big decisions before the release of important US GDP and inflation data later in the week. The Japanese stock market is showing a slight decline after a small increase in the previous session. This comes after Wall Street displayed negative trends. The Nikkei 225 is dropping below the 39,500 level as traders respond to recent business activity data. While some index heavyweights and financial stocks are weak, there are gains in technology stocks.

Luxury conglomerate LVMH's sales fell short due to restrained spending by Chinese consumers, while major U.S. tech companies Tesla and Alphabet also reported disappointing results. This is expected to make investors cautious as they await a wave of European earnings. European banks will be in the spotlight on Wednesday, with attention on whether the benefits of higher interest rates have plateaued and if recent political turmoil is affecting market sentiment. Spain's Santander, France's BNP Paribas, Germany's Deutsche Bank, and Italy's UniCredit are set to report their earnings for the April to June period, with Deutsche Bank the standout disappointment so far, with shares getting slashed in early trade. Following LVMH's announcement of a 14% sales decline in Asia (excluding Japan) in the second quarter, luxury stocks in Europe are likely to suffer. The top 10 European luxury stocks have already dropped by 2.6% in July, marking a fifth consecutive month of decline after a profit warning from Burberry last week. The technology sub-index in Europe, which has been volatile due to concerns about trade tensions impacting chip manufacturers, is expected to face pressure following Tesla's report of its smallest profit margin in over five years.

The UK's composite PMI decreased for the second month in a row in June, settling at 52.3, but still indicating some level of growth. Markets are forecasting an increase to 53.0 in July, driven by improvements in both the manufacturing and services sectors. With the election uncertainty resolved, some of the decision-making delays reported previously may now be resolving. Services PMI is expected to rise to 52.8 from 52.1, and manufacturing PMI to 51.6 from 50.9, marking a two-year high for manufacturing. However, this positive outlook may be deceptive. Anticipated impacts from shipping delays could lead to longer delivery times, artificially boosting the headline manufacturing PMI due to supply-side constraints rather than reflecting stronger demand. In the euro area, flash PMIs are likely to show a continued divergence with a contracting manufacturing sector and an expanding services sector.

Overnight Newswire Updates of Note

- Keir Starmer Suspends MPs After Rebellion

- Latest PMIs Review For Australia and Japan

- Trump Files Complaint - Biden Giving Harris $96 Mln

- US To Launch Arctic Defense Eyeing Russia, China

- Tensions Between Bibi Netanyahu And Kamala Harris

- China's Desire For Growth And Economic Road Map

- Japan, Britain, Italy Pursue Fighter Jet Co-Development

- Japan Protests Russia's Entry Prevention Of 13 Nationals

- Bitcoin Conference, Trump & Harris As Speakers

- Sanctions On Russian Oil May Cause Fuel Exports Cuts

- XAU Gains Amid Risk-off Mood, Fed Rate Cut Bets

- Alphabet Revenue Shows No Sign Of AI Denting Business

- Tesla Misses Profit Estimates, Delayed ‘Robotaxi’ Launch

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0825-30 (470M), 1.0850-55 (457M), 1.0900 (574M)

- 1.0920-25 (491M), 1.0950 (1BLN), 1.0990-1.1000 (4.2BLN))

- USD/CHF: 0.8900 (220M), 0.8925-30 (439M)

- EUR/CHF: 0.9600 (201M), 0.9725 (200M). EUR/GBP: 0.8400 (530M)

- GBP/USD: 1.2885 (250M), 1.2925 (261M), 1.2950 (453M)

- USD/CAD: 1.3750 (532M), 1.3800 (464M)

- AUD/USD: 0.6600 (1.7BLN), 0.6660-70 (905M), 0.6720 (1.1BLN)

- USD/JPY: 154.95-155.00 (2.8BLN), 155.50 (825M), 156.00-05 (2.5BLN)

- AUD/JPY: 105.00 (600M)

CFTC Data As Of 16/7/24

- Equity fund managers raise S&P 500 CME net long position by 19,908 contracts to 997,340

- Equity fund speculators increase S&P 500 CME net short position by 28,517 contracts to 370,142

- Japanese yen net short position is 151,072 contracts

- British pound net long position is 132,902 contracts

- Euro net long position is 24,749 contracts

- Swiss franc posts net short position of -49,793 contracts

- Bitcoin net short position is -579 contracts

Technical & Trade Views

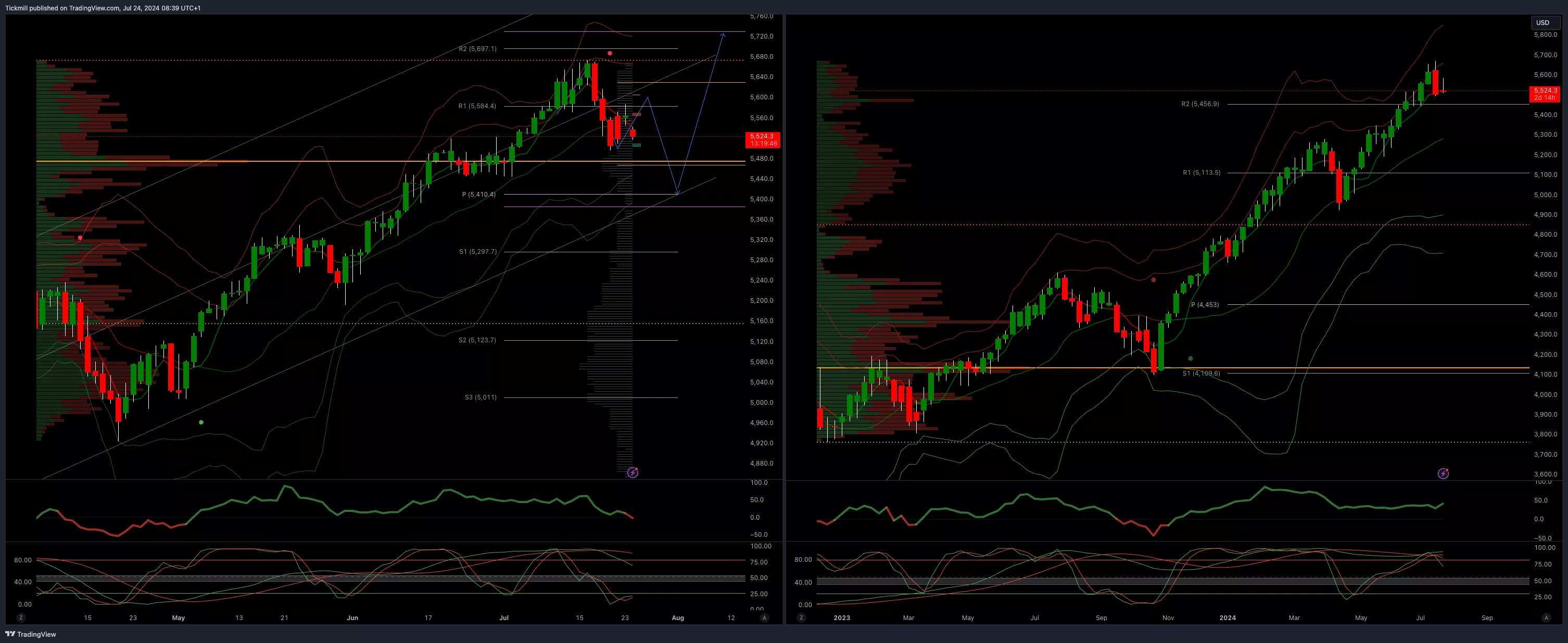

SP500 Bullish Above Bearish Below 5480

- Daily VWAP bearish

- Weekly VWAP bearish

- Below 5475 opens 5450

- Primary support 5400

- Primary objective is 5700

(Click on image to enlarge)

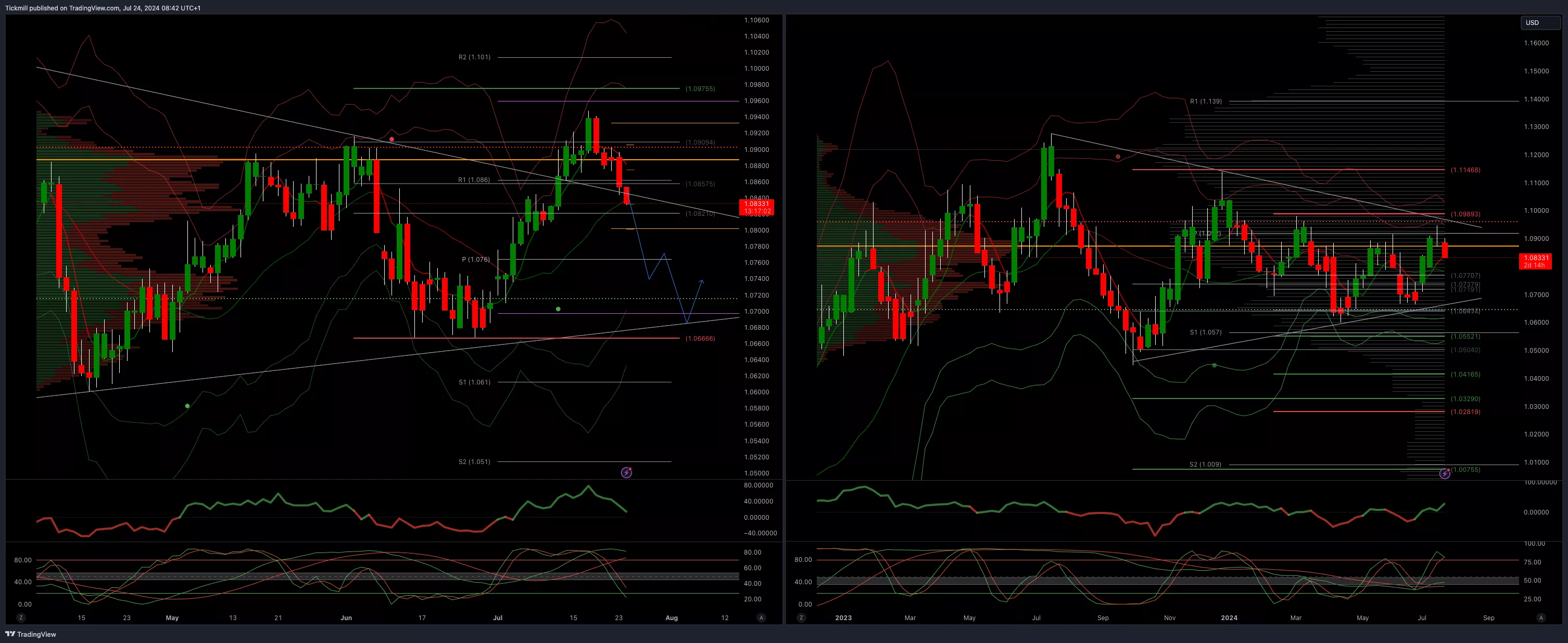

EURUSD Bullish Above Bearish Below 1.09

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 1.880 opens 1.0940

- Primary resistance 1.0981

- Primary objective is 1.07

(Click on image to enlarge)

GBPUSD Bullish Above Bearish Below 1.29

- Daily VWAP bearish

- Weekly VWAP bullish

- Below 1.2670 opens 1.2450

- Primary support is 1.2690

- Primary objective 1.3137/60

(Click on image to enlarge)

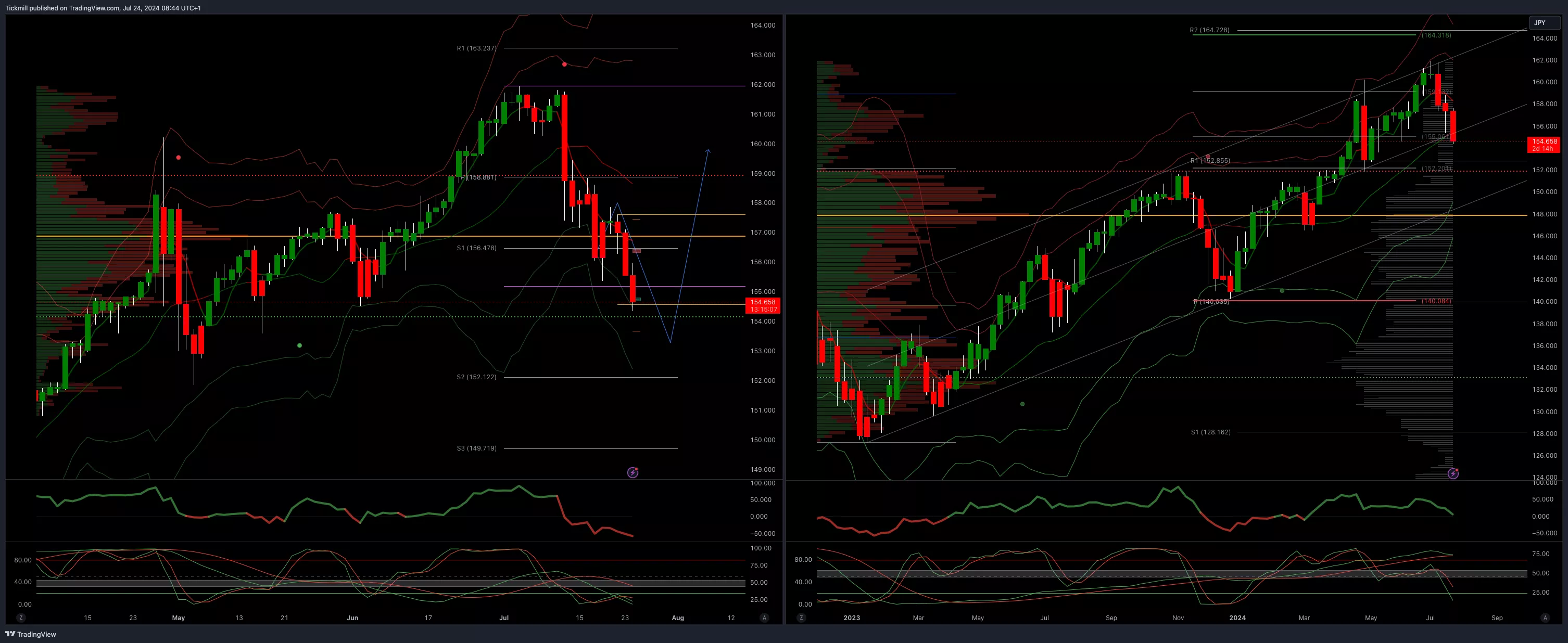

USDJPY Bullish Above Bearish Below 156

- Daily VWAP bearish

- Weekly VWAP bearish

- Below 156 opens 153

- Primary support 152

- Primary objective is 164

(Click on image to enlarge)

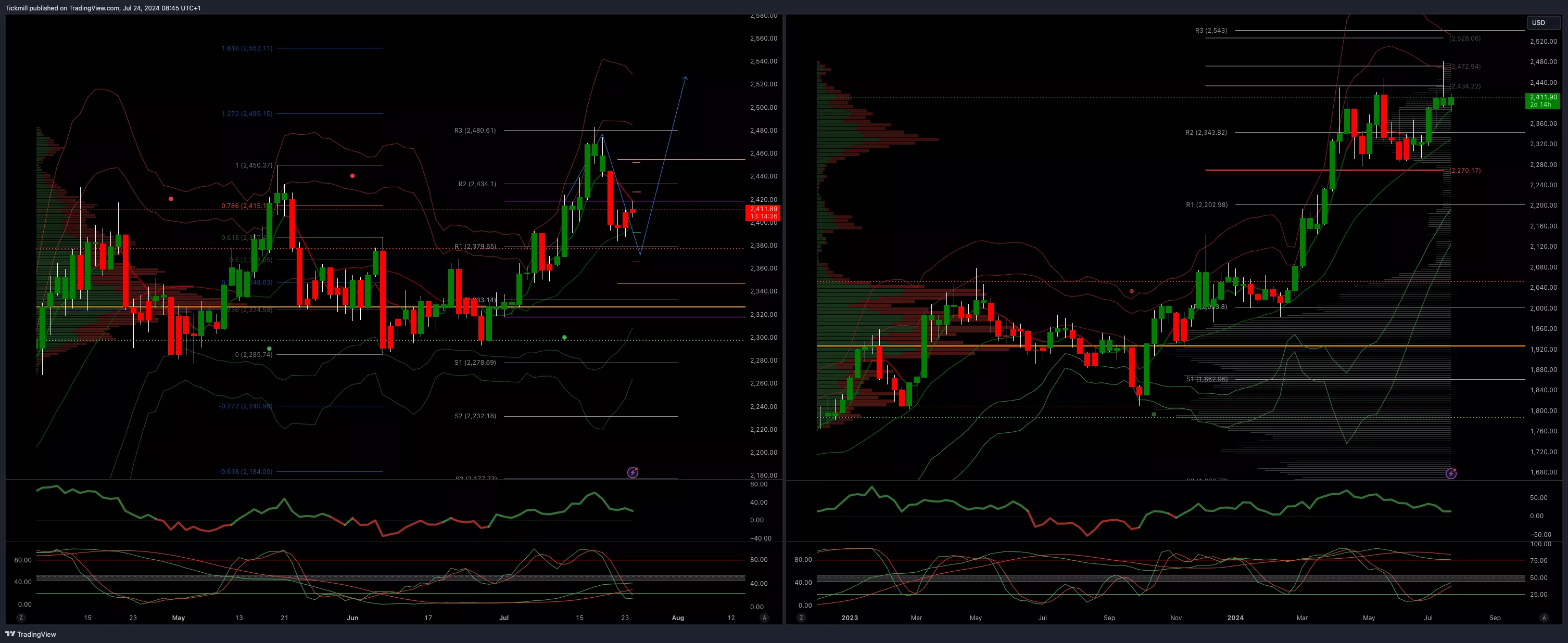

XAUUSD Bullish Above Bearish Below 2345

- Daily VWAP bearish

- Weekly VWAP bullish

- Below 2400 opens 2330

- Primary support 2300

- Primary objective is 2598

(Click on image to enlarge)

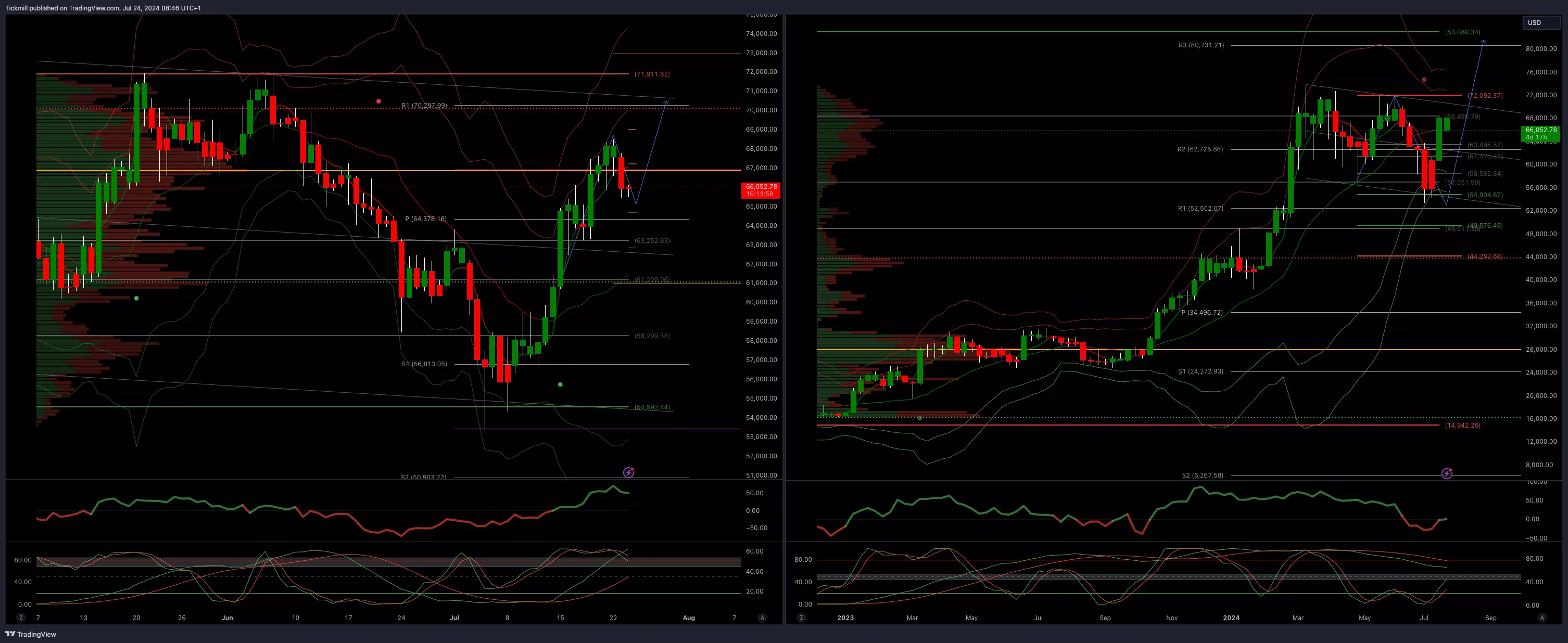

BTCUSD Bullish Above Bearish below 62000

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 67000 opens 70000

- Primary support is 50000

- Primary objective is 70000

(Click on image to enlarge)

More By This Author:

FTSE Reverses Lower As Copper’s Decline Weights On The Miners

SP500 Daily Trade Plan - Tuesday, July 23

Daily Market Outlook - Tuesday, July 23