Daily Market Outlook - Wednesday, Feb. 4

Image Source: Unsplash

Software stocks across Asia, from India to Japan, took a hit as concerns mounted over how advancements in artificial intelligence could disrupt traditional business models, echoing the declines seen in their U.S. counterparts. In India, tech giant Tata Consultancy Services saw its shares tumble by 6%, while Infosys experienced a drop of over 5%. Meanwhile, Australia's cloud-based accounting software company Xero suffered a sharp decline of more than 15%, and Japan's Nomura Research Institute slid by 8%. On a different note, oil prices climbed after the U.S. Navy intercepted and shot down an Iranian drone near an aircraft carrier in the Arabian Sea. The Japanese Yen weakened as markets prepared for the upcoming national election, while gold prices surged above $5,000 per ounce, driven by dip buying. European stock futures also saw slight declines. The slump in Asian software stocks was somewhat balanced by gains in traditional sectors like finance and manufacturing, which are anticipated to benefit as investors shift their focus away from technology. The MSCI Asia Pacific Index remained relatively steady. Oil prices continued their upward trend for a second consecutive day, fuelled by heightened geopolitical tensions following the downing of the Iranian drone. Brent crude reached approximately $68 per barrel, building on a 1.6% increase from the previous trading session.

Domestically, the December MPC minutes highlighted that the annual survey conducted by the BoE Regional Agents on pay settlements would serve as a crucial input for the February MPC round. At that time, early indications suggested that pay settlements for 2026 were likely to average 3.5%. While this figure is slightly lower than the 3.7% projected for 2025 during the same period last year, the minutes also noted that it is nearly half a percentage point below the figures reported for 2025. Firstly, while this reflects progress in moderating pay growth pressures contributing to inflation, it still leaves settlements above historical averages. Secondly, referencing Lombardelli’s speech from last year on target-consistent wage growth rates, pay settlements of around 3.5% remain higher than her preferred levels—particularly if optimistic productivity forecasts fail to materialise. Thirdly, the DMP survey, which has gained prominence compared to the Agents’ survey, indicates expected average earnings growth of 3.7% for the upcoming year. This suggests that the anticipated moderation in pay growth is likely to be modest and insufficient to satisfy the hawkish members of the MPC. Although the direction of pay settlement trends aligns with the MPC’s goals, the pace of change remains slow. This perspective on the February MPC/MPR suggests that while the rate-cutting cycle may continue, it is likely to proceed only to a limited extent and at a very gradual pace.

European markets aimed for a stable opening Wednesday after a sharp drop in software and data analytics stocks pulled the STOXX 600 index from record highs. Concerns over AI disruption weighed on the sector, though SAP shares rose 1% in early Frankfurt trading, hinting at a possible pause in the sell-off. Deutsche Bank, following a meeting with SAP CEO Christian Klein, remained cautiously optimistic about the company’s potential. Elsewhere, Novo Nordisk faced scrutiny in Copenhagen after its 2026 guidance led to a 15% drop in New York, halting its recovery from November lows. Mixed results emerged across sectors: UBS beat profit expectations, Equinor reported lower Q4 earnings, and GSK forecast slower sales growth. Euro STOXX 50 and FTSE futures showed slight gains of 0.1–0.3%, with Wall Street futures also edging higher.

Overnight Headlines

- EZ Inflation To Extend Drop Below ECB Target; Rate Holds Likely

- Fed Gov Miran Steps Down From White House CEA Role

- House Approves Measure To End Partial Government Shutdown

- China Services Gauge Expands At Faster Rate Despite Frail Demand

- New Zealand Unemployment Rate Highest In Over A Decade

- Gold Extends Rally, Jumps Over 2% As US-Iran Tensions Flare

- Oil Rises On Flareup In US-Iran Tensions And Drop In Inventories

- Amgen Beats Expectations As Top Drugs Boost Sales And Profit

- UK Looks At Subsidising Small Modular Reactors To Power AI Boom

- AMD Outlook Disappoints Investors Seeking Bigger AI Payoff

- Amazon, Prosus Reach AI, Cloud Deal For Double-Digit Cost Saving

- Texas Instruments In Adv. Talks To Buy Chip Designer Silicon Labs

- Nvidia AI Chip Sales To China Stalled By US Security Review

- Nvidia Nears Deal To Invest $20B In OpenAI Round

- Anthropic Plans Employee Tender Offer At $350B Valuation

- KKR Makes AI Play With $10.9B Asia Data-Centre Deal

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries and is more magnetic when trading within the daily ATR.)

- EUR/USD: 1.1730-35 (640M), 1.1795-1.1800 (1.5BLN), 1.1850-55 (2BLN)

- 1.1900 (845M), 1.1925 (597M)

- USD/CHF: 0.7580 (300M), 0.7725 (330M), 0.7925 (476M)

- EUR/CHF: 0.9080 (230M), 0.9180 (200M)

- GBP/USD: 1.3575 (360M), 1.3675 (278M), 1.3770 (200M)

- AUD/USD: 0.6950 (2BLN), 0.7000 (900M), 0.7100 (1.1BLN)

- NZD/USD: 0.5975 (900M). USD/CAD: 1.3700 (602M)

- USD/JPY: 155.50 (570M), 156.25 (712M), 156.45-55 (1.7BLN)

CFTC Positions as of January 30th:

- .Equity fund speculators have increased their net short position in the S&P 500 CME by 20,307 contracts, bringing the total to 420,688. Meanwhile, equity fund managers have raised their net long position in the S&P 500 CME by 27,365 contracts, resulting in a total of 909,993 contracts.

- Speculators have reduced their net short position in CBOT US 5-year Treasury futures by 45,473 contracts, now totaling 2,091,046. Conversely, they have increased their net short position in CBOT US 10-year Treasury futures by 70,511 contracts, reaching 726,151 contracts. There has also been a reduction in the net short position for CBOT US 2-year Treasury futures by 6,123 contracts, now at 1,218,999. Furthermore, speculators have boosted the net short position in CBOT US UltraBond Treasury futures by 14,649 contracts, bringing it to 273,471. They have trimmed their net short position in CBOT US Treasury bonds futures by 14,903 contracts, which now stands at 8,167.

- Bitcoin's net long position is recorded at 690 contracts. The Swiss franc has a net short position of -42,893 contracts, while the British pound shows a net short position of -16,162 contracts. The euro has a net long position of 132,134 contracts, and the Japanese yen has a net short position of -33,933 contracts.

Technical & Trade Views

SP500

- Daily VWAP Beraish

- Weekly VWAP Bearish

- Above 6950 Target 7050

- Below 6835 Target 6785

EURUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 1.1950 Target 1.2150

- Below 1.1840 Target 1.1750

GBPUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 1.38 Target 13950

- Below 1.3770 Target 1.3570

USDJPY

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 154.35 Target 157.50

- Below 153.50 Target 151

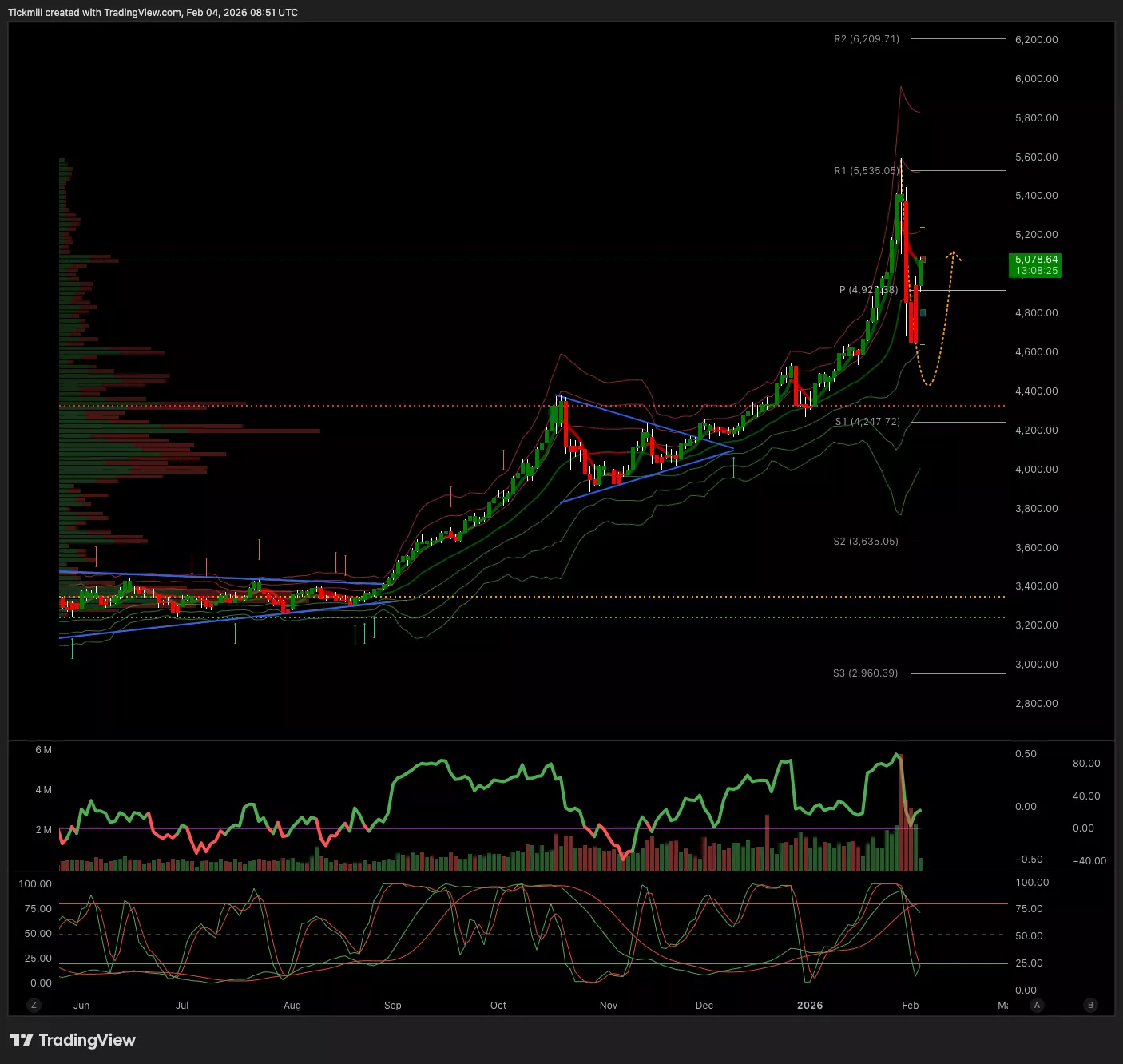

XAUUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 4850 Target 5100

- Below 4400 Target 4200

BTCUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Above 81k Target 84k

- Below 80.5k Target 72k

More By This Author:

The FTSE 100 Finish Line - Tuesday, Feb. 3

Daily Market Outlook - Tuesday, Feb. 3

The FTSE 100 Finish Line - Friday, Feb. 2