Daily Market Outlook - Tuesday, Nov. 7

Image Source: Pixabay

Asia - stocks experienced a decline across the board, retreating from the previous day's gains, with Wall Street's mixed performance contributing to the uncertainty. South Korea's KOSPI was a significant underperformer, dropping over 2.8% following the previous day's surge driven by the ban on stock short-selling. The Nikkei 225 fell below the 32,5K handle, aligning with losses in the broader region. Both the Hang Seng and Shanghai Composite opened on a negative note, reflecting the overall market sentiment. Although the Chinese Trade Balance data for October was narrower than expected, imports surprisingly saw growth, leading to relatively subdued price action. Additionally, China Vanke's shares strengthened after state shareholders signaled their intent to provide liquidity support.

Europe - Today's King Speech is a significant event marking the state opening of the UK parliament. Given the likelihood of a general election within the next 12 months, the window for new legislation is limited. Consequently, today's speech is not anticipated to introduce many new economic measures. Potential measures that may be included involve allowing annual licenses for North Sea oil and gas projects and making some adjustments to the leasehold system for homeowners. The rest of today's economic calendar lacks major data releases. In the Eurozone, earlier data revealed a 1.4% decline in industrial production in Germany for September, confirming ongoing pressure on the sector. Spanish data is also expected this morning, with a consensus for a slight increase, although it follows a significant drop in August. Data for the entire Eurozone is scheduled for the following week. European futures indicate a flat open, with the Eurostoxx 50 showing a 0.08% gain after a -0.4% decline in cash markets yesterday.

US - Stateside, attention will likely be focused on comments from central bank policymakers, particularly those from the US Federal Reserve, in the wake of last week's significant rally in financial markets. Federal Reserve Chair Jerome Powell is scheduled to speak on both Wednesday and Thursday, and his remarks will be closely scrutinized. Today, speeches from five other US Federal Reserve officials are expected, and their comments will be closely watched for any reaction to market expectations of potential early cuts in US interest rates. On the data front, September's US international trade data are anticipated to show an expansion of the monthly trade deficit to $60.5 billion, up from $58.3 billion in August. This aligns with data previously released for trade in goods, which indicated a larger deficit with both exports and imports increasing by more than 2% on a monthly basis. US futures began the session with modest declines with the emini SP500 off -0.24%. News flow was relatively quiet for most of the session, and Federal Reserve's Neel Kashkari expressed the view that the Fed still has work to do to bring inflation under control, suggesting he would be more inclined to overtighten policy than not doing enough to combat inflation.

FX Positioning & Sentiment

EUR/USD implied volatility is presently trading well below historical and realized volatility levels, signaling the potential for value in options trading. Longer-dated options, with maturities extending to the November 5, 2024, U.S. presidential elections, have become available and may start attracting interest in USD-related pairings.

There has been demand for USD put options and this demand has continued, especially for early 2024 maturities. Although the current demand is relatively light, it indicates growing concerns about further USD weakness. Holders of these options could be rewarded if any additional weak U.S. economic data threatens long USD positions. This increased USD put option demand has led to GBP/USD strike prices reaching as high as 1.2600 on Monday. The 1-month 25 delta risk reversal has seen its implied volatility premium for GBP puts relative to USD calls hit long-term lows.

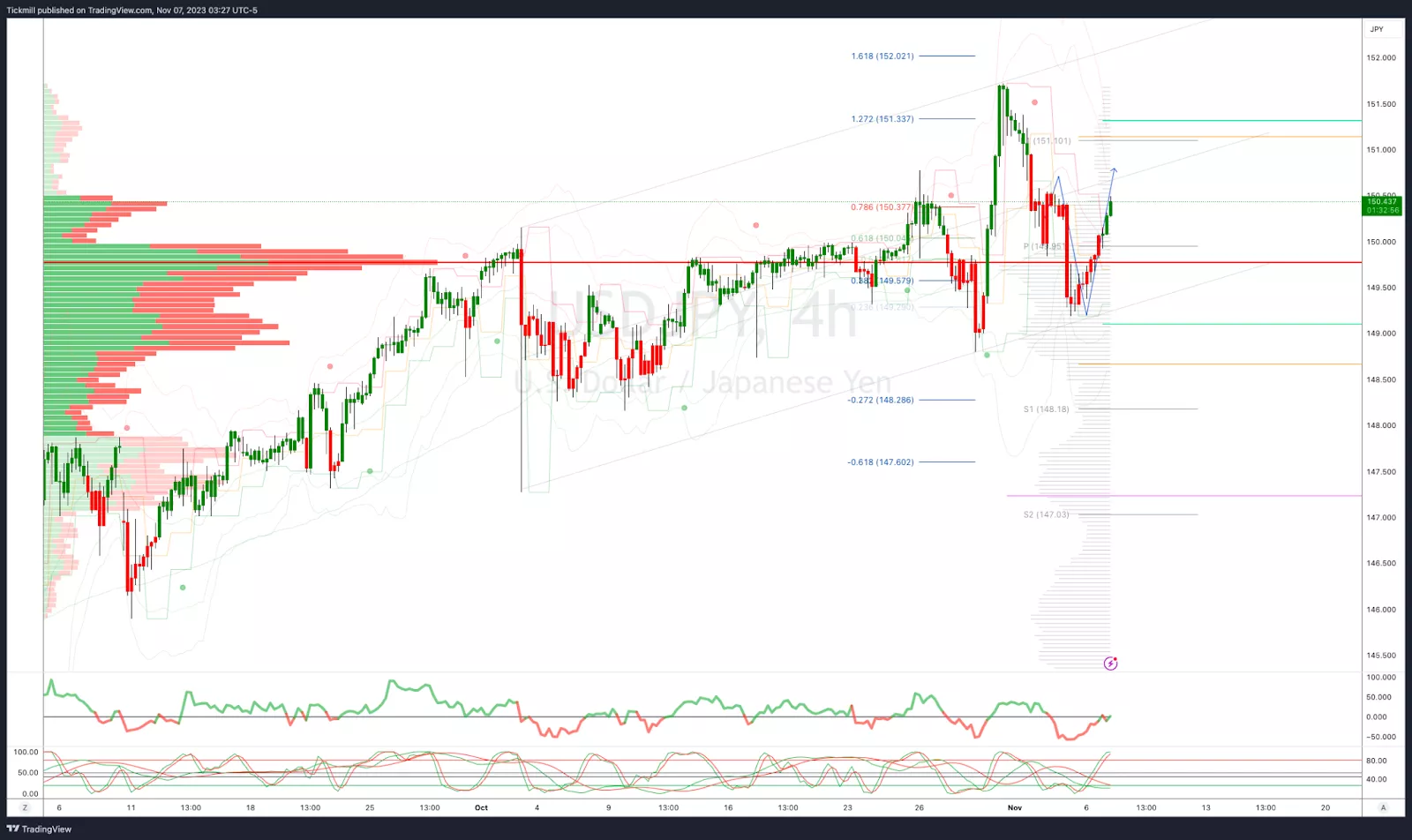

Additionally, there are significant $7.5 billion USD/JPY strike expiries at the 150.00 level scheduled for this week, with the largest ($2.7 billion) set to expire on Thursday. This could help limit any potential gains in USD/JPY above that level.

CFTC Data As Of 3-11-23

- EUR net spec long 85,389 contracts vs 85,253 the previous week

- JPY net spec short 103,848 contracts vs 99,629

- GBP short 20,371 vs 18,636

- AUD short 75,110 vs 83,081

- CAD short 49,332 vs 48,639 Source (Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0650-60 (2.4BLN), 1.0695-1.0700 (655M), 1.0720 (325M)

- 1.0750 (455M). USD/CHF: 0.8985 (400M)

- GBP/USD: 1.2170 (480M), 1.2225 (296M), 1.2300 (340M), 1.2400-10 (450M)

- AUD/USD: 0.6400 (440M), 0.6450-60 (540M), 0.6475-80 (487M)

- AUD/JPY: 96.00 (471M)

- USD/JPY: 149.50 (582M), 150.00 (1BLN), 150.50 (670M), 150.80 (621M)

Overnight Newswire Updates of Note

- RBA Resumes Rate Hikes, Lifts Hurdle To Further Tightening

- China’s Exports Record Bigger Slump Than Expected In October

- Japan's Inflation-Adjusted Wages Slip In September For 18th Month

- Fed’s Neel Kashkari Not Convinced FOMC Rate Hikes Are Over

- House GOP Prepares Stopgap Bill To Avert Nov 18 Shutdown

- Bank Of England's Pill Says Mid-2024 Might Be Time For Rate Cuts

- BRC: UK Retail Spending Growth Drops In Run-Up To Christmas

- Oil Dips As Shaky Demand Outweighs Saudi, Russian Supply Cuts

- Asia Shares Fall On Fed Pause Doubts And The Aussie Drops

- Intel In Lead To Get Billions For Secure Defence-Chip Facilities

- Tesla To Raise Model Y Prices In China Following Style Revamp

- Israeli PM: Open To ‘Little Pauses’ In Gaza, But Not A ‘General Ceasefire’

- Attacks On US Troops In Middle East Spike Amid Military Buildup

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

SP500 Bias: Bullish Above Bearish Below 4320

- Below 4310 opens 4285

- Primary support 4200

- Primary objective is 4400

- 20 Day VWAP bearish, 5 Day VWAP bullish

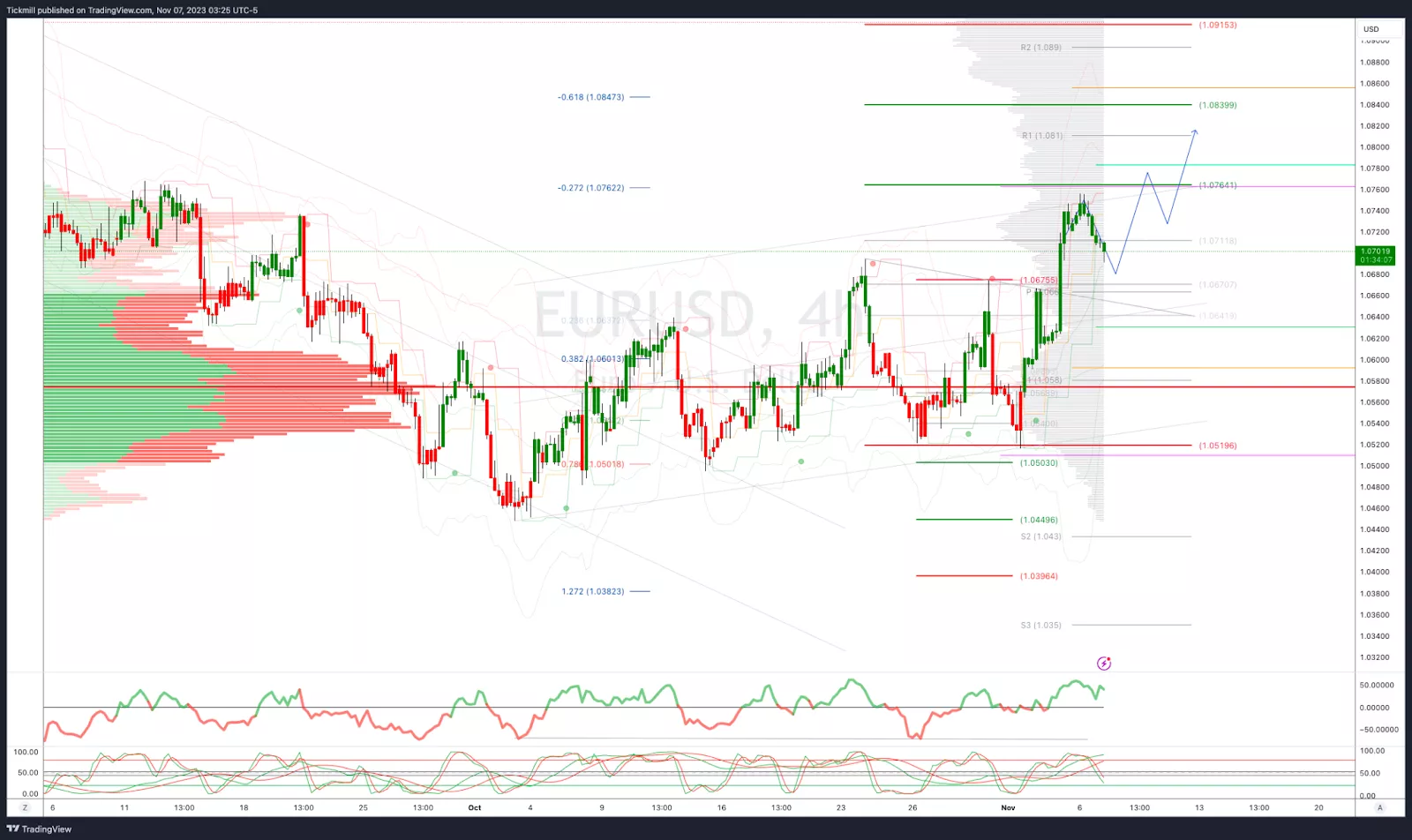

EURUSD Bias: Bullish Above Bearish Below 1.07

- Below 1.07 opens 1.0650

- Primary support 1.06

- Primary objective is 1.0760

- 20 Day VWAP bearish, 5 Day VWAP bullish

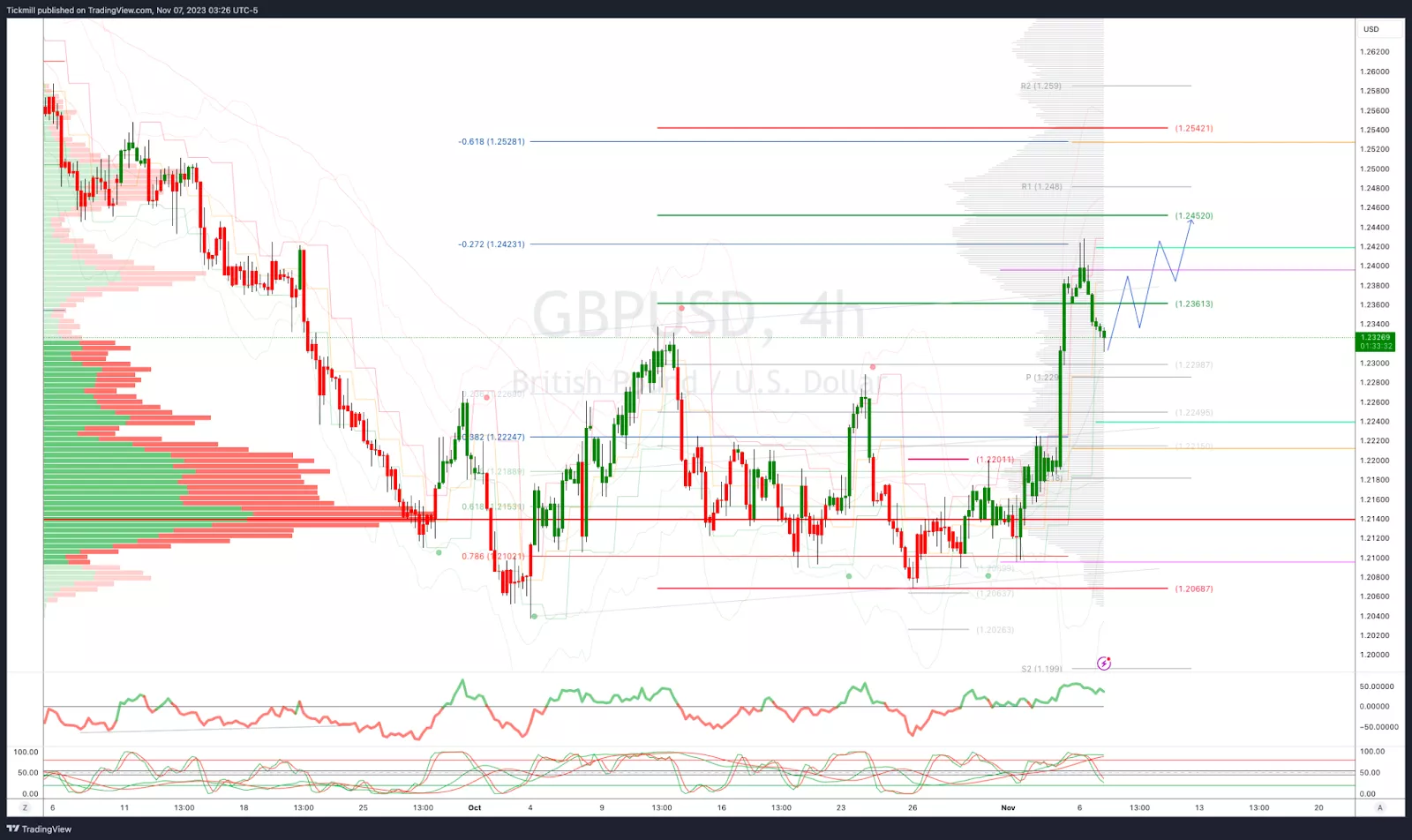

GBPUSD Bias: Bullish Above Bearish Below 1.23

- Below 1.23 opens 1.2250

- Primary support is 1.2069

- Primary objective 1.2450

- 20 Day VWAP bearish, 5 Day VWAP bullish

USDJPY Bias: Bullish Above Bearish Below 150

- Below 149 opens 148.30

- Primary support 147.30

- Primary objective is 152.50

- 20 Day VWAP bullish, 5 Day VWAP bullish

AUDUSD Bias: Bullish Above Bearish Below .6450

- Above .6475 opens .6525

- Primary support .6380

- Primary objective is .6620

- 20 Day VWAP bearish, 5 Day VWAP bullish

BTCUSD Bias: Bullish Above Bearish below 32000

- Below 27100 opens 26500

- Primary support is 30000

- Primary objective is 37000

- 20 Day VWAP bullish, 5 Day VWAP bullish

More By This Author:

FTSE Starts The Week In The Green Ahead Of Key Econ DataDaily Market Outlook, Monday, Nov. 6

FTSE Reverses Early Gains To Head Into The Red At The Close